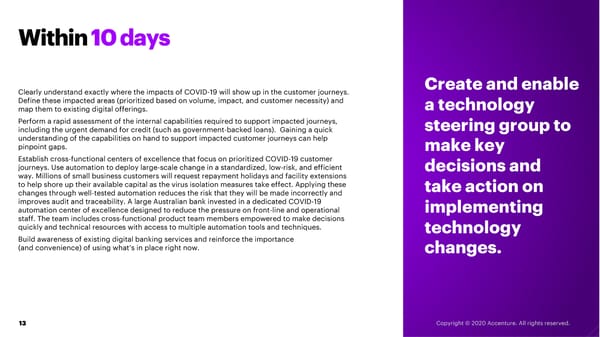

Within 10 days Clearly understand exactly where the impacts of COVID-19 will show up in the customer journeys. Create and enable Define these impacted areas (prioritized based on volume, impact, and customer necessity) and a technology map them to existing digital offerings. Perform a rapid assessment of the internal capabilities required to support impacted journeys, steering group to including the urgent demand for credit (such as government-backed loans). Gaining a quick understanding of the capabilities on hand to support impacted customer journeys can help pinpoint gaps. make key Establish cross-functional centers of excellence that focus on prioritized COVID-19 customer journeys. Use automation to deploy large-scale change in a standardized, low-risk, and efficient decisions and way. Millions of small business customers will request repayment holidays and facility extensions to help shore up their available capital as the virus isolation measures take effect. Applying these take actionon changes through well-tested automation reduces the risk that they will be made incorrectly and improves audit and traceability. A large Australian bank invested in a dedicated COVID-19 automation centerof excellence designed to reduce the pressure on front-line and operational implementing staff. The team includes cross-functional product team members empowered to make decisions quickly and technical resources with access to multiple automation tools and techniques. technology Build awareness of existing digital banking services and reinforce the importance (and convenience) of using what’s in place right now. changes. 13 Copyright © 2020 Accenture. All rights reserved.

Navigating COVID-19: Commercial Banks Page 12 Page 14

Navigating COVID-19: Commercial Banks Page 12 Page 14