Technology Vision for Insurance 2020

Report | Can Enterprise survive the "tech-clash?" | 68 Pages

#TECHVISION2020 Provocative thinking, transformative insights, tangible outcomes

Contents

#TECHVISION2020 Introduction Trend 4: Robots in the Wild 4 4 We, the Post-Digital People 38 Growing the enterprise’s reach—and responsibility 6 People are changing; companies must, too 8 Leaving the roadmap behind Technology Vision Trends Trend 5: Innovation DNA 10 The five trends most likely to impact insurance in 2020 and beyond 48 Create an engine for continuous innovation Trend 1: The I in Experience Conclusion 12 The five trends most likely to impact insurance in 2020 and beyond 58 Trend 2: AI and Me About the Technology Vision 20 Reimagine the business through human and AI collaboration 60 Trend 3: The Dilemma of Smart Things References 30 Overcome the “beta burden” 62 Technology Vision for Insurance 2020 | We, the Post-Digital People 3

Introduction 1 2 3 4 5 We, the Post-Digital People People’s love for technology has let businesses weave it—and themselves—into our lives, transforming the way we work, live and interact with the world. But that unconditional love is starting to fray, and the approaches companies took to reach this point won’t take them any further. Even as people’s expectations for their future with technology grow, many enterprises’ attempts to deliver on those expectations are being rejected. Leading companies will need to take a new path forward, developing models that bring a human focus. 4 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Digital is everywhere and people’s interactions across society are changing. They are Chinese insurance company, Ping An, has, to date, invested an eye-popping $7 billion reevaluating their relationships with businesses and governments. Many are rethinking their into technology and R&D and plans to spend another $15 billion over the next decade. actions in a globally interconnected economy and seeking more sustainable products and With 32,000 researchers and a combined 101,000 tech staff, Ping An is a bigger services. And a growing number are reexamining whether the offerings that enterprises technology company than most big technology companies—its fintech and cloud 3,4 deliver are fully aligned with their core values. computing products are used by 3,600-plus Chinese financial institutions. In a post-digital world—one where digital is not new to people and no longer a And Ping An’s goals go far beyond being one of the world’s largest online financial differentiating advantage for organizations—technology is deeply embedded in how we services supermarkets. It aims to be at the heart of five ecosystems in Asia: finance, work and live. Insurance enterprises have furthered this reliance by weaving technologies property, automotive, healthcare, and services for the “smart city”. These ecosystems are into their product and service offerings and how they are delivered to consumers and already bringing in about one-third of the group’s new financial-services clients, and more commercial customers. Many of the world’s leading insurance organizations have embarked than 576 million users and 100 Chinese cities are connected to at least one of them. on bold, wide-ranging digital transformation programs to reshape how they interact with people and other businesses. Similar trends are unfolding even in segments of insurance where the product has been difficult to understand and cumbersome to purchase online. For example, direct digital Generali, one of Europe’s largest insurers, in 2018 committed €1 billion in investment to a platforms for small commercial insurance in the US are maturing as companies come range of strategic innovation and technology initiatives. Its aim? To become a trusted life to market with simpler offerings that don’t need to be explained by a broker. partner to customers, able to deliver 360° advisory services, and comprehensive, 24/7 assistance. Following digitization and simplification of many core processes, Generali Insurtech unicorn, Next Insurance, offers tailored insurance offerings for some 1,000 types now aims to be a partner to customers in the moments that matter across the mobility, of small and micro business on its digital platforms,5 while Berkshire Hathaway has created 1,2 Its transformation efforts have been deep and home, business and health ecosystems. Three as an online one-stop shop providing a transparent, three-page policy covering 6 wide-ranging—from launching a pan-European mobility platform and developing B2B2C workers compensation, multiple liability coverages, and property and auto. ecosystems to digitizing agent-customer relationships and embedding artificial Intelligence (AI) in its core operations. Technology Vision for Insurance 2020 | We, the Post-Digital People 5

Introduction 1 2 3 4 5 People are changing; companies must, too Enterprise investments such as those mentioned above mean that technology plays Given the starring role technology has in people’s lives, it makes sense that we take a central role in people’s lives and in business today. But the increasingly strong and technology personally. It also explains why we expect so much more from it going symbiotic connection between people and technology is starting to take strain. Not forward. Just as many current models fail to account for the growing impact of because technology has ceased to be valuable, but because enterprises have not technology, our once unconditional love for unlimited technology is becoming yet re-oriented to just how personal and meaningful technology has become in conditional on us having control and agency. most people’s lives. Some are labeling today’s environment a “tech-lash,” or backlash against technology. This isn’t surprising. Just 20 years ago, digital access was limited by dial-up connections But that description fails to account for the fact that we’re using technology more than and desktop PCs, and individuals remained predominantly anonymous online. Tools ever. Rather, it’s a tech-clash—a collision between old models that are incongruous with like e-mail, forums and e-commerce were more efficient or far-reaching than analog people’s current expectations. counterparts, but hardly vital to people’s existence. Companies didn’t need to closely consider the impact of technology in their customers’ lives; our digital lives were distinctly separate from our “real” ones. It’s hard to find that kind of separation today as technology has become an inextricable part of the human experience. More than half the world’s population—a whopping 7 4.5 billion people—have access to the internet. People are ever-connected on every 8 Enterprises have not yet type of device, globally spending an average of 6.4 hours online daily. re-oriented to just how personal and meaningful technology has become in most people’s lives. 6 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 The tech-clash arrives at a time that insurance carriers are under growing pressure to accelerate their digital transformation. The Accenture Disruptability Index 2.0 ranks insurance in 2018 as the fourth most disrupted 9 sector, the most susceptible to future disruption, and one of the least innovative sectors. Insurance has lagged many other sectors in adopting digital technologies to transform its core, embrace customer-focused experience design, and weave its offering into people’s daily lives and into organizations’ daily operations. But with compressed margins, slowing growth, new competition and the erosion of traditional industry strengths, change is imperative for the incumbents. Some are looking at a “living business” model to reignite growth and enhance profitability. This approach sees insurers aim to provide products, services and experiences that “wrap around” individual customers, constantly learning more about their needs, intents and preferences. Making this transition will not be possible without winning customers’, employees’ and intermediaries’ confidence that insurers are using digital technology in ways that benefit them. Technology Vision for Insurance 2020 | We, the Post-Digital People 7

