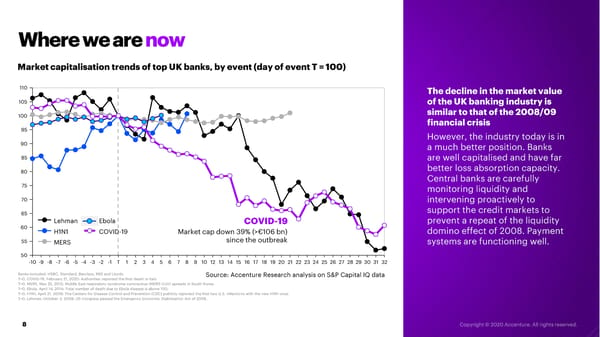

Where we are now Market capitalisationtrends of top UK banks, by event (day of event T = 100) 110 The decline in the market value 105 of the UK banking industry is 100 similar to that of the 2008/09 financial crisis 95 However, the industry today is in 90 a much better position. Banks 85 are well capitalised and have far 80 better loss absorption capacity. Central banks are carefully 75 monitoring liquidity and 70 intervening proactively to 65 support the credit markets to Lehman Ebola COVID-19 prevent a repeat of the liquidity 60 H1N1 COVID-19 domino effect of 2008. Payment Market cap down 39% (>€106 bn) 55 MERS since the outbreak systems are functioning well. 50 -10 -9 -8 -7 -6 -5 -4 -3 -2 -1 T 1 2 3 4 5 6 7 8 9 10 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Banks included: HSBC, Standard, Barclays, RBS and Lloyds Source: Accenture Research analysis on S&P Capital IQ data T=0, COVID-19, February 21, 2020: Authorities reported the first death in Italy T=0, MERS, May 25, 2015: Middle East respiratory syndrome coronavirus (MERS-CoV) spreads in South Korea. T=0, Ebola, April 14, 2014: Total number of death due to Ebola disease is above 100. T=0, H1N1, April 21, 2009: The Centers for Disease Control and Prevention (CDC) publicly reported the first two U.S. infections with the new H1N1 virus. T=0, Lehman, October 3, 2008: US Congress passed the Emergency Economic Stabilisation Act of 2008. 8

UK Banks Accelerating to the New Normal Page 7 Page 9

UK Banks Accelerating to the New Normal Page 7 Page 9