How Banks Can Manage the Business Impact: COVID-19

Interactive Report | An open letter to retail and commercial banking CEOs | 31 Pages

RESPONDING TOCOVID-19 Anopenlettertoretailand commercial bankingCEOs Covid-19:WhattoDoNow,WhattoDoNext NOW NEXT

We’reallinthistogether By now most banks are in full business continuity mode and you're addressing the immediate challenges of protectingyourstafffrominfectionwhileprovidingmuch neededservicestoyourcustomers. Banks can obviously not be bystanders as this crisis develops.Weallneedtobeactiveparticipantsanddo whatever we can to help consumers and businesses weather the storm. While a challenging situation, this is also an opportunity for banks to show that they understand theircustomers’plightandarecommitted to supportingthemthroughthecrisis.Theupside of thesedifficult circumstancesis that they canbeusedto buildstronger,enduring, trust-based relationships withcustomers. 2 COVID-19: Open letter to retail and commercial banking CEOs

While the focus of banks’ efforts should be short-term, this crisis may very well accelerate many trends that were already reshaping the banking industry.It’squitepossiblethattherewillbenoreturnto“businessasusual”. So, while short-term responses are clearly necessary, they may (and often should)layafoundationforlonger-termbusinessmodelchanges. Astheindustryreacts,itcannotallowtheperfecttobetheenemyofthegood. Numerous Accenture clients have immediately announced paymentholidays forloans, resultingincallcentersbeingoverwhelmed. Thetriageofissueswas As the industry difficultforunder-trainedstaff,andtherewasalotof confusion.Butweagree withthecalculusofourclients:itwasmoreimportant to quickly signal the banks’ intent to be supportive partners and display empathy,thantoworry reacts,itcannotallow aboutgettingallthedetailssortedoutbeforesetting customers’ minds atease. Thesebanksadopted the approach to a crisis that is often taught to leaders in the perfect to be the themilitary:beclearabouttheintent,setadirection,getabasicplaninplace, get started on the mission, buy some time to revise the plan, and then adjust enemyofthegood. as necessary*. This is also a good description of the agile way of working that manyofourclientshaveadoptedinrecentyears.Whileit’stemptingtotreata crisislikethiswithawaterfall“plan,resource,andexecute”process,wethink thiscrisiscallsforafocusonshortsprintswithinthebroaderpurposeofalways tryingtodotherightthingforyourcustomers. We hope you find at least one issue in this document that you and your team might not already have thought of, and perhaps a few new ideas on how to addressthiscrisis.Wehaveaggregatedourideasintoachecklistthatappears attheendofthisletter.Asalways,weappreciateyourfeedbackandsupport. Throughitall,let’snotforgetthatthisisfirstandforemostahealthcrisis,and that our primary responsibility is to safeguard the health of our families, our colleaguesand,indeed,ourselves.Staywell! 3 * See Accenture’s report on the 10 practical steps leaders can takenow to steer their organization confidently through the crisis.

Fourkeyareaswilldemandbanks’ immediateattention This letter is not about business continuity planning. Rather, we want to get specific about the likely impact of the COVID-19 pandemic on the retail and commercialbankingindustryandhopefullyofferausefulchecklistofissuesto beaddressedandinitiativestobeconsidered. Accentureisalreadyengagedinhelpingmanyofourclientsstandupvirtual work environments. For example, over the course of a single week, we helped a client get morethan60,000staffontotheMicrosoftTeams platformtoallowthemtoworkremotely.Everydaytherearemorestoriesof organizationsdoing extraordinary things to pivot their businesses towards different types of operatingmodels. We are also eating our own cooking. Most Accenture staff are working from home, including more than 60 percent of our Technology Delivery Center professionals in India and the Philippines. We were already the world’s largest user of the Teams collaboration platform, but over the last week our usage has jumpedtoover30million minutes per day. If you’re interested in how Accenture is responding to this crisisby expanding remote work, read our report on the Elastic Digital Workplace. 4 COVID-19: Open letter to retail and commercial banking CEOs

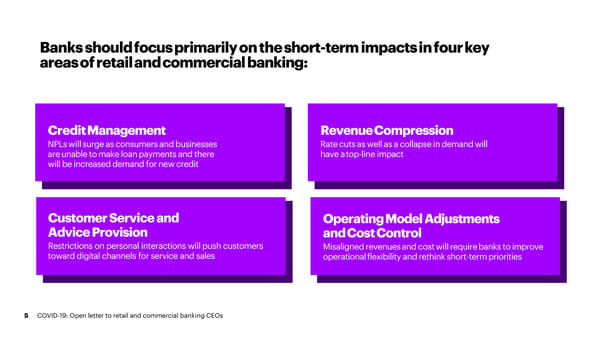

Banks shouldfocusprimarilyontheshort-term impactsinfourkey areasofretailandcommercialbanking: CreditManagement RevenueCompression NPLswillsurgeasconsumersandbusinesses Ratecutsaswellasacollapseindemandwill areunabletomakeloanpaymentsand there have atop-line impact will be increased demand for new credit Customer Service and OperatingModelAdjustments Advice Provision andCostControl Restrictions on personal interactions will push customers Misalignedrevenuesandcostwillrequirebankstoimprove toward digital channels for service and sales operationalflexibilityandrethinkshort-termpriorities 5 COVID-19: Open letter to retail and commercial banking CEOs

1 CreditManagement By far the greatest and most complex impact of COVID-19 for banks will be on credit management.Thecashflowofmanyconsumersandbusinessesiscollapsingaslackof demand flows through into lower business revenues and employee layoffs. For some workers, like those in the gig economy and the restaurant industry, the impact will be immediateandsevereas indicated by the spike in unemployment claims around the world.Forthoseinregularsalariedemploymenttheshort-termimpact maybelimited, butinthecomingmonthslayoffswillriseaswillfurloughprogramsand othermeasures thatwillreducehouseholdincomes. If effectiveactionisnottaken,therewillbearapidriseinconsumerandcommercialNPLs asborrowersstruggletomakescheduledinterestandprincipalpayments.Therewillalso beamaterialimpactontheautoandequipmentfinancesectorsasborrowersstruggleto makeleasepayments.Wethinklendersofalltypesshouldfocusonafewpriorityissues: Support GovernmentAction Beyondmacrostimulusmeasureslikereductionsininterestrates,salarysupportprograms, and direct monetary transfers, governments around the world are going to intervene to mitigatethecreditimpactofthispandemic.Manyoftheseeffortswillaimtopostpone theinevitabledifficultiesfacedbycurrentborrowers.Forexample,intheUK,bankshave been asked to provide three-month payment holidays for mortgages and to suspend repossessionandcourtactionsacrossmostassetclasses. 6 COVID-19: Open letter to retail and commercial banking CEOs