Introduction 1 2 3 4 5 Leaving the roadmap behind The roadmaps that digital pioneers used to build their platforms will need to change, considering the ongoing tech-clash. What does that mean for insurance enterprises? There’s no defined path left to follow. Insurance companies should be guided by the core values and concerns of their commercial and personal lines customers, agents, employees and other stakeholders. Here’s their opportunity to invent a virtuous circle of trust, data and deeper experiences— a more human future. 8 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Consider just one of the challenges today’s models create. People’s information—whether medical, shopping or other data—is generated, stored, shared, accessed and controlled by the companies and 81% ecosystems with which they do business, and sometimes even by businesses with whom they have no direct relationship. As these ecosystems grew to provide expansive personalization and valuable services, companies were relied on to steward more data and manage 52% increasingly complex relationships. But now customers are growing hungry for more input on how their data is used, and many businesses lack the mechanisms needed to provide that engagement. In this absence, consumers and business customers can grow wary of a business and potentially distrust it. Governments, sensing that distrust, are looking to impose consumer access and control requirements on personal data. of the 539 insurance business and IT of the 2,000 consumers surveyed this executives worldwide that Accenture year, 52 percent say that technology As a variety of technology models hit their breaking point, they herald surveyed for the Technology Vision report plays a prominent role or is ingrained a bigger shift that enterprises must note: people will no longer be this year, 81 percent acknowledge that into almost all aspects of their bystanders when it comes to technology. technology has become an inextricable day-to-day lives. part of the human experience. Technology Vision for Insurance 2020 | We, the Post-Digital People 9

Introduction 1 2 3 4 5 Technology Vision Trends To truly bring a human touch to the next decade, the new models that insurance businesses build must be rooted in collaboration. As technology’s level of impact grows ever higher throughout society, successful insurers will be those that use new models to invite people—customers, employees, partners, intermediaries and the public—to co-create their new course for the future. 10 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Five key trends have been identified: The I in AI and Me The Dilemma Robots in Innovation DNA Experience Reimagine the business of Smart Things the Wild Create an engine for Helping people choose through human and AI Overcome the Growing the enterprise’s continuous innovation collaboration Tap into the unprecedented scale their own adventure “beta burden” reach—and responsibility Redesign digital experiences with new Take a new approach that uses AI Address the new reality of product Prepare for robotics to move beyond of disruptive technology available models that amplify personal agency. to bring out the full power of people. ownership in the era of “forever the walls of the enterprise. Companies today. Build the capabilities and Turn passive audiences into active Move beyond deploying AI for beta.” Transform pain points in every industry will unlock new ecosystem partnerships necessary participants by transforming one-way automation alone and push into to assemble the organization’s the new frontier of co-creation into an opportunity to create an opportunities by introducing robots unique innovation DNA. experiences into true collaborations. between people and machines. unprecedented level of business- to the next frontier: the open world. customer partnership. Technology Vision for Insurance 2020 | We, the Post-Digital People 11

Trend 1: The I in Experience Helping people choose their own adventure

#TECHVISION2020 As customers demand more ownership over their digital lives, insurers must find ways to provide individuals with more agency and make them co-creators of their experiences. Those that do will find more active, engaged and loyal customers. Technology Vision for Insurance 2020 | We, the Post-Digital People 13

1 The I in Experience 2 3 4 5 Leaders that explore new avenues to include customer agency today will be laying the foundation for long-term success. Insurance products and services are gradually becoming more interactive, As of late 2018, there were about 11 million telematics-enabled insurance seamless and personalized as carriers use new digital interfaces in cars, policies in place out of roughly 200 million insured automobiles in the US, 11 homes, personal devices and workplaces to transform their relationships according to the Insurance Information Institute (III). Progressive, one of with customers. Some 77 percent of insurance executives in the 2020 the pioneers, has logged more than 25 billion miles through its Snapshot 12 Technology Vision survey agree that organizations need to dramatically program. Extending UBI to bus and truck fleets has helped Progressive to reengineer the experiences that bring technology and people together grow its net written premium in commercial auto from $1.9 billion in 2014 13 in a more human-centric manner. to $4.4 billion in 2019. Take the rise of vehicle telematics and usage-based insurance (UBI) in Not only are more carriers offering UBI policies; their products and markets such as the US and Italy as an example. This segment of the services are becoming more sophisticated. Beyond using smartphone auto insurance market is steadily growing from a niche product into sensors and a beacon device fitted to the vehicle to detect hard braking, the mainstream. With GEICO in 2019 joining the ranks of insurers using excessive speed, harsh acceleration and hard cornering, some telematics- telematics to track and improve driver behavior, the 10 largest carriers driven insurance solutions also offer variable monthly premiums 10 in the US now offer a UBI program. depending on how often and well you drive, including whether 14 you’re a focused or distracted driver. 14 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Digital discomfort Over the years, insurance businesses have built robust data gathering More than 80 percent of consumers are willing to share personal data understand their customers better and doing more to design more and analytics practices for pooling risk. But a shift towards assessing risk in exchange for benefits such as more competitive prices; faster, easier compelling customer experiences. This is a potential game-changer and determining pricing on an individualized level through models like services; priority service; and more relevant advice for their personal in an industry that has traditionally had little ongoing contact with UBI may bring a set of unintended consequences. Commercial and circumstance, according to Accenture’s 2019 Global Financial Services customers outside billing cycles, policy renewals and claims. 15 personal lines customers alike may wonder whether the algorithms Consumer Study. However, 38 percent would leave their insurer over that drive customization really work in their interests—will carriers, concerns about data security. For instance, TrueMotion, the provider of smartphone data platforms for example, scoop up low-risk customers and penalize others with to auto insurers, found in an 18-month trial for a distracted-driving app, unfair or unaffordable pricing? As such, a new trend is emerging. While commercial and personal that users opened the app 12.1 times per week and spent an average lines insurance customers welcome customized experiences, 13.2 minutes with the app. By contrast, consumers think about their Discomfort with the results of customization is only part of the issue. they don’t want these experiences to be overly determined for them insurer for only 9 minutes in the course of a year. Gamification and Consumers also worry about the data gathering practices and black- without their knowledge. They are asking insurance enterprises to be rewards were the key to the app’s success—end-users felt it was box techniques companies use to personalize their offerings. Two- their partners: working with them to create experiences, helping them beneficial to them and that it helped them to become more aware 16 thirds of consumers surveyed for this year’s Tech Vision report they reach their goals and giving them the option to change the experience of their driving behavior. are as concerned about the commercial use of their personal data when their needs or circumstances change. and online identity for personalization purposes as they are about security threats and hackers. More than creating a personalized touchpoint for their customer, insurers can use technology to begin building long-term partnerships and fostering loyalty. But it means sharing control and power in the relationship, giving customers agency. It starts with carriers learning to Technology Vision for Insurance 2020 | We, the Post-Digital People 15

