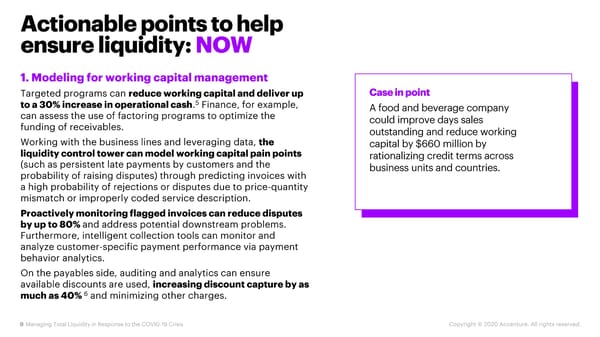

Actionable points to help ensure liquidity: NOW 1. Modeling for working capital management Targeted programs can reduce working capital and deliver up Case in point to a 30% increase in operational cash.5 Finance, for example, A food and beverage company can assess the use of factoring programs to optimize the could improve days sales funding of receivables. outstanding and reduce working Working with the business lines and leveraging data, the capital by $660 million by liquidity control tower can model working capital pain points rationalizing credit terms across (such as persistent late payments by customers and the business units and countries. probability of raising disputes) through predicting invoices with a high probability of rejections or disputes due to price-quantity mismatch or improperly coded service description. Proactively monitoring flagged invoices can reduce disputes by up to 80% and address potential downstream problems. Furthermore, intelligent collection tools can monitor and analyze customer-specific payment performance via payment behavior analytics. On the payables side, auditing and analytics can ensure available discounts are used, increasing discount capture by as much as 40% 6and minimizing other charges. 9 Managing Total Liquidity in Response to the COVID-19 Crisis Copyright © 2020 Accenture. All rights reserved.

Managing Total Liquidity in Crisis: COVID-19 Page 8 Page 10

Managing Total Liquidity in Crisis: COVID-19 Page 8 Page 10