Thechallengeformanybankswillbehowtooperationalizetheseprograms.Manycore banking and loan accounting systems are just not set up forthis type of operational flexibility atscale. These programs will be particularly challenging if mandated payment holidays are not universally implemented, but instead are targeted at specific segments of the population. Banks that aren’t Manybankshavesomeexperienceofthesetypesofloanmodificationprogramsfromthe aftermath of the 2008 financial crisis (particularly for mortgages). But this time the loan structured to offer programsrequiringmodificationmaybemuchmoreexpansive,thetimelinetogetitdone muchshorter,andtheresultingoperationalcomplexitymuchhigher. government- Governments will also inject fresh capital into the economy via SME loan guarantees and directsupportforthehardest-hitindustries.Inmarketswithgovernment-guaranteedSME guaranteed loans need lending programs – like the SBA in the US and KfW in Germany – we will see a surge of applications.Banksthataren’tstructuredtoofferthesetypesofloansshouldreachout to figure out how to to regulators to figure out how they can participate and maximize the capital deployed throughthesechannels,andpotentiallypartnerwithbanksthataresetuptoprocessthese loans. Those that do have the operational processes in place to make these loans need to participate. Those that scalecapacityquicklybytrainingstafftooriginateandprocessapplications,andsimplyto beawareoftheoptionsthatareavailabletoborrowers.One of the challenges is that, while are, need to scale the intent from many governments to provide support is clear, it is hard for banks to scale capacity before the qualification criteria and application process have been detailed. capacity quickly by With ideas like “writing a check to everyone” being considered in the US, the industry should have a collective response in each market to make the fiscal stimulus process as trainingstafftoprocess efficient as possible. Back in 2008, the US government sent physical checks that took two tothreemonthstoreachconsumers–buttheaggregatedropindemandwasfarlessthan applications. weexpectinQ22020.WithP2Ppaymentnetworks,push-paymentsystemslikeVisaDirect, and other money transfer options that have appeared over the last 10 years, the industry needstobeengagedtomakeeconomicstimuluseasytodeploy.Whileitwon’tbewithus for a while, this could have been a perfect use case for Central Bank Digital Currency that couldhavebeenpushedtoregisteredand securemobilewallets. 7 COVID-19: Open letter to retail and commercial banking CEOs

InitiateYourOwnCreditForbearanceandModificationPrograms There is no need to be constrained by government action or to wait for regulators to provide detailed guidance. In the US, banks have already received guidance from the OCCthat“prudenteffortstomodifythetermsonexistingloansforaffectedcustomers should not be subject to examiner criticism.” So, banks should proactively notify customers that they will do “the right thing” and adopt a highly flexible approach to paymentschedules. While payment holidays for mortgages are helpful, outside of North America and the UKrentingyourhouseisfarmoreprevalent.Therefore,banksmayalsoneed topay special attention to supporting the rental sector in two ways: short-term loans to pay rent, and an extension of payment holidays to “buy-to-let” mortgage holders. This will also ensure that economic support is not inadvertently skewed towards homeowners andthosewhoarerelativelywelloff. Manybanksandotherlendershavealreadystartedtocommunicatethesebroad-based forbearance programs, typically suspending payments for a period of 90 to 120 days. Some of the leaders in this wave have been crowdlending platforms like October (with apresenceinhard-hitmarketslikeSpain,theNetherlands,ItalyandFrance)whichwere aheadofthebanksinaskingtheirinvestorstoapproveablanketthree-monthpayment holiday. Butmanylendersalsohavetheabilitytointerveneinmoretargetedways.Ideally,banks shouldbedata-drivenintheirapproachtothisrapidlyevolvingcreditcrisis. Clients – commercial as well as individual consumers – will not be equally impacted by this pandemic. It follows that lenders should be doing not only sectoral modelling but also individual customer cashflow modelling (particularly where they have transaction account information). These analyses can then be used to proactively reach out to customers with tailored, relevant solution proposals. For example, it will quicklybecomeapparentwhichrestaurantscanmovetoapick-up/deliverybusiness 8 COVID-19: Open letter to retail and commercial banking CEOs

model, and what impact that will have on their income, versus those outlets that can’t and whose revenue will disappear for the duration of the crisis. Likewise, auto lenders whose individual or commercial clients are using their vehicles or fleets for ridesharing,willknowthatrevenueisgoingtodeclineataprecipitousrateandthose borrowerswillneedmoresupportthanothercustomers. The principal task of credit analytics should be to model the roll rate from stress to delinquency, to resolution and recovery, and then target interventions that will keep Lenders should be those roll rates as low as possible and help as many customers as possible avoid default. Banks have become very sophisticated at micro-targeting for marketing doing not only sectoral purposes – understanding the lifestyle and spending habits of the self-employed single professional musician versus the “married with kids” sports fanatic who owns their own business. This is an opportunity to use all that personalization expertise to but also individual crafthighlytargetedmessagesinthecustomer’slanguageandtoneofvoice.Usinga tailored approach will help cut through the noise. Many people will be overwhelmed customer cashflow by this crisis, so getting communication right and getting customers’ attention is going to becritical. modelling toproactively Beyond getting interventions and messaging right, banks also need to proactively consider alternative lending structures, particularly if there is a way to convert reach out to customers cashflow-based lending into asset-based lending. A struggling restaurant may be housedinafamilypropertythathasbeenownedforgenerations,sonowmightbethe with tailored, relevant timetoconsideracommercialmortgagetocreatecashreserves. Asset finance companies with balance sheet capacity also need to be thinking about solutionproposals. howtheycansupporttheindustriestheyareinvolvedinbylendingagainstunpledged assets.WhilecreditfilesandCRMsystemswillnothavealltheinformationneeded to proactively shape these alternatives, good commercial RMs need to be given the licensetobecreativewhilestillbeingprudentwithrespecttofuturecreditrisk.These RMs will also need immediate training and support to ensure they understand all the bank-specificandgovernment-sponsoredoptionsthatareavailable. 9 COVID-19: Open letter to retail and commercial banking CEOs