1 The I in Experience 2 3 4 5 A new role for insurance Giving people and businesses the ability to make relevant choices But to do so successfully, insurance companies need to take on that inform their experiences could transform experience delivery a new role—shifting the focus from simply making sales or paying from a one-way street to dynamic and responsive collaborations. claims, to how they can best utilize customer input, guidelines and Not only could this give customers more choice and flexibility in choices to shape their experience. Customizing those experiences their insurance experience; it could also empower them to effectively means understanding when to make the process reduce or avoid risks, in turn driving down claims. seamless and invisible for customers, and when to step back and give the individual control. 16 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 There is a delicate balance that needs to be struck. For example, a commercial customer might Mapfre in Spain, meanwhile, has launched a spin-off digital platform called Savia to enable people to appreciate advice about how it can reduce claims across its fleet, when it is based on aggregated data. take control of their own and their families’ health. Users can use chat or video to contact healthcare It may not welcome its premium being adjusted according to the times of the day its vehicles are on the professionals, store personal information in a secure cloud, and access pay-per-use medical services. road or the routes it uses. And in personal lines, using telematics to track and gamify driving behavior Users can purchase a single service or buy a subscription plan. The plans can be activated and 18 across a family may come across as intrusive and creepy. deactivated on demand, with no contracts or cancellation fees. The new imperative for enterprises is to reposition themselves from an administrator to an enabler and Insurtechs and incumbents alike are also launching on-demand auto, home, life and personal liability a guide. For instance Assurance IQ, a direct-to-consumer life insurance platform in the US, uses data products that offer more flexible terms than the products of old—enabling customers to pick and mix science and machine learning to speed up applying for and purchasing personalized health, life, the cover they want, how long they want it, and when they want it. The Toggle brand from Farmers home, and auto solutions from over 20 providers. Insurance, in the US, for example, offers renters’ insurance for young adults that gives customers the 19 freedom to toggle different elements of coverage up, down, on or off at any time. Prudential Financial last year agreed to acquire Assurance IQ for $2.3 billion, with an additional earnout of up to $1.1 billion. The insurer plans to offer its own financial wellness solutions on the Assurance platform alongside those of third-party providers. The idea is to create a new end-to-end engagement 17 model for “customers who want to shop on their own terms, when, where and how they want.” Technology Vision for Insurance 2020 | We, the Post-Digital People 17

1 The I in Experience 2 3 4 5 Revolutionizing experience delivery Enterprises that are exploring cooperative experiences today are launching Although many of the technologies that will truly revolutionize experience delivery— like augmented reality (AR) and 5G—are still in early stages, there are others that can a new generation of customization, fit for future capabilities and expectations. help insurance carriers get started. For instance, many insurers are already investing in machine learning in functions such as underwriting and claims. These systems Those wanting to keep up, and stay competitive and relevant, will need to start have traditionally left little room for customer input; however, the technology can be building reputations as insurance companies that amplify customers through repurposed to enable greater levels of interaction. curated experiences, rather than marginalizing them. AXA XL’s Connected Cargo solution, for example, is a real-time digital cargo tracking Choose-your-own-adventure stories, customization with live user input and tools solution designed to help customers optimize their supply chain. Connected Cargo that let people design their own experiences are all ways that insurers are embracing gives clients 24/7 monitoring as well as access to AXA XL’s risk engineers’ expertise cooperative experiences that provide value and align to customers’ values. 20 to develop loss prevention plans. The solution uses data from sensors placed on containers—such as geolocation, temperature and humidity fluctuations, door opening and shock—to enable risk engineering experts to develop impactful prevention services for transportation and logistics risks. With every shipment, the data produced by these technologies becomes richer and more valuable, enabling underwriters to more accurately price and underwrite risk. 18 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 It’s a major shift away from how they have operated in the past, but a necessary one. Becoming a true partner to customers will be a defining aspect of insurers’ future. 83% % 83 70 70 of insurance executives believe of consumer respondents are concerned organizations need to elevate their about data privacy and commercial tracking relationships with customers as partners associated with their online activity, behavior, to compete in a post-digital world. location, and interests. Technology Vision for Insurance 2020 | We, the Post-Digital People 19

1 The I in Experience 2 3 4 5 To what extent does your business Decision understand consumers’ trust (perceived or lack thereof) in your business? Consider the risks and benefits associated with the business growing its personalization Points strategy, and the methods used to generate those experiences. Seek out opportunities to generate more customer feedback. Build a holistic understanding of how individuals experience your digital products and services today. Use these insights to inform your approach to designing future interactions. 20 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Does your current method for How is your company preparing for designing experiences lend itself to data regulation that impacts customer sharing control of experience design? experiences? Find points within your customer journeys where individuals may want more Prepare the enterprise to address an increasingly regulated digital landscape. Review control over their experiences. These points are opportunities to give people your current data collection and management practices to identify potential points of risk. using your digital products and services the agency that will drive long-term partnerships. Ensure that your policies for consumer management of data are fully documented and made available to consumers and regulators. Identify and invest in the technologies that will enable your next wave of cooperative experiences. Scalability, immersion and participation will be Revise your data collection and storage strategies to support cooperative experiences key to sharing control and co-creating unique customer engagements. while complying with regulation that requires consumer privacy. Technology Vision for Insurance 2020 | We, the Post-Digital People 21

Trend 2: AI and Me Reimagine the business through human and AI collaboration

#TECHVISION2020 Insurance organizations are only realizing a fraction of the potential of AI—and ultimately their employees. By finding more collaborative use cases and building the capabilities needed for AI and people to work together seamlessly, they will amplify the best qualities of both. Technology Vision for Insurance 2020 | We, the Post-Digital People 23

1 2 AI and Me 3 4 5 Although 68 percent of insurance companies in this year’s research are piloting or adopting AI in one or more business units, most are realizing only a small slice of their AI potential. While insurers are plugging AI and other tech tools into existing workflow, many are focusing on MetLife uses a robust analytical engine to segment and analyze claims, with eligible claims automatically automation and execution rather than its true transformative potential. Simply using AI to make their adjudicated in real-time. This has reduced turnaround from 12 days to 15 minutes. Case managers can organizations run faster and cheaper is to limit its impact. The leaders look at AI differently: not only as use AI, text analysis and visualization solutions to review and reassess in seconds rather than minutes. a way to transform how businesses do work, but also what their people actually do as well as how their In addition, an AI platform provides real-time alerts to help employees listen to and understand their 21 business operates, delivers its services and interacts with customers. AI is becoming an agent of change customers regardless of language or dialect. across the organization. AI can also compensate for human fallibility—for example, improving data quality. In small commercial However, AI can’t reinvent the business on its own. To tap into the unique strengths of the technology, insurance in North America, it is estimated that 20 percent of data from agents and customers is insurance businesses will rely on people’s ability to steward, direct and refine AI. They will need to incorrectly captured. AI can radically improve accuracy, improving pricing and performance. engineer the opportunity for human employees to couple their unique talents and knowledge with the capacity of machines to explore new possibilities. Another use case is the work a large carrier in Japan is doing to develop an integrated, AI-driven platform that supports P&C agents with sales support. Where the sales reps used to seek—and try to convert— Those that do so successfully will build the next generation of intelligent businesses—where humans leads based on their own relationships and experiences, they now get next-best-action recommendations and AI systems work together to reimagine what’s possible. MetLife’s claims organization is one example from the AI engine. The system is constantly improving based on agent feedback. of people and intelligent automation working hand in glove to enhance the customer experience and increase operating efficiencies. Robotic automation has freed up 200,000 hours per year for the US carrier’s case managers. 24 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Human-machine collaboration As these examples show, untethering creativity and catalyzing change begin These challenges are starting to disappear for text and spoken words at the level of human-machine collaboration. Insurers must think beyond a through advancements in NLP. Google’s BERT and Baidu’s ERNIE—which linear “command and response” relationship and engineer an interactive, are both open-source frameworks—enable AI systems to move from 22,23 exploratory and adaptable experience. This requires an innovative set of understanding just one word to understanding phrases in context. NLP capabilities that most enterprises aren’t actively building today. systems are increasingly able to understand the intent behind a human’s words, letting them better inform outcomes without constant intervention. Automation requires designing the skills to get a job done, but collaboration demands the ability to communicate and iterate with partners. Insurers Look at insurtech, Shift Technology, which has developed an AI solution to will need to explore and master the tools and advancements that enable detect claims anomalies and combat fraud. The solution analyzes structured humans and machines to better engage each other. Natural language and unstructured data from internal claims and contract data as well as processing (NLP), explainable AI and extended reality (XR) are examples of external sources such as meteorological data, satellite images or even tools that will all unlock new ways for humans and machines to interact. web data. The system uses NLP to extract structured data for use in fraud detection.Customers include the likes of Generali France, AXA and CNA 24, 25 Financial Services. Meaningful collaboration begins with communication, yet machines have historically struggled to understand human language. Machines typically are precise in their actions and operation, while language is anything but. Between slang, regional variations in dialect, sarcasm and single words that have multiple meanings,the challenges of language have complicated communication with machines. Technology Vision for Insurance 2020 | We, the Post-Digital People 25

