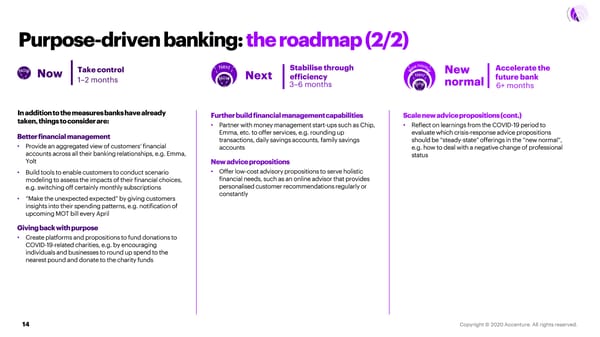

Purpose-driven banking: the roadmap (2/2) New Now Take control Next Stabilise through New Accelerate the 1–2 months New efficiency future bank 3–6 months New normal 6+ months In addition to the measures banks have already Further build financial management capabilities Scale new advice propositions (cont.) taken, things to consider are: • Partner with money management start-ups such as Chip, • Reflect on learnings from the COVID-19 period to Better financial management Emma, etc. to offer services, e.g. rounding up evaluate which crisis-response advice propositions transactions, daily savings accounts, family savings should be “steady-state” offerings in the “new normal”, • Provide an aggregated view of customers’ financial accounts e.g. how to deal with a negative change of professional accounts across all their banking relationships, e.g. Emma, status Yolt New advice propositions • Build tools to enable customers to conduct scenario • Offer low-cost advisory propositions to serve holistic modeling to assess the impacts of their financial choices, financial needs, such as an online advisor that provides e.g. switching off certainly monthly subscriptions personalised customer recommendations regularly or constantly • “Make the unexpected expected” by giving customers insights into their spending patterns, e.g. notification of upcoming MOT bill every April Giving back with purpose • Create platforms and propositions to fund donations to COVID-19-related charities, e.g. by encouraging individuals and businesses to round up spend to the nearest pound and donate to the charity funds 14

UK Banks Accelerating to the New Normal Page 13 Page 15

UK Banks Accelerating to the New Normal Page 13 Page 15