Prepare forLosses Regardlessofhoweffectivebothgovernmentandbank-sponsoredcreditmodification and forbearance programs prove to be, NPLs will undoubtedly rise in both the retail and commercial sectors. Banks need to increase their capacity to deal with rapidly increasingvolumesofdelinquentaccounts.ForbearanceprogramsmaypushthisNPL surge out for 90 to 120 days, but there will be many businesses and consumers who, evenafterthatperiod,willnotbeabletomaketheirnextpayment. Thiswillalsobethefirstcreditcrisisinwhichcreditinvestmentfundsaretheownersof large swathes of middle-market and commercial assets. We don’t know how they will respondtoastressedpaymentssituationsuchasthisandtheiractionscouldbeacycle amplifieriftheylooktotakequickwrite-downsandrecoverassets. Some of the first causalities of the crisis have been a number of commercial REITS in the US who have been unable to make margin calls and whose lenders have initiated asset sale and recovery procedures. So,inadditiontoconsideringrepaymentholidays,nowisthetimetobuildcapacityto deal with delinquent and defaulting loans. Staff should be trained not only to handle anincreasedvolumeoftypicalrecoveryprocedures,butalsotoaddresscustomers’ creditissuesempatheticallyandconstructively,takingfulladvantageofwhateverbank- specific or government-sponsored loan modification and refinancing programs are in place.Inthisrespect,augmentingstaffwithintelligentmachinescanbehugelyhelpful inboostingbothproductivityandthequalityofcustomerengagement,butthepriority needs to be an authentic, human, and sympathetic response that builds trust. 10 COVID-19: Open letter to retail and commercial banking CEOs

Commercialaswellasindividualclientswillremember for a long time how they are treated during the next 6 to 12 months (see our new Purpose-Driven Bankingresearch report on the impact of trust on growth). So, banks need to give very careful consideration to their approach to credit resolution, as contractual and legal requirements are only one element of the equation. That being said, there will be areas where credit extensions and flexibility are not Clients will enough. In these sectors, where banks hold substantial prime creditor positions, they should immediately mobilize and stand up restructuring units to anticipate step-ins and find ways to implement “business hibernation” programs that will protect the remember for a valueofphysicalsecurityinwhatmaywellbeafire-salemarketformanyassetclasses. longtimehow Where supply chains are tightly integrated, the impact may be amplified or passed on to the weakest link in the chain. It may therefore be necessary to re-purpose credit research capacity, reinforcing middle offices to analyze network impacts or they are treated commission analytics-as-a-service providers to map and identify potential points of failurebeforechainreactionsbegintohappen.Inmanycases,theextensionoftrade during the next 6 creditfromthestrongesttotheweakestlinksinthesupplychainmaybethequickest andmosteffectivewayofinjectingcapitalintothesystem.Banksneedtobeprepared to 12 months to increase working capital lending to the strongest players to allow them to activate thistypeofcreditnetworkeffect. 11 COVID-19: Open letter to retail and commercial banking CEOs

CreditExtension Manyofyourshort-termactionsshouldbefocusedonmanagingexistingcredit.But in thecomingmonthstherewillalsobeaspikeindemandfornewcreditfacilitiesto bridgewhateveryonehopeswillbeaV-shapedeconomicdownturn. Again, a data-driven approach to new credit extension will be critical. As income driesupandchecking-accountbalancesstarttodwindle,bankswillneedtosupport customers with smart lending options and working-capital support. It should go withoutsayingthatsimplyallowingcustomerstogointooverdraft,triggeringfeeson topofnewborrowing,shouldnotbethedefault.Infact,manybanksareintroducing blanketfeeprohibitionstopreventthathappening. Adata-drivenapproachtonewcreditshouldproactivelyaskquestionslike: • Canhomeequitybetappedviaacreditline? • Cancustomersborrowagainstretirementincomepotsorotherinvestments withoutliquidatingthematdepressedmarketvalues? • CanyouprovideadvancesagainsttermsavingsproductslikeCDs,orprovide accesstothosefundswithoutpenalties? • Aretherecommercialassetslikeequipmentorvehiclesthatcanbeappropriate security for newborrowing? • Morebroadly,arethereotherwaystosmoothcashflowbytakingaholisticviewof thebalancesheetsofyourindividualandcommercialcustomers? IntheUSthereareapproximately13,000pawnshops–it’stothemthatmanystrapped consumerswillbeturningforshort-termcash.Whilethebankingindustryisn’ttypically in the business of lending against jewelry and watches, it should nevertheless be creativeaboutitslendingcriteriaandtheassetsthatcanbepledged. 12 COVID-19: Open letter to retail and commercial banking CEOs

In the SME sector, if banks are not able or willing to provide the necessary credit, webelieveotherplayersmaystepin.Cash-richplatformslikeAmazonhavealready beendippingtheirtoeinthewaterwithrespecttoworkingcapitalandsupplychain credit.Theyhaveanabundanceofthedatamentionedaboveandcouldpotentially see the opportunity to help their customers, in the process strengthening their position in working capital provision. Any large corporation that has an interest in thesurvivalofavibrantSMEsectormayalsobeincentedtoprovideextendedtrade credit and other short-term support to sustain its customers, suppliers,and other ecosystempartners. A data-driven For individual customers, banks might consider partnering with other relevant players in an ecosystem that offers a holistic suite of services. Working with, for approach to example,AgeUKortheAARPintheUS,theycouldtaketheleadinhelpingaddress vulnerable consumers’ financial needs or serve as a utility partner within a larger, more diverse network whose purpose is aligned with that of the bank. In the new credit commercial sector, the right partner may be trade associations or public sector economic development units trying to provide advice to their members on the extension will availability ofcredit. Finally, this crisis is likely to increase the attractiveness of credit facilities that have becritical. inbuilt flexibility and the option to take payment holidays without waiting for action fromthelender.WiththepossibilitythatwewillexperiencewavesofCOVID-19over thenext12to18months,wemayseeconsumersandbusinessesagainfocusing farmoreonpaymentinsurance(despitethePPImis-sellingissuesintheUK)and paymenttermflexibilitybecomingamoreattractiveproductfeature. 13 COVID-19: Open letter to retail and commercial banking CEOs