1 2 AI and Me 3 4 5 Speaking the same language Language is just one element that machines will need to understand to better collaborate. For many employees, these technologies are most valuable when they can understand the physical context of humans. Companies must ensure the tech can sense—and make sense of—a person’s surroundings to enhance human-machine collaboration. Image recognition and machine learning allow Microsoft’s HoloLens 2 mixed reality headset to not only see, but also understand the wearer’s physical environment.26 26 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 While previous XR devices might only know that something process of an AI system, so that people can fine-tune it or Once enterprises enable the full scope of human-AI exists in the field of vision, the HoloLens 2 identifies an object correct biases as needed. The growing field of explainable collaboration, they can jump on the new opportunity before and understands what that object is: for instance, a couch is AI is letting humans de-mystify the output of previously “black- them—employing AI to reimagine everything: from the way not just a series of pixels, but something that can be sat on box” AI systems—even if the AI wasn’t designed to explain its their organizations are structured, to the way they approach and belongs in a living room. This contextual understanding decision-making process. work, to the value their enterprise creates. of the environment unlocks new capabilities for the device, like being able to identify dangerous equipment and warn the Work at Accenture Labs demonstrates this using data from 27 wearer if the equipment is operating hazardously. Perhaps the loan applications. If an applicant is denied a loan, the system technology could, one day, alert novice adjusters to damage in explains the reasons for the denial and offers the smallest a home during an inspection after a hurricane. number of changes the applicant would need to make to have the application approved, such as having more cash on hand 28 Collaboration can’t just be one-way; insurance companies or increasing annual income. In insurance, explainable AI must complete the feedback loop and build the capabilities should be able to tell a person why their claim was flagged that allow humans to better understand machines. True as potentially fraudulent or the reason for an unexpected iteration will require understanding the decision-making premium hike. By structuring their organizations with human and machine collaboration at the core, insurance pioneers are already positioning AI to be a driver of change. Technology Vision for Insurance 2020 | We, the Post-Digital People 27

1 2 AI and Me 3 4 5 AI-native insurance Consider Lemonade, a startup natively designed to use human-AI collaboration to offer a more seamless experience. At Lemonade, AI is embedded in the organization and present in nearly every workflow. Particularly, the company’s claims payment process was designed to play to the strength of AI and humans working together. 29 28 Technology Vision for Insurance 2020 | We, the Post-Digital People

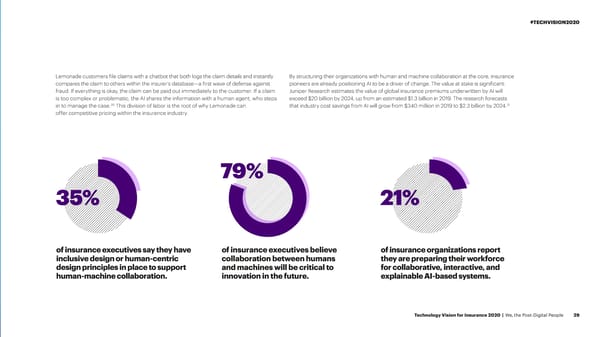

#TECHVISION2020 Lemonade customers file claims with a chatbot that both logs the claim details and instantly By structuring their organizations with human and machine collaboration at the core, insurance compares the claim to others within the insurer’s database—a first wave of defense against pioneers are already positioning AI to be a driver of change. The value at stake is significant: fraud. If everything is okay, the claim can be paid out immediately to the customer. If a claim Juniper Research estimates the value of global insurance premiums underwritten by AI will is too complex or problematic, the AI shares the information with a human agent, who steps exceed $20 billion by 2024, up from an estimated $1.3 billion in 2019. The research forecasts 30 31 in to manage the case. This division of labor is the root of why Lemonade can that industry cost savings from AI will grow from $340 million in 2019 to $2.3 billion by 2024. offer competitive pricing within the insurance industry. 79% 35% 21% of insurance executives say they have of insurance executives believe of insurance organizations report inclusive design or human-centric collaboration between humans they are preparing their workforce design principles in place to support and machines will be critical to for collaborative, interactive, and human-machine collaboration. innovation in the future. explainable AI-based systems. Technology Vision for Insurance 2020 | We, the Post-Digital People 29

1 2 AI and Me 3 4 5 Is your company thinking Decision collaboratively? D etermine the role that AI is playing in your business alongside your existing workforce. Think beyond which tasks could be replaced and imagine how you Points can build a new kind of workforce with humans and AI collaborating side by side. D etermine what tools are available internally to introduce the AI solutions needed to move your organization in this direction. If none is available, evaluate if employees have the skills to build the solutions, or engage partners to generate the necessary capabilities. 30 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 How will you roll out collaborative AI How will you address explainability? initiatives across the organization? E valuate the scope of decision-making that AI is being given in your organization. Identify sensitive areas where additional oversight may be needed and prioritize post-implementation E valuate where your industry is headed. Where are partners or competitors finding explainability solutions, such as counterfactual explanations, for those systems. success in deploying AI? F or all future AI projects, plan for explainability by design. Develop policies and principles T o ensure transparency and trust, gather workforce perspectives into the design that will guide the development, building and implementation of new AI systems. and implementation of AI systems. Ultimately, these employees will be the ones who determine the success of your AI investments. I f you’re not already using AI in the company, find an area to begin piloting the technology, such as co-designing a new product, coaching or training employees or reinventing customer engagement strategies. S pend time “training” AI to ensure that it is smart and useful when launched to the wider workforce. This will help to drive human/machine collaboration and adoption of AI tools. Technology Vision for Insurance 2020 | We, the Post-Digital People 31

Trend 3: The Dilemma of Smart Things Overcome the ‘beta burden’

#TECHVISION2020 As products become conduits for experiences, their features and functionality are constantly in flux. While this state of “forever beta” opens a wellspring of opportunity, if mishandled it risks leaving people overwhelmed, frustrated and wary of what’s around the corner. Technology Vision for Insurance 2020 | We, the Post-Digital People 33

