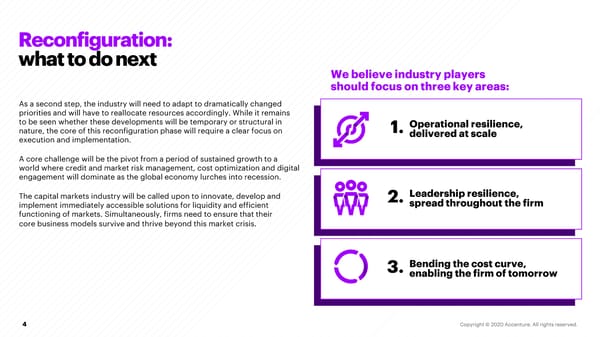

Reconfiguration: what to do next We believe industry players should focus on three key areas: As a second step, the industry will need to adapt to dramatically changed priorities and will have to reallocate resources accordingly. While it remains to be seen whether these developments will be temporary or structural in 1. Operational resilience, nature, the core of this reconfiguration phase will require a clear focus on delivered at scale execution and implementation. A core challenge will be the pivot from a period of sustained growth to a world where credit and market risk management, cost optimization and digital engagement will dominate as the global economy lurches into recession. The capital markets industry will be called upon to innovate, develop and 2. Leadership resilience, implement immediately accessible solutions for liquidity and efficient spread throughout the firm functioning of markets. Simultaneously, firms need to ensure that their core business models survive and thrive beyond this market crisis. 3. Bending the cost curve, enabling the firm of tomorrow 4

A Capital Markets Industry Perspective: COVID 19 Page 3 Page 5

A Capital Markets Industry Perspective: COVID 19 Page 3 Page 5