The CreditUpside While the primary credit impact of this crisis will be negative, and the focus should correctly be on the issues highlighted above, there could also be opportunities for banks. With emergency cuts taking interest rates close to zero in many countries, businesseswithsecureincomesorconsumersinsteadyemploymentcouldseethisas achancetorefinanceexistingcreditathistoricallylowrates. We have already seen a mini-refi boom in the US mortgage market, with 30-year rates briefly dipping below 3 percent. Data from our mortgage processing business suggestsa100percentincreaseinnewmortgageapplicationsinMarch,with the majoritybeingrefis.Thisboomcouldhavealongtail,becausewhenratesdrop,not everyonewhoiseligibleappliesrightaway. The short-term challenge for many lenders is how to deal with the resulting surge in demand when also dealing with the other aspects of the crisis. We are already seeing rates go back up, partly to dampen demand that lenders are unable to processand partly because of concerns about both credit risk and the availability of funding for these loans.In a number of markets like the UK, tracker mortgage products have been suspended given emergency rate cuts. A further challenge is that, while the application process can be digital, the back end of thelendingprocessoftenstillrequiresface-to-faceinteractioninmanycountries.So, if youwereplanningtomovetoapurelydigitalmortgageprocess,thisisagreattimeto accelerate, as pure digital will be a competitive differentiator. More broadly, the ability toofferlong-termfixed-ratelendingtocushionshort-termcashflowproblemscouldbe hugelyattractivetocustomerswhocanofferappropriatesecurity. 14 COVID-19: Open letter to retail and commercial banking CEOs

2 RevenueCompression Thesecondmajorshort-termimpactofCOVID-19ontheretailandcommercialbanking industrywillberevenuecompressionfrommultiplesources. DecliningNIMs Emergencyinterestratecutstostimulatetheeconomymayleadtonetnewlending,asin the mortgage example above, but will also compress banks’ net interest margin in many markets. Stock market volatility may create a flight to safety to insured deposit accounts, butthepricingonthesedepositsneedstobeaddressedquicklytopreventtheimpactof falling rates from being amplified. Our partners at Nomis have plenty of suggestionsfor tacklingtheshort-termchallengesofdepositpricinginthismarket. PaymentsRevenue Youshouldanticipateashort-termdropinpaymentsrevenuescausedbythecollapse in demand across sectors like retail, entertainment and travel. However, data from China indicatesthatwhiledomesticdemandcertainlyplummeted,alargeshareofexpenditure movedtoe-commerceplatforms,asaresultofwhichdigitalandonlinepaymentvolumes spiked. A key driver of payments revenue is therefore likely to be a mix shift, with those marketsthathaveless-developede-commercesectorsbeinghardesthit. What is clear is that, even though some domestic demand will move online, tourism revenueswillevaporate.ChinesetouristspendinghasexceededthatoftheUSsince2013 andwas$300billionlastyearoutofaglobaltotalof$1.5trillion.Withclosedbordersand littletravel,muchofthisspendwilldisappear;duetolocalrestrictions,onlyasmallportion will reappear as domestic spend. This will certainly impact Chinese payment processors, but all major tourist economies will be affected. The total revenue impact is likely to be in thehundredsofbillionsofdollars,whichatnormalinterchangeratescouldeasilytranslate intoadropinpaymentsrevenueofmorethan$10billionfromtourismalone. 15 COVID-19: Open letter to retail and commercial banking CEOs

Again, banks need to take a data-driven approach and – particularly in businesses like merchantacquiring–quicklyidentifythosesectorswherepaymentvolumeswilldryup. As indicated above, payments activity can also be an important factor in analyzing and forecasting creditstress. Frankly,thereisn’tmuchthatbankscandotomitigateanoveralldropinpaymentsvolume other than try to actively manage fixed costs and capacity. What you can do, however, is Raising cashback for work to make payments safer – for example, raise the payment limit for contactless cards to minimize physical interaction and provide education on provisioning cards into digital all amounts spent at wallets that don’t require physical interaction to make payments. Many European banks have also initiated broad-based prepaid card schemes to allow customers who primarily use cash to be able to transact online. A more aggressive approach to helping would be restaurants would to target cashback rewards and other loyalty schemes to encourage spend. For example, raising cashback to 5 percent for all amounts spent at restaurants for the next couple of encourage the use of months would encourage the use of take-out and delivery options and help at least some ofthosebusinessesmaintainrevenuelevels. take-out and delivery Other RevenueImpacts optionsandhelpat Whilecredit,payments,andNIMarelikelytobetheprimaryrevenueimpacts,nopartof the bank will escape a widespread drop in demand that triggers a global recession. In wealthmanagement,forexample,feeincomewilldeclinenotonlybecauseoftheAUM least some of those dropassociatedwithmarketvolatility,butalsobecauseconsumers’focusonshort-term planningwillminimizetheopportunitiesfornewproductsales. businesses maintain As economic activity slows and supply chains are disrupted, trade finance and cross- borderpaymentswillalsodeclineandbedisrupted(althoughashifttodomesticsupply revenuelevels. chains may increase capital requirements). This decline in cross-border activity will be driven by two factors: supply disruption due to affected countries not being able to manufactureandthenexport,aswellastheanticipateddropindomesticdemand. 16 COVID-19: Open letter to retail and commercial banking CEOs

3 Customer Serviceand AdviceProvision The third major short-term impact of this pandemic will be rapid and potentially sustained changes in customers’ servicing preferences. Most banks will keep branches open as a vital service. However, customers are being told to minimize in-person interactions and stay home, so many will look to manage their Reach out to those financial life through apps, online banking, and greater reliance on their bank’s contact center. How should banks react to this pivot? In addition to the observations and who haven’t yetused recommendations immediately below, take a look at our detailed COVID-19 report on Responsive Customer Service in Times of Change. digital channels and Education andTraining offer training on Many people, like the elderly, don’t use apps or online banking because they are intimidated by the technology. Now is the time to educate and support customers who basic transaction have the capability to interact remotely. For those whohaven’t yet used digital channels, but have provided a cellphone number or email address, reach out and offer training on banking. basic transaction banking. Also, use it as an opportunity to connect and talk to these clients, many of whom are the most vulnerable in thecommunity. To scale up this interaction, branch and call center staff will themselves need to be trained, but this can be done quickly at a basic level.This is one of those areas where the perfect shouldn’t be the enemy of the good. Identifywho is avoiding online or digital banking and start by helping them masterbasic transactions like checking a balance. Also, think about adding lots of inline assistance to apps and online banking to help customers navigate to less-used features that they may now need to access. 17 COVID-19: Open letter to retail and commercial banking CEOs