1 2 3 The Dilemma of Smart Things 4 5 Enterprises across all industries are making big bets on a connected future. The internet of things market is expected to grow to 75.44 billion connected devices by 2025, with a projected market value of $1.1 trillion by 2026. 32,33 Insurers, too, are looking at ways that they can play a role in the smart device ecosystems emerging in homes, public spaces and workplaces, often in partnership with industrial equipment companies, tech companies, auto manufacturers, insurtechs, home appliance brands and other innovators. Generali in Italy, for example, has spun out an independent business As enterprises begin to design updateable products with the ability This applies to insurance as much as it does to other industries— called Generali Jeniot to focus on opportunities in connected to expand services and experiences in the future, they are making it a once stable product is evolving into a set of dynamic living services insurance. In partnership with organizations such as Fiat Chrysler possible to respond to changing customer demands and expectations with insurers like Generali embracing mobile apps and smart devices as Automobiles, DriveNow and Google, the company is developing at a moment’s notice. This sets the stage for feedback loops that support customer interfaces. In some cases, the aim is not only to gather richer a growing set of products powered by the internet of things and true partnerships, where companies can get closer to customers and data for underwriting or marketing, but also to interact with customers designed for the urban mobility, smart home, smart health and customers can see the value and utility of products grow over time. more often and deliver value-added functions such as lifestyle services 34 connected workplace ecosystems. or business advice. Enterprises across all industries are making big bets on a connected future. 34 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Updating now Around 70 percent of insurance executives in the 2020 survey say that At its worst, it can prompt customers to disengage from product their organization’s connected products and services will have more, or ecosystems and go back to old ways of doing things. Farmers in the significantly more, updates over the next three years. Groupama is not American Midwest, for example, are reportedly buying 40-year-old only one of France’s leading insurance groups but also one of its largest secondhand tractors rather than put up with smart tractors they can no agricultural insurers. Its application, Gari, illustrates how connected longer repair themselves. The issue for them is a loss of ownership and 36 insurance services may evolve. control over a vital piece of equipment. Groupama launched the farmtech app in 2019 with three free services A similar effect is seen in auto insurance, where claims expenses are (basic weather, market prices for crops and a task scheduling tool) and rising because of the higher costs of the parts and labor needed to repair three paid services (temperature sensors in haystacks, video surveillance high-tech automotive components like sensors and onboard computers. and high-precision meteorological data). The plan is to evolve the platform The number of insurance claims where a vehicle is deemed a total loss 35 are also rising as the cost of parts continues to climb faster than new car through field-testing and validating new features with farmers. prices. Claims severity is rising, but the frequency of claims is not falling fast enough to compensate. The result? The technologies meant to make As companies introduce this state of constantly evolving products and driving safer may be contributing to higher premiums for customers and services, they are challenging traditional perspectives on ownership. 37 lower profits for carriers. Without proper care, this living connection can quickly drift from a wellspring of opportunity, to products that feel completely beyond the control of the people using them. The risk is customers constantly having to play catch-up, not knowing if the next system update is bringing exciting new capabilities, a critical security refresh, a new user interface to learn or a dramatic change to functionality. Call it the beta burden: the unintended consequences when products, and their contained experiences, are constantly in flux. Technology Vision for Insurance 2020 | We, the Post-Digital People 35

1 2 3 The Dilemma of Smart Things 4 5 Who owns it? The question of ownership and the challenges of the beta burden are Evolutions in the engineering space started businesses down two sides of the same coin. Ownership of products is now effectively this path. Agile and DevOps processes allowed the organization to shared among companies and their customers. An evolving digital move and respond to the demands of customers, while application experience is designed to be an intrinsic part of the usefulness and programming interfaces (APIs) opened the door for robust and ever- differentiation of a product. That’s possible because the enterprise transforming ecosystems. But as adoption of this new generation of can take control of a product to improve or expand the experience products continues to grow, the impact is being felt far beyond the throughout its lifecycle. technology organization alone. But this is a huge departure from the past, when what you bought Insurance companies must expand the approach that began in the (and insured!) was what you got. The real value is often embedded engineering space to permeate every aspect of their organization, in software like apps and firmware. Tesla customers have seen their whether it’s sales, customer support, development, design, claims, cars transform without ever visiting a mechanic as new functions underwriting or others. If leaders ignore this imperative, even the like autonomous driving, accommodations for pets and enhanced most successfully delivered product or service will look like a failure safety features are pushed through firmware updates. when the businesses can’t keep up with its evolution. Insurance companies that leverage sensors and apps to interact with customers may need to evolve their strategies and operating models to align with a new role. To deliver the wide-ranging experiences they hope to achieve through flexible, updateable products, companies must rethink the way the entire organization develops, delivers and supports its outputs. 36 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Digital death As insurers work with ecosystem partners to integrate digital from one generation of product to the next will be a key component Enterprises across industries are transitioning to experience-driven technology into products, they will increasingly have to contend of customer retention and loyalty in the future. products because they see the potential of continuous interactions with the “digital deaths” of devices and apps. For example, that with their customers. Reimagining the organization to support these Apple Watch a life insurer gave to a customer to use as a calorie products’ new lifecycle is how insurance leaders will bring that Under today’s new models of ownership, products are more than just counter and fitness tracker won’t be much use when Apple ends potential to life for their own businesses. the object in someone’s hands. That may affect not only how insurers support for that model. interact with customers, but also the nature of certain insurable risks. Not only will old devices limit the business in its ability to deliver the What if, for example, a software update “bricks” an electric car? How most cutting-edge experience; they will also begin to generate risk for do insurers mitigate business continuity risks related to breakdowns the whole ecosystem as aging technology is often rife with security of internet of things devices or robots? vulnerabilities. Building a strategy to smoothly transition customers 78% 72% 65% of insurance executives report their industry of insurance executives believe customers of consumers are tolerant of software is moving toward offering more variety updates that address security issues; generally don’t mind, or even welcome, in ownership models for their connected software updates to their organization’s 46 percent believe software updates products and/or services. connected products and services. often bring new problems with them. Technology Vision for Insurance 2020 | We, the Post-Digital People 37

1 2 3 The Dilemma of Smart Things 4 5 How is your business responding to the Decision changing nature of ownership with the products you sell? T raditional models of ownership are shifting as devices gain the capacity to significantly change Points their functionality. Evaluate your organization’s current ability to support a shared model of product ownership: everything from how customers are on-boarded, to how they are engaged with over time can present myriad new opportunities to build relationships with customers. But it requires changes across the organization. 38 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 What is your company’s How are you creating long-term plan for products? maximally valuable products? A s the focus turns to selling continuous experiences, your company will need a different strategy D esign products to evolve and grow over time in response to customer usage and insights. Build a for the products that support those experiences. Explore ways of helping customers through this feedback loop by identifying what data would be necessary to understand your customers’ evolving transition to ensure long-term loyalty. needs. Develop the tools and platforms to capture that data. I dentify the biggest stakeholders in your ecosystem. This will include customers as well as app M ake future-focused design thinking a part of every product development process. Explore what developers or other device providers. Design a review process that will uncover what obstacles customers might want in five years and work backward to consider what sensors or technologies these stakeholders may face as software updates change the functionality, interoperability and might be necessary to support those ambitions. features of their products. H elp customers meet their sustainability goals. What can they do with aging hardware, and what expenses will they incur over time? Explore new strategies like developing a recycling and trade-in program or allowing people to repair devices themselves. Technology Vision for Insurance 2020 | We, the Post-Digital People 39

