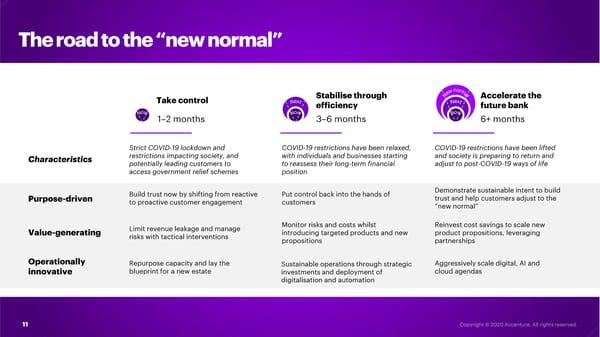

The road to the “new normal” Banks should adopt a three-prong strategy Take control Stabilise through Accelerate the efficiency future bank New 1–2 months New 3–6 months New 6+ months Strict COVID-19 lockdown and COVID-19 restrictions have been relaxed, COVID-19 restrictions have been lifted Characteristics restrictions impacting society, and with individuals and businesses starting and society is preparing to return and potentially leading customers to to reassess their long-term financial adjust to post-COVID-19 ways of life access government relief schemes position Build trust now by shifting from reactive Put control back into the hands of Demonstrate sustainable intent to build Purpose-driven to proactive customer engagement customers trust and help customers adjust to the “new normal” Limit revenue leakage and manage Monitor risks and costs whilst Reinvest cost savings to scale new Value-generating risks with tactical interventions introducing targeted products and new product propositions, leveraging propositions partnerships Operationally Repurpose capacity and lay the Sustainable operations through strategic Aggressively scale digital, AI and innovative blueprint for a new estate investments and deployment of cloud agendas digitalisation and automation 11

UK Banks Accelerating to the New Normal Page 10 Page 12

UK Banks Accelerating to the New Normal Page 10 Page 12