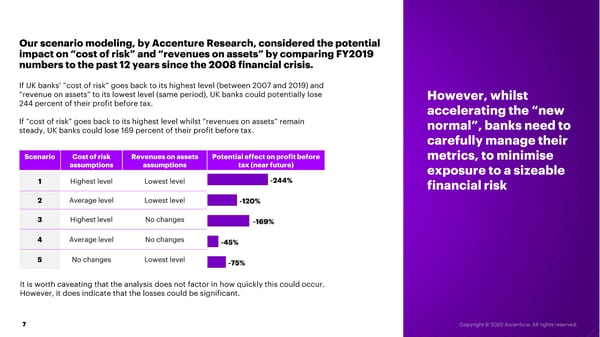

Our scenario modeling, by Accenture Research, considered the potential impact on “cost of risk” and “revenues on assets” by comparing FY2019 numbers to the past 12 years since the 2008 financial crisis. If UK banks’ “cost of risk” goes back to its highest level (between 2007 and 2019) and “revenue on assets” to its lowest level (same period), UK banks could potentially lose However, whilst 244 percent of their profit before tax. accelerating the “new If “cost of risk” goes back to its highest level whilst “revenues on assets” remain steady, UK banks could lose 169 percent of their profit before tax. normal”, banks need to carefully manage their Scenario Cost of risk Revenues on assets Potential effect on profit before metrics, to minimise assumptions assumptions tax (near future) exposure to a sizeable 1 Highest level Lowest level -244% financial risk 2 Average level Lowest level -120% 3 Highest level No changes -169% 4 Average level No changes -45% 5 No changes Lowest level -75% It is worth caveating that the analysis does not factor in how quickly this could occur. However, it does indicate that the losses could be significant. 7

UK Banks Accelerating to the New Normal Page 6 Page 8

UK Banks Accelerating to the New Normal Page 6 Page 8