Trend 4: Robots in the Wild Growing the enterprise’s reach—and responsibility

#TECHVISION2020 Businesses are starting to extend their robotics capabilities into uncontrolled environments and the open world, and robot use cases are expanding from specialized industries to every industry. Insurance will have a key role to play in facilitating the exciting possibilities of a world of ubiquitous robots. Technology Vision for Insurance 2020 | We, the Post-Digital People 41

1 2 3 4 Robots in the Wild 5 Many companies have already seen the benefits of robotics in controlled spaces, from lower production costs to higher productivity and increased capacity for analytics. Advanced robotics is offering a path to push the intelligence of the digital world out into the physical one, amplifying these advantages and unlocking new capabilities in industries that have not traditionally benefited from robotics in the past. Advances in robotics, sensors, speech recognition and computer vision are combining with shrinking hardware 38,39 costs to make robots accessible for companies and individuals that haven’t traditionally used them. IDC predicts that the global robotics market will reach $210 billion by 2022; only half of that will be in manufacturing, 40 the traditional mainstay of robotics sales. At the same time, the rollout of 5G networks will unlock opportunities for all industries to extend their autonomous capabilities outside of contained settings like warehouses and production facilities—and into the open world. More than half (54 percent) of insurance executives expect their organizations will use robotics in uncontrolled environments within the next two years. Some of the world’s biggest companies are already using this shift to find new ways to serve customers and improve operations. Amazon’s small, six-wheeled delivery vehicle, called “Scout,” can autonomously navigate real- 41 world obstacles like trash cans, pets and snow blowers. In the building industry, Advance Construction Robotics’ TyBot is using repurposed self-driving-car technology to automate the physically demanding task of tying rebar, 42 allowing the job to get completed faster and more safely. 42 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 The robot migration These technologies are setting the stage for a massive robotmigration, beyond controlled But how might this change as mobile robots start interacting with people in settings such as environments into uncontrolled spaces and from specialized industries to every industry. Some homes, public roads, hospitals, shops, construction sites, universities and restaurants? In 72 percent of insurance executives surveyed for this report believe robotics will enable the next many cases, companies’ robots will interact with people with whom they have no employee or generation of services in the physical world. customer relationship. By contrast, when robotics remained confined to companies’ own controlled environments, they were likely to interact only with a company’s workforce or existing customers. As this process unfolds, it creates new risk exposure for insurers tocover, threatens traditional business lines, and opens opportunities for insurance companies to weave robots into their own processes. The migration will take many years, but the impact on the insurance sector, particularly commercial lines, could be profound. Industrial robots, constrained to the confines of plants, warehouses and factories, are not more dangerous than most industrial equipment. According to incident reports from the Occupational Safety and Health Administration (OSHA) agency in the US Department of Labor, there were just 43 38 robot-related accidents between 1984 and 2017. Technology Vision for Insurance 2020 | We, the Post-Digital People 43

1 2 3 4 Robots in the Wild 5 New liabilities As such, robotics may introduce new coverage and liability Robots will not only create new risks—they may also reduce old ones. issues in lines such as commercial general liability, product liability, Many of these devices will do jobs that are not only boring and repetitive workers’ compensation, and cyber-insurance. A report from Lloyd’s for humans, but also potentially dangerous and dirty—for example, lifting and the University of Surrey says, for example, that the risk profile for heavy items or navigating unsafe environments such as a building after employers’ liability and public liability could shift as liability is pushed an earthquake. Thus, insurers could see a drop in employee injury claims. back onto the robot product manufacturer. Though the pool of data for assessing risks associated with robots New risks, according to the researchers, include the potential for robots is small for now, the data that robots (along with internet of things in motion to cause damage to public or private property—for example, devices) will generate in years to come could also benefit insurance a delivery robot colliding with a privately-owned vehicle—and cyber- companies in the longer term. Insurers may be able to leverage risks related to the level of sensitive data robots will gather in homes this data to better understand and price risk in the workplace, and 44 and workplaces. Many traditional commercial insurance products perhaps even work with clients to reduce risks in lines such as are not yet tailored to these risks. workers’ compensation. Some insurance companies may find opportunities to underwrite specialist products for personal and commercial robots. The drone market may point the way. Pay-as-you-fly insurance for commercial and recreational drone pilots is available on hourly, monthly and annual plans from insurtechs and insurance carrier/startup partnerships, a model that 45,46 could be emulated in the robot-as-a-service space. 44 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Lessons from the self-driving car Auto insurers are perhaps the most advanced in their Many insurers anticipate that there will be fewer thinking about robots—they have spent years evaluating, and accidents, lower claims and less fraud in a world of preparing for, the potential impact of autonomous vehicles widespread autonomous vehicles because human error on their industry. They foresee that auto insurance could, by will be removed from the equation and insurers will have 2025, look very different to today due to the rise of the self- better data to assess risk and detect fraud. The experience driving car. And many of the same trends may apply to the in connected cars to date indicates that more expensive wider robotics market. vehicle repairs could offset the benefits of fewer accidents and claims in the short term. The longer-term downside might be lower premium income and perhaps even a Nearly two-thirds (64 percent) of insurance respondents reduced need for insurance products and services. to last year’s Tech Vision survey agreed that vehicle manufacturers will—via product liability coverage—assume a bigger share of the auto insurance market. This is already happening. Tesla’s insurance division, for example, professes to offer premiums 20 percent to 30 percent lower than rivals 47 on Tesla vehicles for eligible customers. It would not be surprising if major robot makers followed Tesla’s lead. Technology Vision for Insurance 2020 | We, the Post-Digital People 45

1 2 3 4 Robots in the Wild 5 Facilitating the rise of the robots Across industries, the proliferation of robots from the traditional controlled warehouse and manufacturing environments into the open world offers enormous opportunity. Increased customer interaction, data collection and even branding occasions will be possible, as limitations on the physical services companies can provide in customers’ lives disappear. But capturing this opportunity will never be as simple as buying a robot and sending it out the door. 46 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 48% 50% 50% Finding the right way to integrate robots into organizations and Consumers surveyed for the 2020 Insurance executives surveyed are equally the world includes challenges around talent, questions of human Technology Vision believe robots split in their views of how their employees will -computer interaction and a testbed that quite literally consists of are poised to make their lives easier embrace robotics: half say their employees the whole world—with no boundaries or built-in fail-safes. Insurance (48 percent), more efficient (42 will be challenged to figure out how to work has an as-yet underappreciated but vital role to play in ushering in percent), or more fun (30 percent). with robots; the other half believe their this era of disruption. employees will easily figure it out. By working with robotics manufacturers and enterprises, insurers can help organizations to understand and transfer the risks associated with robots in the wild, in turn facilitating confident adoption of the new technology. Robotics is likely to change the world in unexpected ways in the years to come—and insurance companies can help to make it happen. Technology Vision for Insurance 2020 | We, the Post-Digital People 47

