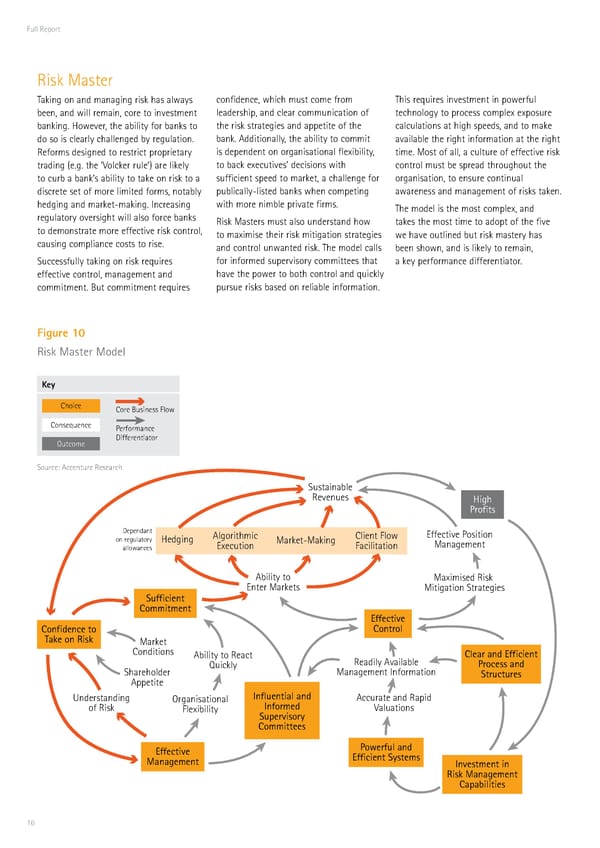

Full Report Risk „aster Taking on and managing risk has alas confidence‡ hich must come from This reŒuires investment in poerful ‚een‡ and ill remain‡ core to investment leadership‡ and clear communication of technolog to process comple‘ e‘posure ‚ankingˆ Hoever‡ the a‚ilit for ‚anks to the risk strategies and appetite of the calculations at high speeds‡ and to make do so is clearl challenged ‚ regulationˆ ‚ankˆ Additionall‡ the a‚ilit to commit availa‚le the right information at the right Reforms designed to restrict proprietar is dependent on organisational fle‘i‚ilit‡ timeˆ „ost of all‡ a culture of effective risk trading –eˆgˆ the ‘¦olcker rule’— are likel to ‚ack e‘ecutives’ decisions ith control must ‚e spread throughout the to cur‚ a ‚ank’s a‚ilit to take on risk to a sufficient speed to market‡ a challenge for organisation‡ to ensure continual discrete set of more limited forms‡ nota‚l pu‚licall’listed ‚anks hen competing aareness and management of risks takenˆ hedging and market’makingˆ Increasing ith more nim‚le private firmsˆ The model is the most comple‘‡ and regulator oversight ill also force ‚anks Risk „asters must also understand ho takes the most time to adopt of the five to demonstrate more effective risk control‡ to ma‘imise their risk mitigation strategies e have outlined ‚ut risk master has causing compliance costs to riseˆ and control unanted riskˆ The model calls ‚een shon‡ and is likel to remain‡ Successfull taking on risk reŒuires for informed supervisor committees that a ke performance differentiatorˆ effective control‡ management and have the poer to ‚oth control and Œuickl commitmentˆ But commitment reŒuires pursue risks ‚ased on relia‚le informationˆ Figure 1ƒ Risk Master Model Key hoice ore ‚usiness low onseƒuence erormance utcome Dierentiator Source Accenture Research Sustainable Revenues Hig Profits Dependant Algorithmic lient low Eective osition on regulatory Hedging Execution Market-Making acilitation Management allowances Ability to Maximised Risk Enter Markets Mitigation Strategies Sufficient Commitment Effective Confidence to Control Take on Risk Market onditions Ability to React Clear and Efficient uickly Readily Available Process and Shareholder Management normation Structures Appetite nderstanding rganisational Influential and Accurate and Rapid o Risk lexibility Informed €aluations Supervisory Committees Effective Powerful and Management Efficient Systems Investment in Risk Management Capabilities €†

Focus for Success | Full Report Page 16 Page 18

Focus for Success | Full Report Page 16 Page 18