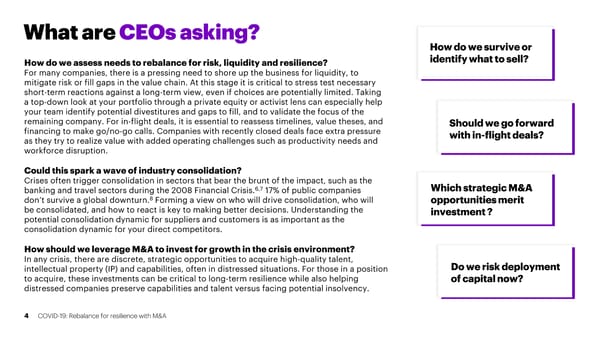

What are CEOs asking? How do we survive or How do we assess needs to rebalance for risk, liquidity and resilience? identify what to sell? For many companies, there is a pressing need to shore up the business for liquidity, to mitigate risk or fill gaps in the value chain. At this stage it is critical to stress test necessary short-term reactions against a long-term view, even if choices are potentially limited. Taking a top-down look at your portfolio through a private equity or activist lens can especially help your team identify potential divestitures and gaps to fill, and to validate the focus of the remaining company. For in-flight deals, it is essential to reassess timelines, value theses, and Should we go forward financing to make go/no-go calls. Companies with recently closed deals face extra pressure with in-flight deals? as they try to realize value with added operating challenges such as productivity needs and workforce disruption. Could this spark a wave of industry consolidation? Crises often trigger consolidation in sectors that bear the brunt of the impact, such as the banking and travel sectors during the 2008 Financial Crisis.6,7 17% of public companies Which strategic M&A don’t survive a global downturn.8 Forming a view on who will drive consolidation, who will opportunities merit be consolidated, and how to react is key to making better decisions. Understanding the investment ? potential consolidation dynamic for suppliers and customers is as important as the consolidation dynamic for your direct competitors. How should we leverage M&A to invest for growth in the crisis environment? In any crisis, there are discrete, strategic opportunities to acquire high-quality talent, Do we risk deployment intellectual property (IP) and capabilities, often in distressed situations. For those in a position to acquire, these investments can be critical to long-term resilience while also helping of capital now? distressed companies preserve capabilities and talent versus facing potential insolvency. 4 COVID-19: Rebalance for resilience with M&A

COVID-19: Rebalance for resilience with M&A Page 3 Page 5

COVID-19: Rebalance for resilience with M&A Page 3 Page 5