1 2 3 4 Robots in the Wild 5 How will the advent of open- Decision world robotics impact your business? C onduct a discovery initiative to identify the latest advancements Points in robotics underway i n your customers’ lives and industries. A ssign a cross-functional group to study these insights and forecast where the company stands to grow, or be threatened, based on the trends. D evelop a strategy to build, buy or partner in order to develop the necessary capabilities to support the shift to robotics. 48 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Is your business ready Are you tracking the launch How will your business build to engage a wider set of 5G networks in relevant trust for robots among the of partners? markets—or exploring variety of stakeholders who new markets based on 5G will encounter them? T o ensure the success of robotics innovations, companies need availability? to be prepared to interact with a larger set of stakeholders. Engage government regulators to create policies for autonomous devices T ake steps to help people who are interacting with these devices to understand machine behavior. Consider the user experience in new environments and identify vendors for collaboration to I ncreased access to 5G networks will help spur widespread and human-machine interaction expertise your company will shape strategic agendas. adoption of connected assets, including robotics. Increased mobile need to navigate these uncertain waters. network speeds and lower latency are major factors that will enable autonomous devices in new environments. Look for opportunities to capitalize on nearby launch markets and explore the industrial applications that 5G networks present. Technology Vision for Insurance 2020 | We, the Post-Digital People 49

Trend 5: Innovation DNA Create an engine for continuous innovation

#TECHVISION2020 Businesses cannot look at innovation as an incremental effort; they must design the capabilities to make it an ongoing practice in the organization. Determining where they hold an advantage, where they are lagging and what their future ambitions are will help insurers construct their innovation DNA. Technology Vision for Insurance 2020 | We, the Post-Digital People 51

1 2 3 4 5 Innovation DNA Constant innovation and thorough transformation are imperatives for insurance companies looking to not just meet but also exceed expectations in coming years. With mounting pressure from competitors and customers alike, insurers know they cannot afford to stand still. Around 58 percent of insurance executives surveyed this year believe that rapid advancements in new technologies and scientific innovations are poised to disrupt their industry. A transformation of this magnitude won’t be easy, and incremental change won’t be enough. But it starts in a familiar place. The path forward begins with a renewed focus on the building blocks that have allowed insurance companies to get to this point of opportunity in the first place: technology. To turn the enterprise into an engine for transformation, businesses must first assemble their unique innovation DNA. The building blocks of this innovation DNA include maturing digital technology that is more commoditized and accessible; scientific advancements that are discrete yet deeply disruptive; and emerging DARQ (distributed ledgers, artificial intelligence, extended reality, and quantum computing) technologies. 52 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 The strands of innovation DNA Leaders are weaving these areas of innovation together, forming their The two companies are working together not only to move Allianz’s For instance, Metromile, a telematics-driven auto insurer in the US, own unique triple helixes and setting their course for the future. To has started licensing its claims platform to other insurers around the global insurance platform to the Azure cloud, but also to develop develop an innovation DNA fit for the future, businesses must find world. Japan’s Tokio Marine has deployed the digital first notice of insurance-as-a-service offerings. Syncier, a startup founded by Allianz, their unique combination of the different building blocks. This starts loss REPORT product from Metromile across its auto insurance book. will offer a new open-source solution built on Microsoft Azure. It will with understanding the opportunities and risks of each. The platform enables drivers to report accidents online and also operate an insurance software marketplace based on Azure 48 through an app. cloud, offering solutions like customer service chatbots and AI-based fraud detection. Allianz’s approach highlights how digitally innovative Maturing digital technology—the social, mobile, analytics and cloud players can tap into new revenue streams—by helping laggard (SMAC) stack—is no longer an advantage, though insurance has Some of these partnerships are making advanced technologies 49 competitors to catch up. lagged many other industries in embedding SMAC into its DNA. Those more accessible to the market, in turn making digital transformations insurers that have advanced further down the road to SMAC maturity increasingly straightforward—threatening any incumbent that are, however, finding new value by commoditizing their systems. gets too comfortable. Consider the implications of a partnership between Allianz, the major German-based insurance carrier, and Microsoft. Technology Vision for Insurance 2020 | We, the Post-Digital People 53

1 2 3 4 5 Innovation DNA Broadening beyond digital Meanwhile, scientific advancements are broadening enterprises’ Now, reinsurers are looking for ways to apply their expertise in this The solution uses virtual reality and AI to realistically simulate innovative efforts beyond digital technology and turning into field not only in their own businesses, but also to scaling global critical workplace conversations. Training scenarios built with the competitive advantage faster than ever before. Advances in responses to extreme weather. Swiss Re, alongside other members platform use virtual environments, speech recognition, NLP, and material sciences, energy, genomic editing and more are deeply of the Insurance Development Forum, has partnered with the UN realistic body language to simulate conversations with customers disruptive in related industries, but also beginning to challenge Development Program (UNDP), jointly committing $5 billion of and colleagues. The virtual environment offers employees a safe 51 boundaries and pull businesses in new and unexpected directions. capacity to support climate resilience in developing countries. space to hone their communication skills. This application builds on Farmers’ success in using VR to help claims representatives 52 practice home damage assessments. Consider climate change as an example—ranked by insurance At the same time, DARQ technologies are steadily growing in executives in the Technology Vision survey as the number one utility and adoption, except for quantum computing, which challenge in society that scientific research and advanced looms further on the horizon. Leading insurers are exploring technology can address. Reinsurers Swiss Re and Munich Re have solutions that blend some of these technologies, building their studied changing climate patterns for decades. According to Munich foundation for a world with digital everywhere. Farmers Insurance Re, there were 820 natural catastrophes in 2019, with losses from these is developing a virtual human-training program in collaboration 50 disasters amounting to $150 billion. with Talespin. The training modules are intended to help improve the overall customer experience by focusing on the moments that may matter most. 54 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Scaling and integrating innovation Differentiation in the future will be driven by powerful The thriving insurtech landscape remains an important AXA, the multiline, multinational insurer, is driving innovation combinations of the different innovation building blocks. under the banner of a company called AXA Next. This source of innovative ideas for insurance incumbents, While leading insurance enterprises should have efforts which are keen investors in insurtech startups. Willis Towers vehicle consolidates and coordinates the group’s venture across all three spaces (maturing digital technology, Watson estimates insurtech investment reached nearly capital arm, incubators, tech labs, corporate partnership scientific advancements, DARQ), what will truly set $6.4 billion in 2019. Some of the funding rounds contributed division and parametric insurance business, with the goal of companies apart is the way they merge and combine the towards the creation of five new insurtech unicorns stretching beyond insurance and becoming a closer partner 53 56 technologies with the core competencies of their business. (privately held start-ups valued at over $1 billion). in customers’ lives. The winners will not be those that simply build innovation “petting zoos”—endless proofs of concept, red teams and Insurers are also looking to big tech for support in driving Under AXA Next, AXA is working on or investing in a insurtech partnerships that are never scaled—but those that and scaling innovation. USAA last year announced a range of ventures that could, in the future, become major also develop the capabilities to mainstream new ideas. collaboration with Google Cloud to develop machine revenue streams or disruptive industry forces—among learning models that nearly instantly predict vehicle them, a remote medical teleconsultation startup called Well-executed strategies will not only combine the damage from digital images, allowing for faster and more Qare; Happytal, which offers concierge services at French 54 different blocks, but also accelerate the discovery process cost-efficient estimates. It pairs such tech partnerships hospitals; insurtechs like Anorak Technologies; cyber-risk by forging new partnerships, fueling experimentation, with a relentless focus on internal innovation strategies. startup, Security Scorecard; and the Fizzy blockchain- and building a culture and ecosystem that will drive powered parametric travel insurance product. those efforts into disruption at scale. While insurtech USAA, which provides financial services to US military partnerships and acquisitions, innovation labs, incubators members, harvests ideas through its “Always on Ideas and venture capital investments all have a role to play, Platform,” a portal available to all employees, and leadership comes from successfully scaling innovation and encourages employees to submit innovative ideas. A telling embedding it into the wider business. point is that among 900 or so patents held by the company, 25 were authored by a single security guard during his 55 tenure at USAA. Technology Vision for Insurance 2020 | We, the Post-Digital People 55