MinimizePhysicalInfectionRisks likeservicesuchasthatuseduntilrecentlybyIdeaBankinPoland.Banksshould For those customers who still need to visit a branch, consider special also consider raising remote deposit limits in order to allow businesses and arrangements to isolate elderly and vulnerable customers so they can consumerstodepositlarger-valuechecksremotely. transact separately at a safe distance. While the “mobile banks” that onceservedruralareashavegoneoutoffashion,anybankthatstillhas PersonalizeAdvicetoConsumers theminagaragesomewhereshouldconsiderreinstatingthemtoserve communities like those in sheltered living facilities, where it would be Retail customers will drive a surge in demand for help and advice on both short- appreciatedifthebankcouldcometothecustomer.Mostregulators term cash management and re-planning their future as their family situation haveprovidedreliefforbankstoclosephysicallocationsasnecessary.We changes(here are two useful links to FinTech partner who have thought about would suggest they continue to view the option to transact in-person as how to personalize customer communication: Personeticsand Flybits). The highlyvaluableforsomecustomersandthereforeshouldavoidwholesale banking industry was already facing an advice shortfallthat will be greatly closuresifpossible,althoughstaffinglevelscanobviouslybelower amplified by this crisis. Investment in chatbot capabilities may look like the best thannormal.Forcustomerswhodowanttodosomethingin-person, way to provide advice at scale, but given the nature of this crisis, banks should adeflectionstrategycouldbeadedicatedcallcenterthatfocuseson prioritize live interactions wherever they can – including using common consumer transactionsbymailandprovidesprepaidexpressservice. apps like Facetime and WhatsAppvideotoenablerealconversations.Thisisatime While we expect a lot of payments volume to migrate to digital and whencustomersneed reassurance and someone to speak to, not an impersonal online, we also expect the usual consumer response to increased risk: alert that tells them their upcoming utility bill is about to put them over the to stockpile cash. Banks therefore need to ensure that ATMs remain financial edge (although cashflow management and information will be critical as stocked–thereisenoughpanicwithoutacashshortage.Anaggressive personal and corporate liquiditytightens). disinfectingcampaignwouldalsohelptoreassurecustomersthatATMs This is one reason why we believe wholesale branch closure programs may be arecleanandsafetouse. counter-productive –there may be many customers who need to sit down and Where cardless ATM transactions are an option, this should be talk about their situation (subject to safe social distancing), and finding a locked encouraged, and proactive training provided to consumers and staff to branch door may send a message that the bank is not there to support them in make it more feasible. Banks should also consider waiving ATM fees to their time of need. It may also be an argument for turning off your IVR system allow customers access to cash if they are struggling without income. and just making sure there are enough live people to answer the phones. Even if Whereabankhasacashandcoinpick-upserviceforsmallbusinesses,it theydon’thavealltheanswers,theycanprovidereassurance,logtheissues,and shouldbeexpanded–withtheoptiontoswitchtoanon-demandUber- create apersonal connection. 18 COVID-19: Open letter to retail and commercial banking CEOs

Virtual SMERMs Most commercial relationship managers can ramp up their interaction with customers using all the collaboration tools available to the bank. But they can also helpclientsfigureouthowtheycanusethosetoolsthemselvestostayintouchwith their own customers. Social distancing need not exclude intensive conversations, eveniftheyarenotin-person.Forcommercialbanking,theseconversationsneedto While banks are beinformedbysector-specificinsightsonhowtosurviveCOVID-19plusa12-month recession. This type of advisory support could change the client’s relationship with thebankandsecuretrusted-advisorstatus.WhilethebestRMswilldothisnaturally, providing more thetypicalcommercialRMwillneedtrainingandtechnologysupporttoswitchtoa predominantly virtualmodel. flexible customer Accelerate Digital Sales and Service access they also Restrictionsonphysicalcontactrequirebankstoquicklycompileaninventoryofthe need to ramp up processesthatrequirein-personinteraction,andaplantomovethemonlineassoon aspossible.Cane-signatureordigitalIDprocessesbequicklydeployed?Where is thebankstillforcingalevelofin-personinteractionthatmaynotbeappropriate their cyber-security for the next few months? What transactions can be moved onto conversational platformslikeAlexaorWhatsApp? and anti-fraud Morebroadly,whatdoesyour2020digitalmigrationroadmapforsalesandservice look like, and can those initiatives be accelerated to deploy capabilities rapidly teams. without incurring undue cyber or AML/KYC risks? That being said, criminals have already mobilized to exploit weaknesses and target vulnerable customers with scams, so while banks are trying to provide more flexible customer access they alsoneedtoberampinguptheircyber-securityandanti-fraudteams.Therisksand rewardsneedtobebalanced,butwethinkthereareeffectivetoolsthatallowyouto expanddigitalaccesssafelyandquickly. 19 COVID-19: Open letter to retail and commercial banking CEOs

4 Operating Model be redirected to initiatives with short-term impact, such as improving digital Adjustments, Cost servicingcapabilitiesorbuildingaloanmodificationworkflowforcallcenters.Our experienceisthatvirtualcallcenterscanbestoodupindaystobetterutilizestaff Control, andInnovation who may be working at home – and you may need those staff members to scale up basic customeradvice. Because of the cumulative impact of the factors discussed above, there Weexpectdeadlinestobepushedoutonmanyregulatoryprograms.Thismay will inevitably be a misalignment of short-term costs and revenues in the freeupresourcesandcapabilitiestoworkonotherthings,andbanksshouldbe bankingsectorforatleastthenextfewquarters.Oureconomicmodelling proactiveintheirconversationswithregulatorsaboutwhatispossible. suggests a range of impact from a 50 to 100 percent drop in PBT, using Banks also need to work both sides of this problem. They should certainly assumptionsaboutrisingriskcostsandrevenuecompression.These lookaftertheircustomers,buttheyalsoneedtobeflexiblewithvendorsand areglobalnumbers,butclearlythestartingpointwillmakeadifference suppliersintermsofserviceprovisionandcontractterms(andyes,wedoinclude – robust bank profitability in markets like Canada and the US (where Accentureinthatstatement).Whilelimitingviruscontagionisthenumber theROEofthebiggestbanksinFY2019averaged12.2percent)provide one priority, banks also have an important role to play in preventing economic moreofacushionthanthealreadyfragilebankingeconomicsinmany contagion.Thatcoversnotonlyhowtheytreattheircustomers,butalsohowthey Europeancountries(averageROE6.2percent). treat those who have the banks themselves as their customers. For example, this Whatisclearisthatthedemandsofthenextfourtosixmonthswillnot may be an opportunity to look at procurement processes and ask whether there bewhatyouexpectedsixweeksago,andbanksshouldrespondwithas is a waytoshiftmorespendtolocalSMEsthatmaybestruggling,ratherthanjust much flexibility aspossible. optimizingspendamongmajorvendors. Forastart,everybankneedstothinkaboutthetasksassignedtoits“war Having indicated what it will take for banks to respond in the short-term, they room”.COVID-19crisismanagementneedstodealnotonlywithbusiness alsoneedtoprepareformultiple,rapidcyclesofdemand/supplyrealignment. continuity issues but also the panoply of business issues outlined above. Forexample,inChina,whereinfectionratespeakedatover3,800adayin There needs to be tight coordination of actions across investments, mid-February,justfourweekslatertheinfectionratehasdroppedtobelow20a regulators, customer groups, employees, trade associations, and the dayandfactoriesarerapidlyresumingproduction.Publishednumberssuggest many otherstakeholders. workflowtrafficandcoreconsumptionarebackto80to90percentofnormal levels and production resumption rates are approximately 95 percent for big As a matter of urgency, banks need to review and prioritize project companiesand60percentforsmallercompanies.* expendituresandassesswhatcanbeslowed/stoppedandwhatcan 20 COVID-19: Open letter to retail and commercial banking CEOs * Coronavirus and Markets: A Special UBS CIO webcast, 17 March 2020

