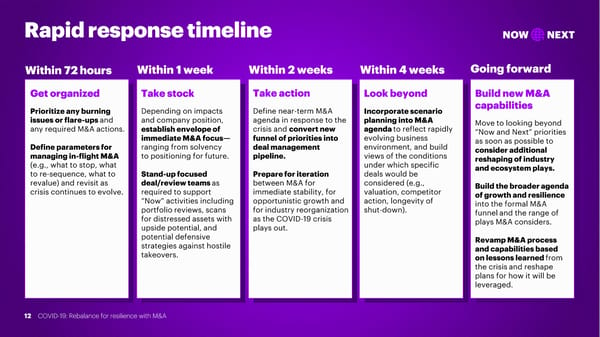

Rapid response timeline NOW NEXT Within 72 hours Within 1 week Within 2 weeks Within 4 weeks Going forward Get organized Take stock Take action Look beyond Build new M&A Prioritize any burning Depending on impacts Define near-term M&A Incorporate scenario capabilities issues or flare-ups and and company position, agenda in response to the planning into M&A Move to looking beyond any required M&A actions. establish envelope of crisis and convert new agenda to reflect rapidly “Now and Next” priorities immediate M&A focus— funnel of priorities into evolving business as soon as possible to Define parameters for ranging from solvency deal management environment, and build consider additional managing in-flight M&A to positioning for future. pipeline. views of the conditions reshaping of industry (e.g., what to stop, what under which specific and ecosystem plays. to re-sequence, what to Stand-up focused Prepare for iteration deals would be revalue) and revisit as deal/review teams as between M&A for considered (e.g., Build the broader agenda crisis continues to evolve. required to support immediate stability, for valuation, competitor of growth and resilience “Now” activities including opportunistic growth and action, longevity of into the formal M&A portfolio reviews, scans for industry reorganization shut-down). funneland the range of for distressed assets with as the COVID-19 crisis plays M&A considers. upside potential, and plays out. potential defensive Revamp M&A process strategies against hostile and capabilities based takeovers. on lessons learned from the crisisand reshape plans for how it will be leveraged. 12 COVID-19: Rebalance for resilience with M&A

COVID-19: Rebalance for resilience with M&A Page 11 Page 13

COVID-19: Rebalance for resilience with M&A Page 11 Page 13