Innovation Agenda

The Digital Insurer Network (DIN) Seventh Annual Meeting in May 2020 | An Innovation Agenda for the Covid-19 Era | 25 Pages

AN INNOVATION AGENDA FOR THE COVID-19 ERA Digital Insurer Network Meeting 2020 AN INNOVATION AGENDA FOR THE COVID-19 ERA 01

This is a modal window.

MEETING AGENDA Exploring the organizational and digital The Digital Insurer Network (DIN) convened for its seventh capabilities insurers must master to reinvent annual meeting in May 2020, facilitated by the team at The Dock, their businesses at scale, weather a volatile Accenture’s Global Center for Innovation in Dublin. This year, the event took the form of a virtual conference because of travel business environment and position for restrictions and social distancing requirements arising from the growth after the pandemic. COVID-19 pandemic. Senior leaders from Europe’s largest insurers attended two half-day online sessions. The program included stimulating exchanges, world-class speakers and exposure to innovative ideas from four leading insurtech companies. AN INNOVATION AGENDA FOR THE COVID-19 ERA 02

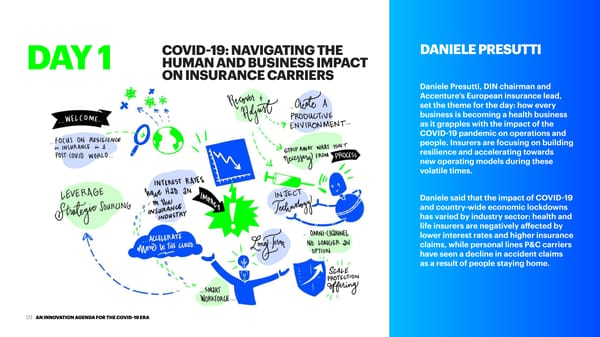

COVID-19: NAVIGATING THE DANIELE PRESUTTI DAY 1 HUMAN AND BUSINESS IMPACT ON INSURANCE CARRIERS Daniele Presutti, DIN chairman and Accenture‘s European insurance lead, set the theme for the day: how every business is becoming a health business as it grapples with the impact of the COVID-19 pandemic on operations and people. Insurers are focusing on building resilience and accelerating towards new operating models during these volatile times. Daniele said that the impact of COVID-19 and country-wide economic lockdowns has varied by industry sector: health and life insurers are negatively affected by lower interest rates and higher insurance claims, while personal lines P&C carriers have seen a decline in accident claims as a result of people staying home. AN INNOVATION AGENDA FOR THE COVID-19 ERA 03

ACCORDING TO DANIELE, MOST INSURANCE CARRIERS In the longer term, insurance companies will need to reconfigure WORLDWIDE INITIALLY RESPONDED TO RISING COVID-19 for a new normal way of working. Insurers will have no option but INFECTIONS AND THE LOCKDOWNS THAT FOLLOWED IN to embrace full omni-channel relationships and digital channel THREE WAYS: orchestration. They will also accelerate the restructuring of their products, with a view to scaling their protection offerings. • They mobilized their resources to help customers by, for example, donating to communities, extending insurance Other steps insurers will take include leveraging new strategic coverage for existing policies and educating customers about sourcing options, accelerating the move to the cloud, and COVID-19 prevention and their policies. building a smart and resilient remote workforce that embraces data-driven insights. Daniele concluded that many insurance • They worked with agents to ensure continuous distribution. companies are already taking the right actions to prevail in the • They enabled their organizations for remote work to ensure ‘new normal’. business continuity while keeping employees safe. DANIELE OUTLINED TWO NEXT STEPS INSURANCE COMPANIES CAN TAKE IN THE NEAR TERM TO STABILIZE THEIR BUSINESSES AND ADJUST TO A NEW WAY OF WORKING: • Transforming the cost curve by restructuring the workforce for agility and modernizing technology with new digital capabilities. • Planning for the recovery by scaling digital platforms and using data to power customer lifecycle strategies. AN INNOVATION AGENDA FOR THE COVID-19 ERA 04