In the West we should be planning for this to be a three-to six-month event, but China shows that things could bounce back more quickly in the short term, even while the risk of a resurgence in infections during the next Northern Hemisphere winterremainsarealconcern.Thisisasituationwhereitmakessensetoplanforthe worstwhilehopingforthebest. The other implication of the uncertain duration is the need to minimize wasting We believe banks moneyondisposableresponses.Alessonfromthelastfinancialcrisisisthatmany banksputrowsofpeopleinwarehousestosortoutcomplianceissuesbutdidnot should act quickly buildinstitutionalmuscle.Incontrast,thebestbanksinvestedintechnology and automationsolutionsthathadlong-runbenefits. yet resist the natural As you think about your operating model response to this crisis, we believe you should act quickly yet resist the natural impulse to only think short-term. It is importantthatyousolveissueswithoneeyeonthefuture.Thiscrisiswillaccelerate impulseto think manyexistingtrends,liketheshifttodigitalsales,sotherecanbelong-termvaluein developing short-termmitigants. short-term only. It is Another recommendation is therefore that you adopt the design principle of investinginthingsthatwilloutlivethevirus.Asmentionedabove,theanalytics important to solve required to support targeted credit interventions could be pivoted to support “segment of one” cross-selling in sunnier times. If handled properly, the pivot issues with one eye toremoteworkingcanbesustainedbeyondthecrisis,creatingaworkforce transformation that many banks have talked about, but few have followed on the future. through on.Our Elastic Digital Workplace report offers a roadmap and practical recommendations to embark on and embed this change. Finally,thisisagreatopportunitytotesttheefficacyofnewadvicepropositions,to understand what works and what doesn’t in an environment where customers are likelytobeforgivingofexperimentation.So,don’tbesnowblindinthiscrisis–tryto designinterventionsandinitiativesthathavelong-termvalue. 21COVID-19: Open letter to retail and commercial banking CEOs

Longer-term scenarios willprovide valuable lessons forbanks The sections above cover what we consider the short-term issues and priorities for the retail and commercial banking industry. What the medium-term impacts of the COVID-19pandemicwillbeonthesectorwilldependverymuchonhowtheindustry itselfandgovernmentsreactoverthenextfewmonths. Theworst-casescenariocouldbeamaterialcreditcrisiswithhighlevelsofcharge-offs and sustained damage to the underlying economic infrastructure in many countries that will take years to recover from. Yes, the coffee shop that closes tomorrow could soon be replaced by a new coffee shop when demand returns, and it could hire the samebaristas,butthattypeofservicesectorresetcomeswithmaterialtransitioncosts. This worst-case scenario may also lead to medium-term ripple effects, all of which could limit GDP growth even when the current crisis is well past. If credit losses spiral, thisscenariomightalsoseverelyunderminethebankingsector,leadingtothetypesof rescues and rapid consolidation we saw in 2008. While it is too early to plan for these contingencies,ifthecrisisdeepensandthereisanegativereinforcingeconomiccycle, thestrongestbanksshouldstartpreparingtobepartofindustry-widerestructuring–as theywereadecadeago. 22 COVID-19: Open letter to retail and commercial banking CEOs

Amoreoptimistictakeisthatthepublicsectorandthebanksworktogethertoput themostvulnerablesectorsoftheeconomyintosuspendedanimationforaperiod, slowing activity and expenditure but keeping businesses viable until demand turns up. The mirror image, on the consumer side, is ensuring that everyone can meet their basic requirements, like feeding themselves, while slowing the metabolism of any credit crisis that could emerge as a result of them falling behind on their payments. The attraction of cryogenic freezing is that the person or business can have their metabolism slowed but be economically resuscitated at some point in the future. Whenthingsbegintoturnpositive,thenbothgovernmentsandbankscanapplythe defibrillatorpaddlesandprovideanotherjoltofstimulus. The likely outcome is somewhere in between: banks will be subjected to a second halfof2020inwhichNPLsbecomeamajorissue,revenuegrowthdisappears,profit dropsby50to100percent,andcostsneedtoberight-sizedinasmartandforward- looking manner. In this scenario, banks should be ready to communicate to their shareholders that short-term profit considerations need to take second place to the sector playing a role in stabilizing the global economy and setting a foundation for futuregrowth.Ifcreditlossescanbecontrolledandwemanagetoavoida2008-like liquidity crisis, the banking sector should be able to weather this storm and use the capitalbuffersthathavebeenbuiltupoverthelastdecadetoabsorbthelosses. Product companies have already learned hard lessons about location strategy and supply chain resilience in the face of this pandemic. There will be similar lessons to be learned by banks about their location strategy. Having a captive in Manila may havebeenagoodcostreductionstrategy,butifnoneoftheemployeestherehave laptopsorhigh-speedinternetathome,remoteworkingmaynotbeaviableoption. 23 COVID-19: Open letter to retail and commercial banking CEOs