1 2 3 4 5 Innovation DNA Innovation as an ecosystem play Not every business has the resources to open a dedicated innovation The Collaborative facilitates joint development of DLT use cases hub or make big bets on insurtech investment. But all can translate the and creation of shared services between a community of insurance innovation attitude and mindset into their own strategies. Plus, there carriers, reinsurers, brokers, and agents. Based on proof of insurance are some problems that will be best solved through ecosystem-based and first notice of loss use cases in auto personal lines, the RiskStream innovation strategies, be it those venture-backed partnerships, academic Collaborative estimates its members could save between $19 million research engagements or relationships with other companies. and $68 million in the first year of use and between $99 million and $277 million in year three by implementing blockchain applications 57 in the US market. The Institutes RiskStream Collaborative, an initiative from more than 40 members of The Institutes—a non-profit knowledge partner for the risk and insurance industry—shows how this approach could benefit the Innovation, then, is evolving. Success in the future means constantly industry and its customers. The members of the consortium are working exploring what’s ahead, around and inside of the business. Insurance together to develop DLT use cases and solutions for the wider industry. leaders will seize opportunities through each of today’s innovation building blocks and form their own unique innovation DNA. Those that do will thrive in the next wave of industry transformation. 56 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 76% 28% of insurance executives say the stakes of insurance executives rank climate for innovation have never been higher— change as society’s biggest challenge getting it “right” will require new ways of that scientific research and advanced innovating with ecosystem partners and technology can address. Next are third-party organizations. sustainable development (22 percent), energy (19 percent) and health & wellness (19 percent). Technology Vision for Insurance 2020 | We, the Post-Digital People 57

1 2 3 4 5 Innovation DNA How is your enterprise DeDecicisisioonn exploring multiple fronts of innovation today? E xamine your current approaches to the three categories of PoPoiinnttss innovation. Identify where your strengths are and what areas may be untouched. S et organizational goals and strategies that build towards a comprehensive innovation DNA. Grow existing efforts or stake out new areas across all three fronts. 58 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 Is your organization Does your company have Which organizations are developing an integrated resources (time, space, possible partners for innovation strategy? people) dedicated to co-innovation efforts? continuous innovation? G ather input from internal groups to determine the breadth of S eek out industry and ecosystem partnerships to help each team’s innovation agendas. With this input, work with your your company establish a dedicated innovation practice or A s your organization develops and refines its innovation strategy, organization’s leadership to recalibrate and reflect the shared oversee specific co-innovation projects. Your organization’s explore the potential of launching a dedicated innovation practice. goals of the various teams. ability to innovate around multiple innovation frontiers will These practices can present a more straightforward way of exploring depend on looking outward and understanding advances multiple innovation frontiers in a systematic fashion, while giving other that are happening. A strong set of partners is necessary groups in your organization a resource when they are interested in a for this to succeed. technology with future potential. Technology Vision for Insurance 2020 | We, the Post-Digital People 59

1 2 3 4 5 About the Technology Vision Conclusion: Review, reinvent and reengineer

#TECHVISION2020 Many industry assumptions and entrenched approaches are up for review and reinvention This reimagination of the enterprise offers tremendous opportunities for those that take towards people-centric models. Insurance companies must reengineer the experiences that the lead. Getting there is one of the greatest challenges the C-suite will face during the next bring people and technology together; they must raise questions about the democratization of decade. When insurance leaders successfully build technology that delivers a human focus, data and technology; and they must reevaluate the application and value of intelligence—what they will be poised to do far more than meet expectations. They’ll set the new standard that technology is providing for people, and the ways it’s changing people in the process. every competitor—in every industry—will be forced to try to meet. The success of the next generation of products and services will rest on insurance companies’ ability to elevate the human experience. Companies that have a shared-success mindset— and invite collaboration with customers, employees, ecosystem partners, governments and the public—will create new opportunities for growth in a way that benefits all. Technology Vision for Insurance 2020 | We, the Post-Digital People 61

1 2 3 4 5 About the Technology Vision About the Technology Vision Every year, the Technology Vision team partners with Accenture Research to pinpoint the emerging IT developments that will have the greatest impact on companies, government agencies and other organizations in the coming years. These trends have significant impact across industries and are actionable for businesses today. 62 Technology Vision for Insurance 2020 | We, the Post-Digital People

#TECHVISION2020 The research process begins by gathering input from the Technology Vision External In parallel, a consumer survey is conducted to understand the use and role of Advisory Board, a group of more than two dozen experienced individuals from the technology in people’s lives. The consumer survey canvassed 2,000 people in four public and private sectors, academia, venture capital and entrepreneurial companies. countries, the US, the UK, India and China. The survey asked consumers about their In addition, the Technology Vision team conducts interviews with technology luminaries viewpoints and use of technology in their daily lives, including voice assistants, robots and industry experts, as well as nearly 100 Accenture business leaders from across and connected products. the organization. As a shortlist of themes emerges from the research process, the Technology Vision The research process also includes a global survey of thousands of business and IT team reconvenes its advisory board. The board’s workshop, a series of “deep-dive” executives from around the world, to understand their perspectives on the impact sessions with Accenture leadership and external subject-matter experts, validates of technology in business. This year, 539 insurance executives participated in the and further refines the themes. survey. Survey responses help to identify the technology strategies and priority investments of companies from across industries and geographies. These processes weigh the themes for their relevance to real- world business challenges. The Technology Vision team seeks ideas that transcend the well-known drivers of technological change, concentrating instead on the themes that will soon start to appear on the C-level agendas of most enterprises. Technology Vision for Insurance 2020 | We, the Post-Digital People 63