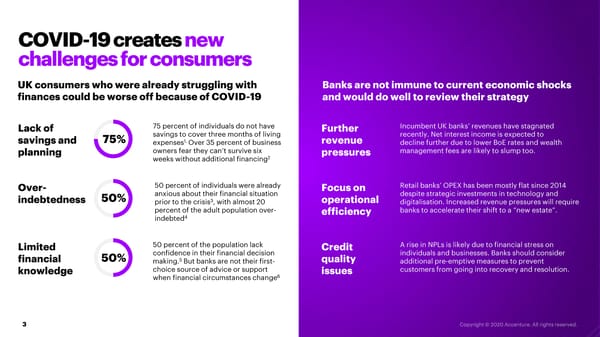

COVID-19 creates new challenges for consumers UK consumers who were already struggling with Banks are not immune to current economic shocks finances could be worse off because of COVID-19 and would do well to review their strategy Lack of 75 percent of individuals do not have Further Incumbent UK banks’ revenues have stagnated savings to cover three months of living recently. Net interest income is expected to savings and 75% 1. revenue expenses Over 35 percent of business decline further due to lower BoE rates and wealth planning owners fear they can’t survive six pressures management fees are likely to slump too. 2 weeks without additional financing Over- 50 percent of individuals were already Focus on Retail banks’ OPEX has been mostly flat since 2014 50% anxious about their financial situation despite strategic investments in technology and indebtedness 3 operational prior to the crisis , with almost 20 digitalisation. Increased revenue pressures will require percent of the adult population over- efficiency banks to accelerate their shift to a “new estate”. indebted4 Limited 50 percent of the population lack Credit A rise in NPLs is likely due to financial stress on confidence in their financial decision individuals and businesses. Banks should consider financial 50% 5 quality making. But banks are not their first- additional pre-emptive measures to prevent knowledge choice source of advice or support issues customers from going into recovery and resolution. 6 when financial circumstances change 3

UK Banks Accelerating to the New Normal Page 2 Page 4

UK Banks Accelerating to the New Normal Page 2 Page 4