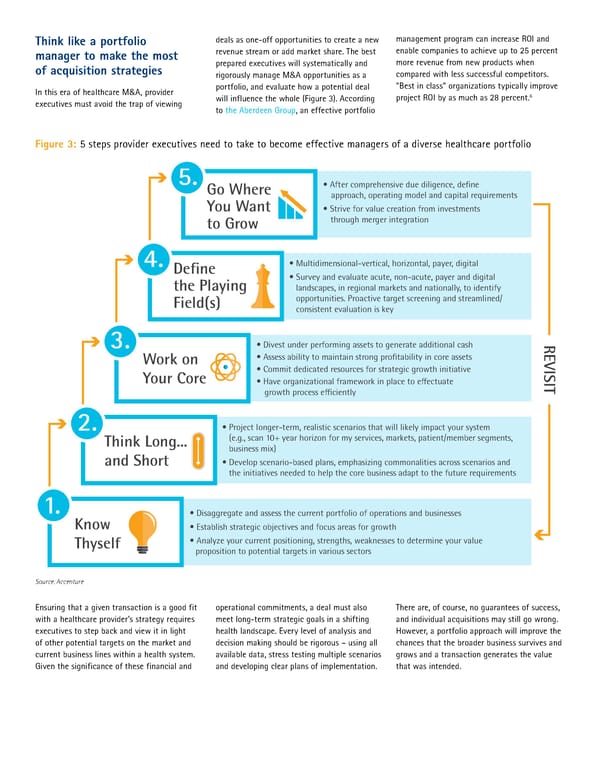

Think like a portfolio deals as one-off opportunities to create a new management program can increase ROI and manager to make the most revenue stream or add market share. The best enable companies to achieve up to 25 percent of acquisition strategies prepared executives will systematically and more revenue from new products when rigorously manage M&A opportunities as a compared with less successful competitors. In this era of healthcare M&A, provider portfolio, and evaluate how a potential deal “Best in class” organizations typically improve will influence the whole (Figure 3). According project ROI by as much as 28 percent.6 executives must avoid the trap of viewing to the Aberdeen Group, an effective portfolio Figure 3: 5 s teps provider executives need to take to become effective managers of a diverse healthcare portfolio 5. Go Where • After comprehensive due diligence, define You Want approach, operating model and capital requirements • Strive for value creation from investments to Grow through merger integration 4. Define • Multidimensional-vertical, horizontal, payer, digital • Survey and evaluate acute, non-acute, payer and digital the Playing landscapes, in regional markets and nationally, to identify Fields opportunities. roactive target screening and streamlined consistent evaluation is key 3. • ivest under performing assets to generate additional cash ST Work on • Assess aility to maintain strong profitaility in core assets Your Core • ommit dedicated resources for strategic groth initiative • ave organizational frameork in place to effectuate groth process efficiently 2. • ro‚ect longer-term, realistic scenarios that ill likely impact your system Think Long... ƒe.g., scan „…† year horizon for my services, markets, patientmemer segments, usiness mi‡ˆ and Short • evelop scenario-ased plans, emphasizing commonalities across scenarios and the initiatives needed to help the core usiness adapt to the future requirements 1. • isaggregate and assess the current portfolio of operations and usinesses Know • ‰stalish strategic o‚ectives and focus areas for groth Thyself • Analyze your current positioning, strengths, eaknesses to determine your value proposition to potential targets in various sectors Source: Accenture Ensuring that a given transaction is a good fit operational commitments, a deal must also There are, of course, no guarantees of success, with a healthcare provider’s strategy requires meet long-term strategic goals in a shifting and individual acquisitions may still go wrong. executives to step back and view it in light health landscape. Every level of analysis and However, a portfolio approach will improve the of other potential targets on the market and decision making should be rigorous – using all chances that the broader business survives and current business lines within a health system. available data, stress testing multiple scenarios grows and a transaction generates the value Given the significance of these financial and and developing clear plans of implementation. that was intended.

Healthcare M&A: Mastering the 3D chessboard Page 2 Page 4

Healthcare M&A: Mastering the 3D chessboard Page 2 Page 4