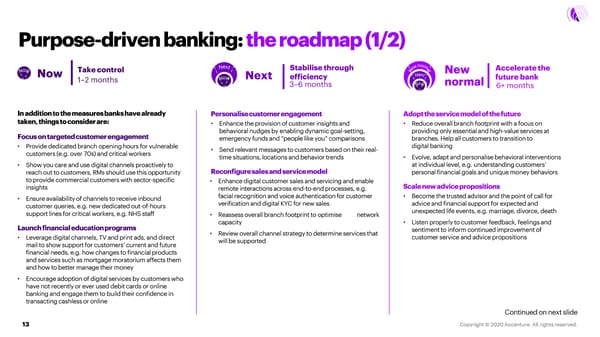

Purpose-driven banking: the roadmap (1/2) New Now Take control Next Stabilise through New Accelerate the 1–2 months New efficiency future bank 3–6 months New normal 6+ months In addition to the measures banks have already Personalisecustomer engagement Adopt the service model of the future taken, things to consider are: • Enhance the provision of customer insights and • Reduce overall branch footprint with a focus on Focus on targeted customer engagement behavioral nudges by enabling dynamic goal-setting, providing only essential and high-value services at emergency funds and “people like you” comparisons branches. Help all customers to transition to • Provide dedicated branch opening hours for vulnerable • Send relevant messages to customers based on their real- digital banking customers (e.g. over 70s) and critical workers time situations, locations and behavior trends • Evolve, adapt and personalisebehavioral interventions • Show you care and use digital channels proactively to Reconfigure sales and service model at individual level, e.g. understanding customers’ reach out to customers, RMs should use this opportunity personal financial goals and unique money behaviors to provide commercial customers with sector-specific • Enhance digital customer sales and servicing and enable Scale new advice propositions insights remote interactions across end-to-end processes, e.g. • Ensure availability of channels to receive inbound facial recognition and voice authentication for customer • Become the trusted advisor and the point of call for customer queries, e.g. new dedicated out-of-hours verification and digital KYC for new sales advice and financial support for expected and support lines for critical workers, e.g. NHS staff • Reassess overall branch footprint to optimise network unexpected life events, e.g. marriage, divorce, death Launch financial education programs capacity • Listen properly to customer feedback, feelings and • Review overall channel strategy to determine services that sentiment to inform continued improvement of • Leverage digital channels, TV and print ads, and direct will be supported customer service and advice propositions mail to show support for customers’ current and future financial needs, e.g. how changes to financial products and services such as mortgage moratorium affects them and how to better manage their money • Encourage adoption of digital services by customers who have not recently or ever used debit cards or online banking and engage them to build their confidence in transacting cashless or online Continued on next slide 13

UK Banks Accelerating to the New Normal Page 12 Page 14

UK Banks Accelerating to the New Normal Page 12 Page 14