COVID-19 Impact

DANIELE PRESUTTI, DIN Chairman & Accenture‘s European Insurance Lead | Digital Insurer Network Meeting 2020 | 5 Pages

COVID-19: NAVIGATING THE HUMAN & BUSINESS IMPACT ON INSURANCE CARRIERS 1 Copyright © 2020 Accenture. All rightsreserved.

This is a modal window.

BUSINESS IMPACTSOFCOVID-19ONINSURERS BUSINESSMODEL IMPACT Life/ Health P&C Technical Premium Weakeneddemandduetoeconomiccontraction,risingunemploymentandsupplychaindisruption Income Decreasein-person salesasaresultofwidespreadsocialdistancingimpactinginsuranceface-to-facedistribution Focus next Increaseindirectandonlinesalesas aresultofincreasedonline platformtraffic and useofdronesandmobiledevices slide Increasedawarenessanddemandforinnovativeproductsaround preventionandrestorationwithrespecttosystemicrisks Claims Decliningaccidentfrequencyas aresultofsocialdistancingandremoteworkforce deployment Increasedandunfavorablelitigationasaresultofpolicy wordingambiguity onexclusionsand governmentmandates/pressure Increasedlife/healthinsuranceclaimsasaresultofCOVID-19impactonhealthandmortality Investment Investment Lowinterestratesreducing future investmentincome onnewandrollingsecurities Income Income Increasedcreditspreadanddefaultsoncertainportfoliosegments(e.g.below-investment-gradefixed-incomesecurities) Decliningportfolioearningsasa resultofcostlierhedgingand postponementofstocks’dividendspayments OtherIncome Decreasedfee-basedincomeasaresultoflowervalueofAUM AssetandLiabilityPosition Lowerunrealizedcapitalgainsdrivingcapitalizationandsolvencylevelsdownas aresultofassetrevaluation Lowerrealizedcapitalgainsdriving liquiditysqueeze as aresultofaccelerated liquidationand assetrevaluation Defaultsonbelow-investment-gradefixed-incomesecuritiesimpactingcapitalpositions Lowerinflationcould resultinmorefavorableprioryearreservedevelopmentparticularlyonproperty lines Increasedreservingduetoassumptionrevisionsfor long-tail andinterest-sensitiveproducts withembedded guarantees Ineffectivehedgingleading tooverallreductioninportfoliobalance OperationalCosts Operationalconstraintsandhigherexpensesasaresultofremoteworkforce mobilizationandcrisismanagement Increaseincyberattacksanddatabreachesas aresultoflargescaleworkforce digitizationanddatademand Reductioninfixedcostsasaresultofremoteworkforceefficiencyandreductionsin-officespacerequirements Copyright © 2020 Accenture. All rightsreserved. Source: Accenture Research based on Capital IQ data, Analyst Insights, Market Research, Press

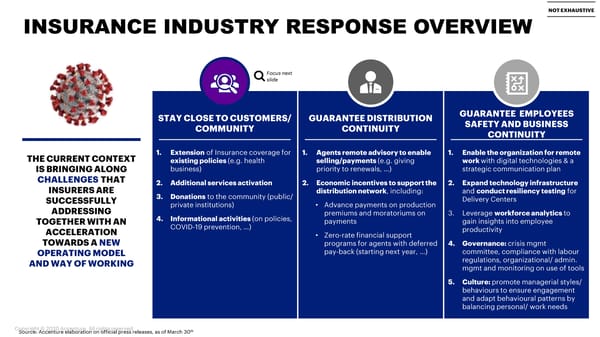

NOT EXHAUSTIVE INSURANCE INDUSTRY RESPONSE OVERVIEW Focus next slide STAY CLOSE TO CUSTOMERS/ GUARANTEE DISTRIBUTION GUARANTEE EMPLOYEES COMMUNITY CONTINUITY SAFETY AND BUSINESS CONTINUITY THE CURRENT CONTEXT 1. Extensionof Insurance coverage for 1. Agents remote advisory to enable 1. Enable the organization for remote existing policies (e.g. health selling/payments (e.g. giving work with digital technologies & a IS BRINGING ALONG business) priority to renewals, …) strategic communication plan CHALLENGESTHAT 2. Additional services activation 2. Economic incentives to support the 2. Expand technology infrastructure INSURERS ARE 3. Donationsto the community (public/ distribution network, including: and conduct resiliency testing for SUCCESSFULLY private institutions) • Advance payments on production Delivery Centers ADDRESSING premiums and moratoriums on 3. Leverage workforce analytics to TOGETHER WITH AN 4. Informational activities (on policies, payments gain insights into employee ACCELERATION COVID-19 prevention, …) productivity TOWARDS A NEW • Zero-rate financial support programs for agents with deferred 4. Governance: crisis mgmt OPERATING MODEL pay-back (starting next year, …) committee, compliance with labour AND WAY OF WORKING regulations, organizational/ admin. mgmtand monitoring on use of tools 5. Culture: promote managerial styles/ behaviours to ensure engagement and adapt behavioural patterns by balancing personal/ work needs Copyright © 2020 Accenture. All rightsreserved. th Source: Accenture elaboration on official press releases, as of March 30

