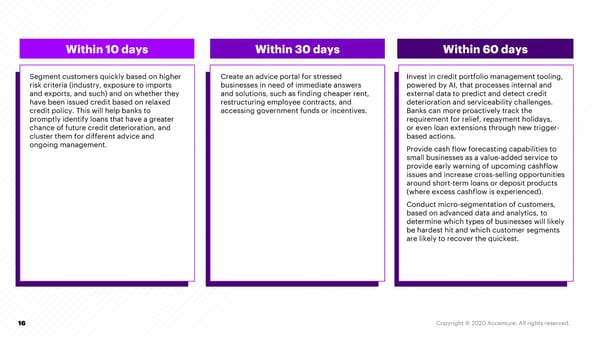

Within 10 days Within 30 days Within 60 days Segment customers quickly based on higher Create an advice portal for stressed Invest in credit portfolio management tooling, risk criteria (industry, exposure to imports businesses in need of immediate answers powered by AI, that processes internal and and exports, and such) and on whether they and solutions, such as finding cheaper rent, external data to predict and detect credit have been issued credit based on relaxed restructuring employee contracts, and deterioration and serviceability challenges. credit policy. This will help banks to accessing government funds or incentives. Banks can more proactively track the promptly identify loans that have a greater requirement for relief, repayment holidays, chance of future credit deterioration, and or even loan extensions through new trigger- cluster them for different advice and based actions. ongoing management. Provide cash flow forecasting capabilities to small businesses as a value-added service to provide early warning of upcoming cashflow issues and increase cross-selling opportunities around short-term loans or deposit products (where excess cashflow is experienced). Conduct micro-segmentation of customers, based on advanced data and analytics, to determine which types of businesses will likely be hardest hit and which customer segments are likely to recover the quickest. 16 Copyright © 2020 Accenture. All rights reserved.

Navigating COVID-19: Commercial Banks Page 15 Page 17

Navigating COVID-19: Commercial Banks Page 15 Page 17