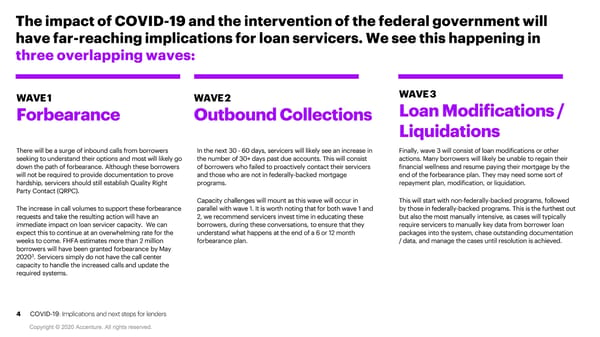

The impact of COVID-19 and the intervention of the federal government will have far-reaching implications for loan servicers. We see this happening in three overlapping waves: WAVE 1 WAVE 2 WAVE 3 Forbearance Outbound Collections Loan Modifications / Liquidations There will be a surge of inbound calls from borrowers In the next 30 -60 days, servicers will likely see an increase in Finally, wave 3 will consist of loan modifications or other seeking to understand their options and most will likely go the number of 30+ days past due accounts. This will consist actions. Many borrowers will likely be unable to regain their down the path of forbearance. Although these borrowers of borrowers who failed to proactively contact their servicers financial wellness and resume paying their mortgage by the will not be required to provide documentation to prove and those who are not in federally-backed mortgage end of the forbearance plan. They may need some sort of hardship, servicers should still establish Quality Right programs. repayment plan, modification, or liquidation. Party Contact (QRPC). Capacity challenges will mount as this wave will occur in This will start with non-federally-backed programs, followed The increase in call volumes to support these forbearance parallel with wave 1. It is worth noting that for both wave 1 and by those in federally-backed programs. This is the furthest out requests and take the resulting action will have an 2, we recommend servicers invest time in educating these but also the most manually intensive, as cases will typically immediate impact on loan servicer capacity. We can borrowers, during these conversations, to ensure that they require servicers to manually key data from borrower loan expect this to continue at an overwhelming rate for the understand what happens at the end of a 6 or 12 month packages into the system, chase outstanding documentation weeks to come. FHFA estimates more than 2 million forbearance plan. / data, and manage the cases until resolution is achieved. borrowers will have been granted forbearance by May 3 2020 . Servicers simply do not have the call center capacity to handle the increased calls and update the required systems. 4 COVID-19: Implications and next steps for lenders

Implications and Next Steps for Lenders: COVID-19 Page 3 Page 5

Implications and Next Steps for Lenders: COVID-19 Page 3 Page 5