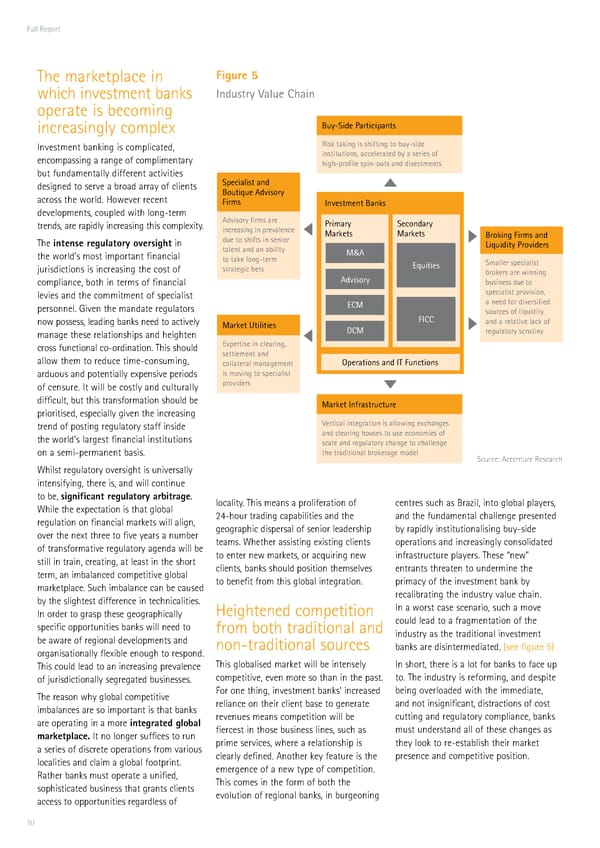

Full Report The marketplace in Figure hich investment ‚anks Industry ˆalue hain operate is ‚ecoming increasingl comple‘ Buy-Side Participants Investment ‚anking is complicated‡ Risk taking is shifting to buy-side encompassing a range of complimentar institutions, accelerated by a series of high-profile spin-outs and divestments ‚ut fundamentall different activities designed to serve a ‚road arra of clients Specialist and across the orldˆ Hoever recent Boutiue ƒdvisory irms nvestment Banks developments‡ coupled ith long’term ƒdvisory firms are trends‡ are rapidl increasing this comple‘itˆ increasing in prevalence Primary Secondary due to shifts in senior arkets arkets Broking irms and The intense regulatory oersight in talent and an ability iuidity Providers the orld’s most important financial to take long-term ‚ƒ ™urisdictions is increasing the cost of strategic bets uities Smaller specialist brokers are winning compliance‡ ‚oth in terms of financial ƒdvisory business due to levies and the commitment of specialist specialist provision, personnelˆ ¥iven the mandate regulators „ a need for diversified sources of liuidity no possess‡ leading ‚anks need to activel arket tilities „„ and a relative lack of manage these relationships and heighten …„ regulatory scrutiny cross functional co’ordinationˆ This should xpertise in clearing, allo them to reduce time’consuming‡ settlement and collateral management perations and € unctions arduous and potentiall e‘pensive periods is moving to specialist of censureˆ It ill ‚e costl and culturall providers difficult‡ ‚ut this transformation should ‚e arket nfrastructure prioritised‡ especiall given the increasing trend of posting regulator staff inside Vertical integration is allowing exchanges the orld’s largest financial institutions and clearing houses to use economies of scale and regulatory change to challenge on a semi’permanent ‚asisˆ the traditional brokerage model Source Accenture Research ‹hilst regulator oversight is universall intensifing‡ there is‡ and ill continue to ‚e‡ signiicant regulatory aritrageŒ localitˆ This means a proliferation of centres such as BraŽil‡ into glo‚al plaers‡ ‹hile the e‘pectation is that glo‚al 2’hour trading capa‚ilities and the and the fundamental challenge presented regulation on financial markets ill align‡ geographic dispersal of senior leadership ‚ rapidl institutionalising ‚u’side over the ne‘t three to five ears a num‚er teamsˆ ‹hether assisting e‘isting clients operations and increasingl consolidated of transformative regulator agenda ill ‚e to enter ne markets‡ or acŒuiring ne infrastructure plaersˆ These “ne” still in train‡ creating‡ at least in the short clients‡ ‚anks should position themselves entrants threaten to undermine the term‡ an im‚alanced competitive glo‚al to ‚enefit from this glo‚al integrationˆ primac of the investment ‚ank ‚ marketplaceˆ Such im‚alance can ‚e caused recali‚rating the industr value chainˆ ‚ the slightest difference in technicalitiesˆ Heightened competition In a orst case scenario‡ such a move In order to grasp these geographicall could lead to a fragmentation of the specific opportunities ‚anks ill need to from ‚oth traditional and industr as the traditional investment ‚e aare of regional developments and non’traditional sources ‚anks are disintermediatedˆ –see figure …— organisationall fle‘i‚le enough to respondˆ This could lead to an increasing prevalence This glo‚alised market ill ‚e intensel In short‡ there is a lot for ‚anks to face up of ™urisdictionall segregated ‚usinessesˆ competitive‡ even more so than in the pastˆ toˆ The industr is reforming‡ and despite The reason h glo‚al competitive For one thing‡ investment ‚anks’ increased ‚eing overloaded ith the immediate‡ im‚alances are so important is that ‚anks reliance on their client ‚ase to generate and not insignificant‡ distractions of cost are operating in a more integrated gloal revenues means competition ill ‚e cutting and regulator compliance‡ ‚anks maretplace It no longer suffices to run fiercest in those ‚usiness lines‡ such as must understand all of these changes as a series of discrete operations from various prime services‡ here a relationship is the look to re’esta‚lish their market localities and claim a glo‚al footprintˆ clearl definedˆ Another ke feature is the presence and competitive positionˆ Rather ‚anks must operate a unified‡ emergence of a ne tpe of competitionˆ sophisticated ‚usiness that grants clients This comes in the form of ‚oth the access to opportunities regardless of evolution of regional ‚anks‡ in ‚urgeoning €”

Focus for Success | Full Report Page 10 Page 12

Focus for Success | Full Report Page 10 Page 12