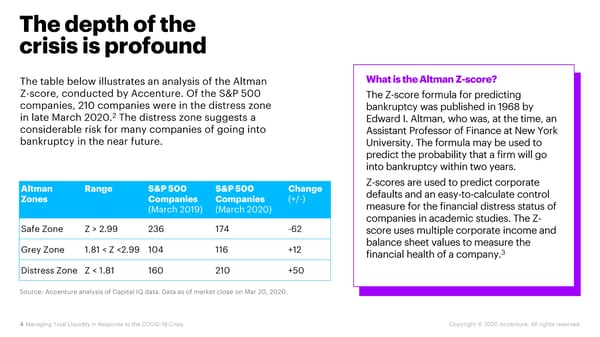

The depth of the crisis is profound The table below illustrates an analysis of the Altman What is the Altman Z-score? Z-score, conducted by Accenture. Of the S&P 500 The Z-score formula for predicting companies, 210 companies were in the distress zone bankruptcy was published in 1968 by in late March 2020.2 The distress zone suggests a Edward I. Altman, who was, at the time, an considerable risk for many companies of going into Assistant Professor of Finance at New York bankruptcy in the near future. University. The formula may be used to predict the probability that a firm will go into bankruptcy within two years. Altman Range S&P 500 S&P 500 Change Z-scores are used to predict corporate Zones Companies Companies (+/-) defaults and an easy-to-calculate control (March 2019) (March 2020) measure for the financial distress status of companies in academic studies. The Z- Safe Zone Z > 2.99 236 174 -62 score uses multiple corporate income and Grey Zone 1.81 < Z <2.99 104 116 +12 balance sheet values to measure the 3 financial health of a company. Distress Zone Z < 1.81 160 210 +50 Source: Accenture analysis of Capital IQ data. Data as of market close on Mar 20, 2020. 4 Managing Total Liquidity in Response to the COVID-19 Crisis Copyright © 2020 Accenture. All rights reserved.

Managing Total Liquidity in Crisis: COVID-19 Page 3 Page 5

Managing Total Liquidity in Crisis: COVID-19 Page 3 Page 5