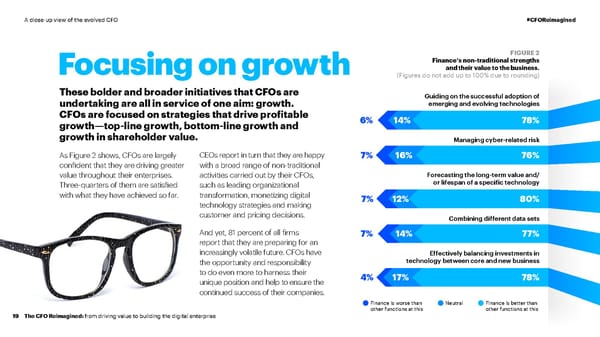

A close-up view of the evolved CFO #CFOReimagined FIGURE 2 Finance’s non-traditional strengths Focusing on growth and their value to the business. (Figures do not add up to 100% due to rounding) These bolder and broader initiatives that CFOs are Guiding on the successful adoption of undertaking are all in service of one aim: growth. emerging and evolving technologies CFOs are focused on strategies that drive profitable 6% 14% 78% growth—top-line growth, bottom-line growth and growth in shareholder value. Managing cyber-related risk As Figure 2 shows, CFOs are largely CEOs report in turn that they are happy 7% 16% 76% confident that they are driving greater with a broad range of non-traditional value throughout their enterprises. activities carried out by their CFOs, Forecasting the long-term value and/ Three-quarters of them are satisfied such as leading organizational or lifespan of a specific technology with what they have achieved so far. transformation, monetizing digital 80% technology strategies and making 7% 12% 80% customer and pricing decisions. Combining different data sets And yet, 81 percent of all firms 7% 14% 77% report that they are preparing for an increasingly volatile future. CFOs have Effectively balancing investments in the opportunity and responsibility technology between core and new business to do even more to harness their 4% 17% 78% unique position and help to ensure the continued success of their companies. Finance is worse than Neutral Finance is better than other functions at this other functions at this 19 The CFO Reimagined: from driving value to building the digital enterprise

CFO Reimagined | CFO Global Research | Accenture Page 18 Page 20

CFO Reimagined | CFO Global Research | Accenture Page 18 Page 20