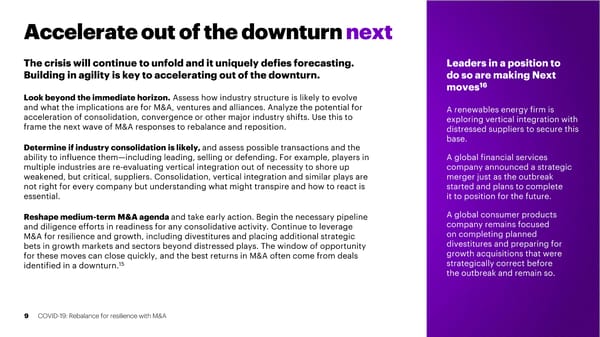

Accelerate out of the downturn next The crisis will continue to unfold and it uniquely defies forecasting. Leaders in a position to Building in agility is key to accelerating out of the downturn. do so are making Next moves16 Look beyond the immediate horizon. Assess how industry structure is likely to evolve and what the implications are for M&A, ventures and alliances. Analyze the potential for A renewables energy firm is acceleration of consolidation, convergence or other major industry shifts. Use this to exploring vertical integration with frame the next wave of M&A responses to rebalance and reposition. distressed suppliers to secure this base. Determine if industry consolidation is likely, and assess possible transactions and the ability to influence them—including leading, selling or defending. For example, players in A global financial services multiple industries are re-evaluating vertical integration out of necessity to shore up company announced a strategic weakened, but critical, suppliers. Consolidation, vertical integration and similar plays are merger just as the outbreak not right for every company but understanding what might transpire and how to react is started and plans to complete essential. it to position for the future. Reshape medium-term M&A agenda and take early action. Begin the necessary pipeline A global consumer products and diligence efforts in readiness for any consolidative activity. Continue to leverage company remains focused M&A for resilience and growth, including divestitures and placing additional strategic on completing planned bets in growth markets and sectors beyond distressed plays. The window of opportunity divestitures and preparing for for these moves can close quickly, and the best returns in M&A often come from deals growth acquisitions that were identified in a downturn.15 strategically correct before the outbreak and remain so. 9 COVID-19: Rebalance for resilience with M&A

COVID-19: Rebalance for resilience with M&A Page 8 Page 10

COVID-19: Rebalance for resilience with M&A Page 8 Page 10