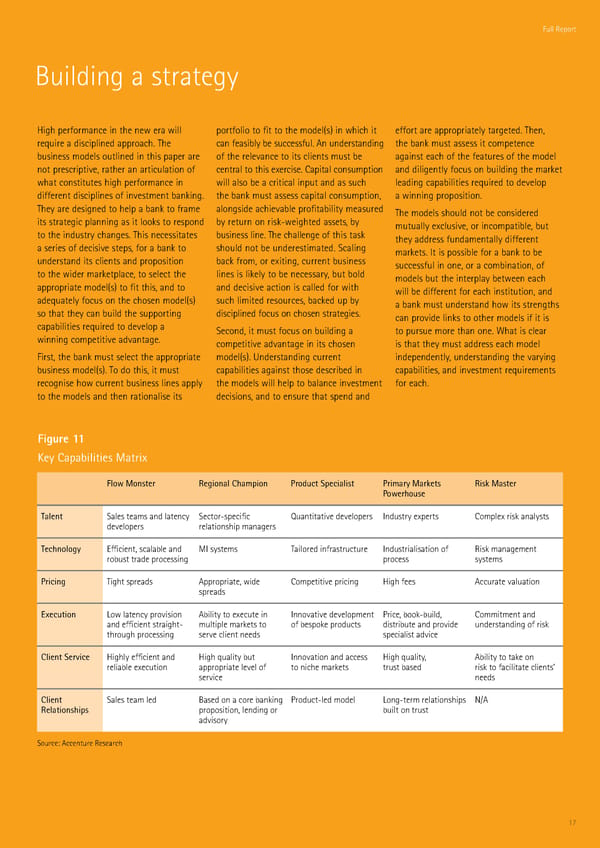

Full ReportFull Report Building a strateg High performance in the ne era ill portfolio to fit to the model–s— in hich it effort are appropriatel targetedˆ Then‡ reŒuire a disciplined approachˆ The can feasi‚l ‚e successfulˆ An understanding the ‚ank must assess it competence ‚usiness models outlined in this paper are of the relevance to its clients must ‚e against each of the features of the model not prescriptive‡ rather an articulation of central to this e‘erciseˆ apital consumption and diligentl focus on ‚uilding the market hat constitutes high performance in ill also ‚e a critical input and as such leading capa‚ilities reŒuired to develop different disciplines of investment ‚ankingˆ the ‚ank must assess capital consumption‡ a inning propositionˆ The are designed to help a ‚ank to frame alongside achieva‚le profita‚ilit measured The models should not ‚e considered its strategic planning as it looks to respond ‚ return on risk’eighted assets‡ ‚ mutuall e‘clusive‡ or incompati‚le‡ ‚ut to the industr changesˆ This necessitates ‚usiness lineˆ The challenge of this task the address fundamentall different a series of decisive steps‡ for a ‚ank to should not ‚e underestimatedˆ Scaling marketsˆ It is possi‚le for a ‚ank to ‚e understand its clients and proposition ‚ack from‡ or e‘iting‡ current ‚usiness successful in one‡ or a com‚ination‡ of to the ider marketplace‡ to select the lines is likel to ‚e necessar‡ ‚ut ‚old models ‚ut the interpla ‚eteen each appropriate model–s— to fit this‡ and to and decisive action is called for ith ill ‚e different for each institution‡ and adeŒuatel focus on the chosen model–s— such limited resources‡ ‚acked up ‚ a ‚ank must understand ho its strengths so that the can ‚uild the supporting disciplined focus on chosen strategiesˆ can provide links to other models if it is capa‚ilities reŒuired to develop a Second‡ it must focus on ‚uilding a to pursue more than oneˆ ‹hat is clear inning competitive advantageˆ competitive advantage in its chosen is that the must address each model First‡ the ‚ank must select the appropriate model–s—ˆ nderstanding current independentl‡ understanding the varing ‚usiness model–s—ˆ To do this‡ it must capa‚ilities against those descri‚ed in capa‚ilities‡ and investment reŒuirements recognise ho current ‚usiness lines appl the models ill help to ‚alance investment for eachˆ to the models and then rationalise its decisions‡ and to ensure that spend and Figure 11 –ey aƒabilities MatriŽ ‘lo… Monster Regional hamƒion Product ƒecialist Primary Markets Risk Master Po…erhouse alent Sales teams and latenc Sector’specific ªuantitative developers Industr e‘perts omple‘ risk analsts developers relationship managers echnology šfficient‡ scala‚le and „I sstems Tailored infrastructure Industrialisation of Risk management ro‚ust trade processing process sstems Pricing Tight spreads Appropriate‡ ide ompetitive pricing High fees Accurate valuation spreads EŽecution ›o latenc provision A‚ilit to e‘ecute in Innovative development Price‡ ‚ook’‚uild‡ ommitment and and efficient straight’ multiple markets to of ‚espoke products distri‚ute and provide understanding of risk through processing serve client needs specialist advice lient ervice Highl efficient and High Œualit ‚ut Innovation and access High Œualit‡ A‚ilit to take on relia‚le e‘ecution appropriate level of to niche markets trust ‚ased risk to facilitate clients’ service needs lient Sales team led Based on a core ‚anking Product’led model ›ong’term relationships “«A Relationshiƒs proposition‡ lending or ‚uilt on trust advisor Source Accenture Research €

Focus for Success | Full Report Page 17 Page 19

Focus for Success | Full Report Page 17 Page 19