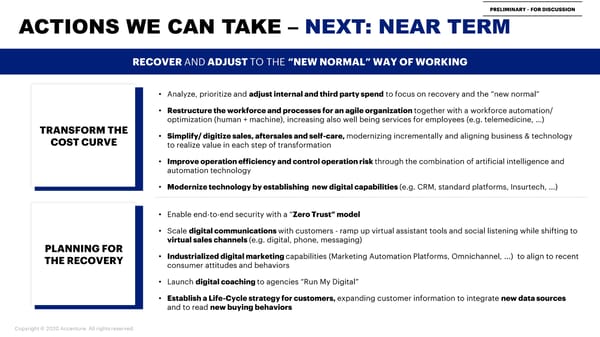

PRELIMINARY –FOR DISCUSSION ACTIONS WE CAN TAKE –NEXT: NEAR TERM RECOVER ANDADJUST TO THE “NEW NORMAL” WAY OF WORKING • Analyze, prioritize and adjust internal and third party spend to focus on recovery and the “new normal” • Restructure the workforce and processes for an agile organization together with a workforce automation/ optimization (human + machine), increasing also well being services for employees (e.g. telemedicine, …) TRANSFORM THE • Simplify/ digitize sales, aftersales and self-care, modernizing incrementally and aligning business & technology COST CURVE to realize value in each step of transformation • Improve operation efficiency and control operation risk through the combination of artificial intelligence and automation technology • Modernize technology by establishing new digital capabilities (e.g. CRM, standard platforms, Insurtech, ...) • Enable end-to-end security with a “Zero Trust” model • Scale digital communications with customers - ramp up virtual assistant tools and social listening while shifting to PLANNING FOR virtual sales channels (e.g. digital, phone, messaging) THE RECOVERY • Industrialized digital marketing capabilities (Marketing Automation Platforms, Omnichannel, ...) to align to recent consumer attitudes and behaviors • Launch digital coaching to agencies “Run My Digital” • Establish a Life-Cycle strategy for customers, expanding customer information to integrate new data sources and to read new buying behaviors Copyright © 2020 Accenture. All rightsreserved.

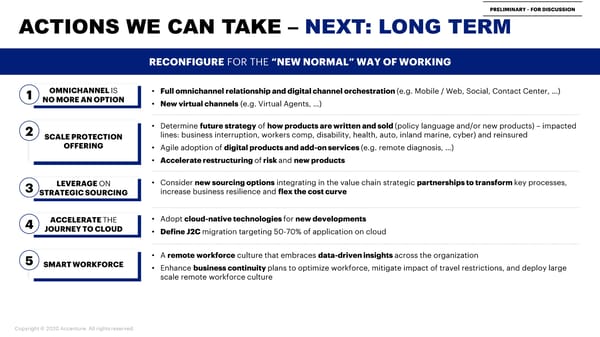

PRELIMINARY –FOR DISCUSSION ACTIONS WE CAN TAKE –NEXT: LONG TERM PRIORITIES PRIORITIES DESCRIPTION RECONFIGUREFOR THE “NEW NORMAL” WAY OF WORKING 1 OMNICHANNEL IS • Full omnichannel relationship and digital channel orchestration (e.g. Mobile / Web, Social, Contact Center, …) NO MORE AN OPTION • New virtual channels (e.g. Virtual Agents, …) 2 • Determine future strategyof how products are written and sold (policy language and/or new products) – impacted SCALE PROTECTION lines: business interruption, workers comp, disability, health, auto, inland marine, cyber) and reinsured OFFERING • Agile adoption of digital products and add-on services (e.g. remote diagnosis, …) • Accelerate restructuring ofrisk and new products 3 LEVERAGE ON • Consider new sourcing optionsintegrating in the value chain strategic partnerships to transform key processes, STRATEGIC SOURCING increase business resilience and flex the cost curve 4 ACCELERATE THE • Adopt cloud-native technologies for new developments JOURNEY TO CLOUD • Define J2C migration targeting 50-70% of application on cloud 5 • A remoteworkforceculture that embraces data-driven insights across the organization SMART WORKFORCE • Enhance business continuity plans to optimize workforce, mitigate impact of travel restrictions, and deploy large scale remote workforce culture Copyright © 2020 Accenture. All rightsreserved.