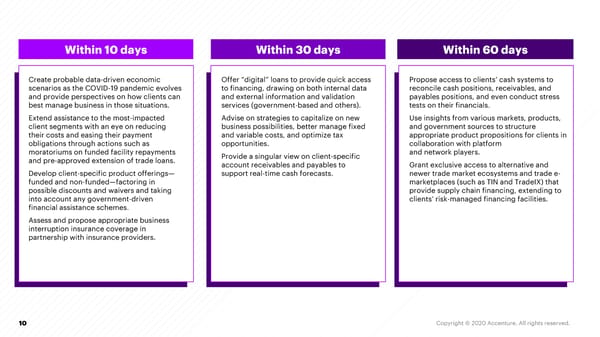

Within 10 days Within 30 days Within 60 days Create probable data-driven economic Offer “digital” loans to provide quick access Propose access to clients’ cash systems to scenarios as the COVID-19 pandemic evolves to financing, drawing on both internal data reconcile cash positions, receivables, and and provide perspectives on how clients can and external information and validation payables positions, and even conduct stress best manage business in those situations. services (government-based and others). tests on their financials. Extend assistance to the most-impacted Advise on strategies to capitalize on new Use insights from various markets, products, client segments with an eye on reducing business possibilities, better manage fixed and government sources to structure their costs and easing their payment and variable costs, and optimize tax appropriate product propositions for clients in obligations through actions such as opportunities. collaboration with platform moratoriums on funded facility repayments Provide a singular view on client-specific and network players. and pre-approved extension of trade loans. account receivables and payables to Grant exclusive access to alternative and Develop client-specific product offerings— support real-time cash forecasts. newer trade market ecosystems and trade e- funded and non-funded—factoring in marketplaces (such as TIN and TradeIX) that possible discounts and waivers and taking provide supply chain financing, extending to into account any government-driven clients’ risk-managed financing facilities. financial assistance schemes. Assess and propose appropriate business interruption insurance coverage in partnership with insurance providers. 10 Copyright © 2020 Accenture. All rights reserved.

Navigating COVID-19: Commercial Banks Page 9 Page 11

Navigating COVID-19: Commercial Banks Page 9 Page 11