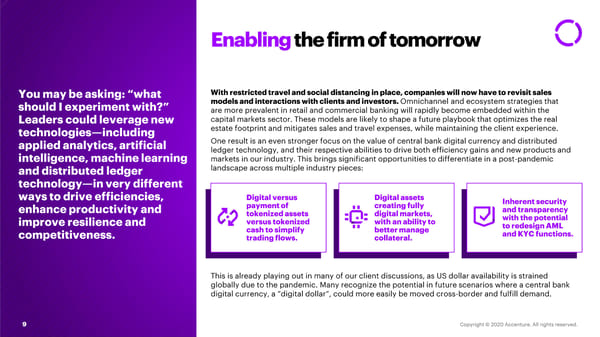

Enablingthe firm of tomorrow With restricted travel and social distancing in place, companies will now have to revisit sales You may be asking: “what models and interactions with clients and investors. Omnichannel and ecosystem strategies that should I experiment with?” are more prevalent in retail and commercial banking will rapidly become embedded within the Leaders could leverage new capital markets sector. These models are likely to shape a future playbook that optimizes the real technologies—including estate footprint and mitigates sales and travel expenses, while maintaining the client experience. applied analytics, artificial One result is an even stronger focus on the value of central bank digital currency and distributed ledger technology, and their respective abilities to drive both efficiency gains and new products and intelligence, machine learning markets in our industry. This brings significant opportunities to differentiate in a post-pandemic and distributed ledger landscape across multiple industry pieces: technology—in very different ways to drive efficiencies, Digital versus Digital assets Inherent security enhance productivity and payment of creating fully and transparency tokenized assets digital markets, with the potential improve resilience and versus tokenized with an ability to to redesign AML competitiveness. cash to simplify better manage and KYC functions. trading flows. collateral. This is already playing out in many of our client discussions, as US dollar availability is strained globally due to the pandemic. Many recognize the potential in future scenarios where a central bank digital currency, a “digital dollar”, could more easily be moved cross-border and fulfill demand. 9

A Capital Markets Industry Perspective: COVID 19 Page 8 Page 10

A Capital Markets Industry Perspective: COVID 19 Page 8 Page 10