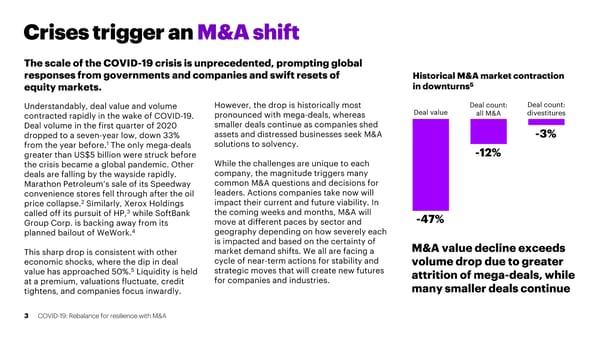

Crises trigger an M&A shift The scale of the COVID-19 crisis is unprecedented, prompting global responses from governments and companies and swift resets of Historical M&A market contraction 5 equity markets. in downturns Understandably, deal value and volume However, the drop is historically most Deal count: Deal count: contracted rapidly in the wake of COVID-19. pronounced with mega-deals, whereas Deal value all M&A divestitures Deal volume in the first quarter of 2020 smaller deals continue as companies shed dropped to a seven-year low, down 33% assets and distressed businesses seek M&A -3% from the year before.1 The only mega-deals solutions to solvency. -12% greater than US$5 billion were struck before the crisis became a global pandemic. Other While the challenges are unique to each deals are falling by the wayside rapidly. company, the magnitude triggers many Marathon Petroleum’s sale of its Speedway common M&A questions and decisions for convenience stores fell through after the oil leaders. Actions companies take now will price collapse.2 Similarly, Xerox Holdings impact their current and future viability. In called off its pursuit of HP,3 while SoftBank the coming weeks and months, M&A will -47% Group Corp. is backing away from its move at different paces by sector and planned bailout of WeWork.4 geography depending on how severely each is impacted and based on the certainty of M&A value decline exceeds This sharp drop is consistent with other market demand shifts. We all are facing a economic shocks, where the dip in deal cycle of near-term actions for stability and volume drop due to greater value has approached 50%.5 Liquidity is held strategic moves that will create new futures attrition of mega-deals, while at a premium, valuations fluctuate, credit for companies and industries. many smaller deals continue tightens, and companies focus inwardly. 3 COVID-19: Rebalance for resilience with M&A

COVID-19: Rebalance for resilience with M&A Page 2 Page 4

COVID-19: Rebalance for resilience with M&A Page 2 Page 4