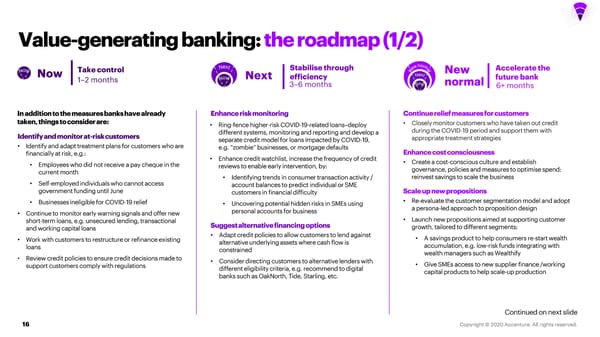

Value-generating banking: the roadmap (1/2) New Now Take control Next Stabilise through New Accelerate the 1–2 months New efficiency future bank 3–6 months New normal 6+ months In addition to the measures banks have already Enhance risk monitoring Continue relief measures for customers taken, things to consider are: • Ring-fence higher-risk COVID-19-related loans–deploy • Closely monitor customers who have taken out credit Identify and monitor at-risk customers different systems, monitoring and reporting and develop a during the COVID-19 period and support them with separate credit model for loans impacted by COVID-19, appropriate treatment strategies • Identify and adapt treatment plans for customers who are financially at risk, e.g.: e.g. “zombie” businesses, or mortgage defaults Enhance cost consciousness • Employees who did not receive a pay cheque in the • Enhance credit watchlist, increase the frequency of credit • Create a cost-conscious culture and establish current month reviews to enable early intervention, by: governance, policies and measures to optimise spend; • Identifying trends in consumer transaction activity / reinvest savings to scale the business • Self-employed individuals who cannot access account balances to predict individual or SME government funding until June customers in financial difficulty Scale up new propositions • Businesses ineligible for COVID-19 relief • Uncovering potential hidden risks in SMEs using • Re-evaluate the customer segmentation model and adopt • Continue to monitor early warning signals and offer new personal accounts for business a persona-led approach to proposition design short-term loans, e.g. unsecured lending, transactional Suggest alternative financing options • Launch new propositions aimed at supporting customer and working capital loans growth, tailored to different segments: • Work with customers to restructure or refinance existing • Adapt credit policies to allow customers to lend against • A savings product to help consumers re-start wealth loans alternative underlying assets where cash flow is accumulation, e.g. low-risk funds integrating with constrained wealth managers such as Wealthify • Review credit policies to ensure credit decisions made to • Consider directing customers to alternative lenders with • Give SMEs access to new supplier finance /working support customers comply with regulations different eligibility criteria, e.g. recommend to digital capital products to help scale-up production banks such as OakNorth, Tide, Starling, etc. Continued on next slide 16

UK Banks Accelerating to the New Normal Page 15 Page 17

UK Banks Accelerating to the New Normal Page 15 Page 17