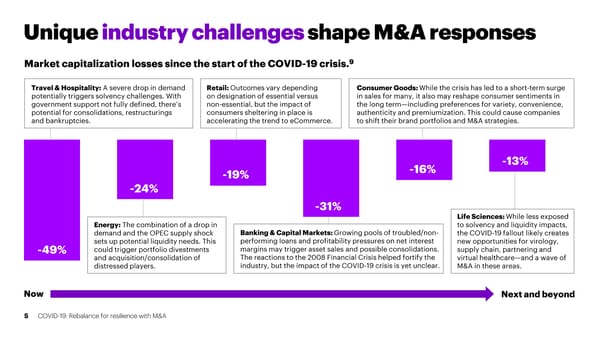

Unique industry challenges shape M&A responses 9 Market capitalization losses since the start of the COVID-19 crisis. Travel & Hospitality: A severe drop in demand Retail: Outcomes vary depending Consumer Goods: While the crisis has led to a short-term surge potentially triggers solvency challenges. With on designation of essential versus in sales for many, it also may reshape consumer sentiments in government support not fully defined, there’s non-essential, but the impact of the long term—including preferences for variety, convenience, potential for consolidations, restructurings consumers sheltering in place is authenticity and premiumization. This could cause companies and bankruptcies. accelerating the trend to eCommerce. to shift their brand portfolios and M&A strategies. -16% -13% -19% -24% -31% Life Sciences: While less exposed Energy:The combination of a drop in to solvency and liquidity impacts, demand and the OPEC supply shock Banking & Capital Markets: Growing pools of troubled/non- the COVID-19 fallout likely creates sets up potential liquidity needs. This performing loans and profitability pressures on net interest new opportunities for virology, -49% could trigger portfolio divestments margins may trigger asset sales and possible consolidations. supply chain, partnering and and acquisition/consolidation of The reactions to the 2008 Financial Crisis helped fortify the virtual healthcare—and a wave of distressed players. industry, but the impact of the COVID-19 crisis is yet unclear. M&A in these areas. Now Next and beyond 5 COVID-19: Rebalance for resilience with M&A

COVID-19: Rebalance for resilience with M&A Page 4 Page 6

COVID-19: Rebalance for resilience with M&A Page 4 Page 6