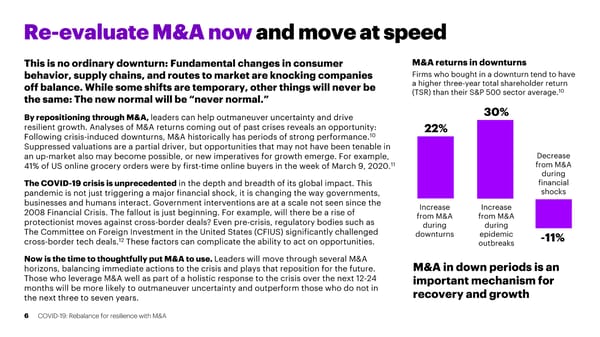

Re-evaluate M&A now and move at speed This is no ordinary downturn: Fundamental changes in consumer M&A returns in downturns behavior, supply chains, and routes to market are knocking companies Firms who bought in a downturn tend to have off balance. While some shifts are temporary, other things will never be a higher three-year total shareholder return 10 the same: The new normal will be “never normal.” (TSR) than their S&P 500 sector average. By repositioning through M&A, leaders can help outmaneuver uncertainty and drive 30% resilient growth. Analyses of M&A returns coming out of past crises reveals an opportunity: 22% Following crisis-induced downturns, M&A historically has periods of strong performance.10 Suppressed valuations are a partial driver, but opportunities that may not have been tenable in an up-market also may become possible, or new imperatives for growth emerge. For example, Decrease 41% of US online grocery orders were by first-time online buyers in the week of March 9, 2020.11 from M&A during The COVID-19 crisis is unprecedented in the depth and breadth of its global impact. This financial pandemic is not just triggering a major financial shock, it is changing the way governments, shocks businesses and humans interact. Government interventions are at a scale not seen since the Increase Increase 2008 Financial Crisis. The fallout is just beginning. For example, will there be a rise of from M&A from M&A protectionist moves against cross-border deals? Even pre-crisis, regulatory bodies such as during during The Committee on Foreign Investment in the United States (CFIUS) significantly challenged downturns epidemic -11% cross-border tech deals.12 These factors can complicate the ability to act on opportunities. outbreaks Now is the time to thoughtfully put M&A to use. Leaders will move through several M&A M&A in down periods is an horizons, balancing immediate actions to the crisis and plays that reposition for the future. Those who leverage M&A well as part of a holistic response to the crisis over the next 12-24 important mechanism for months will be more likely to outmaneuver uncertainty and outperform those who do not in recovery and growth the next three to seven years. 6 COVID-19: Rebalance for resilience with M&A

COVID-19: Rebalance for resilience with M&A Page 5 Page 7

COVID-19: Rebalance for resilience with M&A Page 5 Page 7