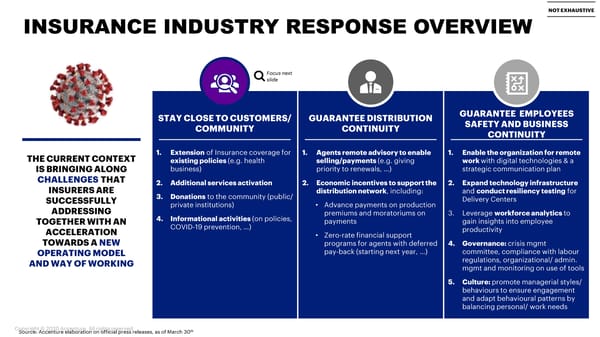

NOT EXHAUSTIVE INSURANCE INDUSTRY RESPONSE OVERVIEW Focus next slide STAY CLOSE TO CUSTOMERS/ GUARANTEE DISTRIBUTION GUARANTEE EMPLOYEES COMMUNITY CONTINUITY SAFETY AND BUSINESS CONTINUITY THE CURRENT CONTEXT 1. Extensionof Insurance coverage for 1. Agents remote advisory to enable 1. Enable the organization for remote existing policies (e.g. health selling/payments (e.g. giving work with digital technologies & a IS BRINGING ALONG business) priority to renewals, …) strategic communication plan CHALLENGESTHAT 2. Additional services activation 2. Economic incentives to support the 2. Expand technology infrastructure INSURERS ARE 3. Donationsto the community (public/ distribution network, including: and conduct resiliency testing for SUCCESSFULLY private institutions) • Advance payments on production Delivery Centers ADDRESSING premiums and moratoriums on 3. Leverage workforce analytics to TOGETHER WITH AN 4. Informational activities (on policies, payments gain insights into employee ACCELERATION COVID-19 prevention, …) productivity TOWARDS A NEW • Zero-rate financial support programs for agents with deferred 4. Governance: crisis mgmt OPERATING MODEL pay-back (starting next year, …) committee, compliance with labour AND WAY OF WORKING regulations, organizational/ admin. mgmtand monitoring on use of tools 5. Culture: promote managerial styles/ behaviours to ensure engagement and adapt behavioural patterns by balancing personal/ work needs Copyright © 2020 Accenture. All rightsreserved. th Source: Accenture elaboration on official press releases, as of March 30

COVID-19 Impact Page 2 Page 4

COVID-19 Impact Page 2 Page 4