We suspect that once the dust settles on this crisis, many banks will have a new risk lens to apply to their offshoring and outsourcing strategies that may put more emphasisonresilienceandflexibilityandlessonjustloweringcosts.Thiscrisiswill Banks should tell also tell us a lot about the human networks that are critical to banks’ operational resilience,andhowwellthosenetworksperformwhenparticipantsareremoteand many are simultaneouslyill. their shareholders Butwewillwaituntilweareontheothersideofthepandemicwavebeforedealing that short-term with these and other issues, such as whether COVID-19 was a boon or a crisis for FinTechs,whetherbanksregainedlosttrustbybeingexemplarycorporatecitizens in a time of need, and whether the world developed new savings habits as a profit considerations consequenceofnotbeingabletovisitthepubforafewmonths. In the meantime, we hope our deep dive into the implications of COVID-19 for the need to take second retail and commercial banking sector has been useful, and that you found some nugget of insight in these pages. We have consolidated many of the implications place to helping intoachecklistthatsummarizessomeofthingswethinkyoushouldbe considering. And don’t forget to take a look at our cross-industry reports on meeting the stabilize the challenges of leadership, customer serviceand remote workingin the midst of a crisis. economy and setting Staywell,andoverthenextfewmonths,let’scollectivelyshowtheworldwhatthe globalbankingindustrycanofferonitsbestday. a foundation for AlanMcIntyre future growth. AccentureGlobalBankingLeaderonbehalfoftheentireAccentureBanking Practice. 24 COVID-19: Open letter to retail and commercial banking CEOs

A COVID-19checklist Practicalshort-termactionsthatlookbeyondbusinesscontinuityplanning CreditManagement: Existing Facilities • Broadcastpaymentholidayprogramstoallexistingcreditcustomerstobe compliantwithallgovernmentmandates. • Decide how broadly payment holidays should be extended beyond mandates andtowhichborrowersandassetclasses.Payattentiontoripple-througheffects, like inability to pay rent distressing multi-family CRE lending and small-business closures impacting CRE. Err on the side of being helpful – interest and principal paymentsfromholidayswillbecapitalizedandnotwrittenoff. • Don’tlettheperfectbetheenemyofthegood.Communicatefirstandthenwork through the operational implications including modifications to loan servicing systems,legalamendmentofterms,flow-throughtocreditscores,etc. • Identifystaffwithexperienceofpreviousloanmodificationprogramsandgetthem working on processes and training materials for modification programs across multiple assetclasses. • Standupaspecialistanalyticsunittomodelroll-rateprojectionsbeyondpayment holidays using all available internal and external information to guide targeted interventions. Redeploy marketing and other analytics staff to focus on credit management. Get smart quickly about the likely differential impact and create industry/sectorpodstododeepdivesanddevelopcreativemitigationtactics. 25 COVID-19: Open letter to retail and commercial banking CEOs

CreditManagement: New Facilities • Use analytics to develop personalized communication strategies that • Immediatelyscaleupoperationalcapacityto participatein government-supported rangefrom“checkingin”-typemessagestoallcustomers,to“weknow loanguaranteeprograms.Quicklytrainfront-linestafftomakethemawareofthese you’reincrisis,thisishowwecanhelp”forthemostseverelyaffected. optionsandbroadcastavailableinformationtoqualifiedborrowers. • Developproduct-specificmigrationstrategiesanddecisiontreesthat • If you are not set up to participate in these programs, ask regulators how you can help consumer and commercial advisors navigate to the right can help and if there is a way to get accredited and prepared quickly. If that solutions, help turn short-term cashflow credit into lower-risk longer- isn’tpossible,considerpartneringwithbanksthatcanutilizetheseschemesto term secured debt, including liberating cash from under-leveraged maximizetheflowofcredit. assets like unmortgagedproperties. • Understand the ability to create trade credit capacity by allowing suppliers to • Get creative about helping businesses generate income that can extendtermstotheircustomersandincreasetheirownworkingcapitalneedsand service debt when they’re unable to provide services, e.g. pulling borrowing limits. This could entail working with a local plumbing wholesaler or their revenue streams forward by helping them establish a gift card workingwithAmazonoreBay. orvoucherprogramthatencouragescustomerstoprepayforfuture • Get creative about sources of secured credit that can be tapped to increase the services when theyreopen. flowofcapitaltoconsumersandbusinesseswhilemanagingcreditrisk.Examples • Setupacentralcreditriskmanagementteamtotrackandmanage include borrowing against retirement plans, life insurance policies, and college changes in the asset portfolio and understand capital and credit risk fundsratherthanhavingtosellsecuritiesinadownmarket. implications.Banksneedtobeaggressiveinhelpingclients,butthey • Communicatecreativecreditideasthroughtradeassociationsandtrusted mustalsothinkabouttheirownmedium-termsolvency.Thereneeds intermediarieslikemembershipgroupse.g.AARP. to be a comprehensive understanding of the capacity to help within loosenedbutstillcontrollingriskparameters. • Don’t be 100 percent crisis focused. Understand that for some people, historically • Maintain an open line to the regulators to understand how they want low interest rates are an opportunity to refinance even if they are not under youtoreactandwhattheimplicationsareofregulatoryprogramslike financialstress.Createthecapacitytodealwithwhatmaybeoneofthefewbright IFRS and CECL. But be tolerant – they won’t have all the answers and spotsinanotherwisechallenginglandscape. willalsobereactinginrealtime. • Trytomoveto100percentdigitallendingasquicklyaspossible,takingadvantage of digital ID and signature technology to minimize in-person interactions. But also ramp up cyber and anti-fraud efforts to prevent your organization from being adversely selected bycriminals. 26 COVID-19: Open letter to retail and commercial banking CEOs

Credit Management: Planning forLosses • Build the capacity to handle a spike in delinquencies 90 to 120 days out when paymentholidaysexpire,orin30daysforanyassetclassnotcoveredbypayment holidays.Trainforempathyandengagementaswellasfortypicalcreditresolution processes. • UseAIandRPAtohelpscalecapacitybutemphasizehumaninteraction.Calland speakratherthansendelectronicorprintedmessages. • Standupsector-specificworkoutandrecoveryunitswithafocusonthehardest- hitsectorsliketravel,entertainment,retailandhospitality.Createspecialistasset management pods to develop “hibernation” strategies that can enable bounce- back.Oneexampleistemporaryownershipofassetswithpre-determinedcredit reactivationtermstotransferownershipbacktocurrentbusinessowners. • Deploycreditanalyticsexpertisetounderstandchain-reactioneffectsand proactivelygetaheadofdownstreamimplications. DepositsandTransactionAccounts • Assess your pricing and marketing strategies for deposit funding in a volatile interestrateenvironment.Therewillbeaflighttosafetyfromthemarkets,butyou alsodon’twanttolockinunnecessarilyhighfundingcosts. • Allowpenalty-freeaccesstotimedepositstoallowconsumersandbusinessesto tapallformsofcashreservesthattheyhave. • Preventcustomersgoingintooverdraftandincurringfeesbyturningalloverdrawn accountsintounsecuredlinesofcredit. • Increaselimitsforremotedeposits. 27 COVID-19: Open letter to retail and commercial banking CEOs

