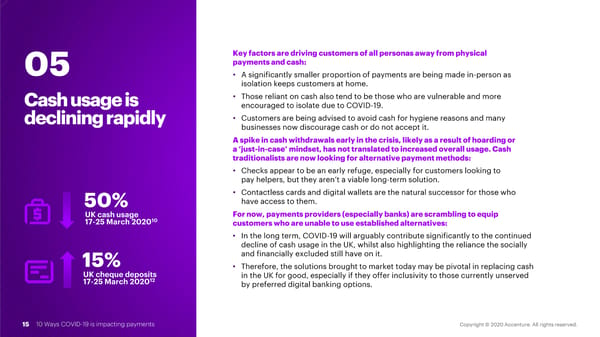

Key factors are driving customers of all personas away from physical 05 payments and cash: • A significantly smaller proportion of payments are being made in-person as isolation keeps customers at home. Cash usage is • Those reliant on cash also tend to be those who are vulnerable and more encouraged to isolate due to COVID-19. declining rapidly • Customers are being advised to avoid cash for hygiene reasons and many businesses now discourage cash or do not accept it. A spike in cash withdrawals early in the crisis, likely as a result of hoarding or a ‘just-in-case’ mindset, has not translated to increased overall usage. Cash traditionalists are now looking for alternative payment methods: • Checks appear to be an early refuge, especially for customers looking to pay helpers, but they aren’t a viable long-term solution. • Contactless cards and digital wallets are the natural successor for those who 50% have access to them. UK cash usage For now, payments providers (especially banks) are scrambling to equip 17-25 March 202010 customers who are unable to use established alternatives: • In the long term, COVID-19 will arguably contribute significantly to the continued decline of cash usage in the UK, whilst also highlighting the reliance the socially 15% and financially excluded still have on it. • Therefore, the solutions brought to market today may be pivotal in replacing cash UK cheque deposits in the UK for good, especially if they offer inclusivity to those currently unserved 17-25 March 202012 by preferred digital banking options. 15 10 Ways COVID-19 is impacting payments

10 Ways COVID-19 Is Impacting Payments Page 14 Page 16

10 Ways COVID-19 Is Impacting Payments Page 14 Page 16