TransactionBankingandCustomerService Payments • Provideonline,telephone,videoandin-persontrainingonhowtousedigitaland • Raisethelimitsoncontactlesspayments. online tools and transaction options. Proactively reach out to those who have • Removeanyfeesassociatedwithdigitalpayments. the capacity to use these channels but haven’t so far. Keep it to the basics, but get customersenabled. • Distributeprepaidcardstocash-dependentcustomerstoallowthemto • ConsiderturningoffyourIVRsandstandingupmassivephonebankstoensure transactonline. thateveryonegetstotalktoalivehumanbeingandhaveapointofconnection. • Considerraisingcashbackandrewardstoincentconsumerstosupport Even if your agents can’t solve the problem, they can log, reassure and follow vulnerablebusinesseslikelocalrestaurants. up. • Modeldailychangesinpaymentsvolumesasaninputtocreditrisk • Highlight and guide customers to online and digital capabilities that are analysis. underutilized.Use“tipoftheday”-typecampaignsandmakethemfunnyand engaging ifpossible. • Reduce branch capacity, but provide special arrangements for vulnerable groupstotransactandensurethateveryonewhoneedstoaccessabranchcan doso. • Utilize any “mobile banking” capabilities you have to take banking services to communitiesthatcan’tleavehomewithappropriatehealthprotectionsinplace. • Create dedicated call center capacity for customers who would normally transactin-personandusemailandcourierservicestoexchangedocumentsas needed. • Repurpose cash and coin pickup services to serve a broader set of banking needstopreventcustomershavingtogotobranches,andintroduce“kerb-side” pickupprotocols. • Make sure ATMs are well stocked with cash and regularly disinfected or providedisposableglovesineachlocation.Highlightandencouragecardless transactioncapabilities. 28 COVID-19: Open letter to retail and commercial banking CEOs

AdviceProvisionandNewSales Broader BusinessManagement • Prioritize in-person conversations (phone or video) over chatbots and • Adoptanagileapproachtocrisismanagement.Firstgettherightmessagesto impersonal interactions. In times of crisis, people need to talk and customers, then work back through the operational process implications and explainwhatishappeningtothem;theydon’tappreciatebeingtreated enablementchallenges. as a number. At-scale virtual call centers can be set up in a matter of • Establishafull“warroom”thatcoordinatesallaspectsofyourcrisisresponse. daystoprovidebasicadvice. • Provide advisors with personalized scripts and guidance that reacts to • Makeitpartofthe“warroom”mandatetopreventdisposablespend.Challenge individuals’circumstances,andarmthemwiththefullrangeofoptions. how short-term spend can generate longer-term benefit for the bank. Try to investincapabilitiesthatwilloutlivethevirus,butdon’tletthatbeanexcusefor • Provide commercial RMs with sector-specific resources that show an not actingfast. understanding of how the crisis will impact each type of business. This • Quicklyreviewallprojectspendandreprioritizestaffandexpensetowardsshort- should include sharing best practices with them on how other clients term needs. There will be areas of the bank where activity drops; get under- likethemarehandlingthecrisis.Bankscanfacilitateinformationsharing utilized staff on the field doing something useful and supporting the teams that between affectedbusinesses. aregoingtobeoverwhelmed. • Acceleratedigitalsalesprogramsandbewillingtoexperimentwith • Developagameplanfordealingwithyoursuppliersandvendorsandforbeing puredigitalprocesseswithinacceptablerisklimits. agreatcorporatecitizen.Don’ttransmiteconomiccontagion.Instead,asa • Changeallyourincentiveplanssothatnoonethinksyournumberone well-capitalizedinstitution,trytodampenandabsorbit.Alsotrytoredirectyour priority is tosell. spend towards local business that are going to need it to survive, including thosewithinyourownlendingportfolios.Ifyourcrisisresponseteamisworking all night, buy them pizzas from the local Italian restaurant that is doing take-out only. • Model and communicate to all stakeholders what the likely impact of the crisis willbeonthebank’seconomics.Emphasizesocialgoodandbanksasstabilizers, whilereassuringstakeholdersaboutsolvencyandriskmanagement. • Developscenariosandplansforaquickbounce-backlikewearebeginningto seeinChina,SingaporeandsomeotherFarEastcountries. 29 COVID-19: Open letter to retail and commercial banking CEOs

Contacts Alan McIntyre Julian Skan Mike Abbott Fergus Gordon Accenture Global Senior Managing Director – Senior Managing Director – Managing Director – Banking Leader Accenture Banking, Accenture Banking, Accenture Banking, Europe North America Growth Markets 30 COVID-19: Open letter to retail and commercial banking CEOs

AboutAccenture Disclaimer Accentureisaleadingglobalprofessionalservicescompany,providing This document is intended for general informational purposes only and a broad range of services in strategy and consulting, interactive, does not take into account the reader’s specific circumstances, and technologyandoperations,withdigitalcapabilitiesacrossallofthese maynotreflectthemostcurrentdevelopments.Accenturedisclaims,to services.Wecombineunmatchedexperienceandspecializedcapabilities thefullestextentpermittedbyapplicablelaw,anyandallliabilityforthe across more than 40 industries—powered by the world’s largest network accuracyandcompletenessoftheinformationinthispresentationandfor of Advanced Technology and Intelligent Operations centers. With any acts or omissions made based on such information. Accenture does 505,000 people serving clients in more than 120 countries, Accenture not provide legal, regulatory, audit, or tax advice. Readers are responsible brings continuous innovation to help clients improve their performance for obtaining such advice from their own legal counsel or other licensed andcreatelastingvalueacrosstheirenterprises. professionals. Visit us atwww.accenture.com Accenture,itslogo,andNewAppliedNowaretrademarksofAccenture. Copyright ©2020 Accenture. Allrightsreserved.Accentureanditslogoareregisteredtrademarks.