LIVING AND WORKING IN A POST COVID-19 WORLD OLOF SCHYBERGSON Olof Schybergson, chief experience officer at Accenture Interactive, shared insights from the Fjord Trends for 2020 and discussed how they will impact customers, employees and businesses as we look beyond the pandemic. Though the report was compiled before the COVID-19 outbreak changed the world, the trends remain as relevant as ever. Olof said that COVID-19 has turned our world upside down, changing what it means to be a customer, an employee, a citizen, and a human being. The way we shop, socialize, work and move around have all been disrupted. Businesses also face difficult decisions and no industry is immune. In a month, the average global insurer lost 35 percent of its market capitalization. AN INNOVATION AGENDA FOR THE COVID-19 ERA 05

AGAINST THIS BACKDROP, FJORD SEES FIVE MAJOR Today’s volatility aligns with the meta-trend that lies beneath IMPLICATIONS FOR PEOPLE’S BEHAVIOR NOW, AND IN Fjord’s trends for the year: a realignment of fundamentals that THE FUTURE offers a once-in-a-lifetime opportunity to reshape business models, services and products around new definitions of value. • Brand trust will be more important than ever. Those that embrace a long-term view—starting with their impact • Everything that can be done virtually will be done virtually. on the world and society—will emerge as winners. • All companies will treat health as a foreground concern. OLOF HIGHLIGHTS THREE FJORD 2020 TRENDS AS PARTICULARLY RELEVANT FOR INSURERS • People will cocoon inside their homes. • Liquid people: We could see the ‘death of demographics’ • Consumers’ attitudes to authority will be reshaped by their as people look for insurers that can seamlessly provide perceptions of how well governments, health services and other coverage across their changing lifecycle stages and fluid institutions in their countries managed the crisis. day-to-day lifestyle. To keep up with these trends, Olof recommends that insurance • Designing intelligence: Deployment of advanced analytics companies adapt digital employee and customer journeys, and artificial intelligence with a human-centric design to building flexible offerings to address our new way of living. collaborate with people and improve business outcomes. They should focus on personalized, omni-channel experiences to nurture customer loyalty. Finally, insurers should identify how • Digital doubles: A similar concept to ‘digital twins’ the pandemic is creating a new environment for new products for machines—the sophisticated use of data to better and services. understand, predict and model people’s future behavior. AN INNOVATION AGENDA FOR THE COVID-19 ERA 06

CUSTOMER EXPERIENCE DR. EDWIN VAN IN A POST-COVID WORLD DER OUDERAA Dr. Edwin Van der Ouderaa, senior MD at Accenture Financial Services, spoke about how the COVID-19 crisis is likely to accelerate the trend towards digital-led customer experiences in insurance. Most delegates in the breakout session agreed they expected insurers to use COVID-19 as an opportunity for transformation rather than returning to business as usual. Edwin noted that digital attackers like Three by Berkshire Hathaway are breezing through this “strange, involuntary experiment in customer experience”. AN INNOVATION AGENDA FOR THE COVID-19 ERA 07

Despite the resilience of these cloud-based, digital insurance Edwin gave an innovative solution for independent living for companies, business continuity was not top of mind when they seniors as an example of the sort of digital experiences that were designed. Other insurance companies, meanwhile, needed are coming to the fore. Such a platform could leverage mobile to rapidly reconfigure their call center operations to support and Internet of Things technology to help an elderly person remote, distributed workers. manage medicines and health appointments, shopping and more. Their vital signs could be tracked remotely. In addition to growing digital competition, changing consumer behaviors will also catalyze wider digital adoption in insurance. Consumer research such as the Accenture COVID-19 Consumer Pulse shows that most consumers reported that they planned to buy—or increase usage of—technologies such as voice-enabled digital assistants, self-service apps and wearables. The result is that we can expect to see a shift towards more immersive digital experiences in insurance, with an emphasis on more ‘human’ digital interfaces like voice or virtual assistants. Omni-channel customer experiences will rapidly evolve into digital-first or even digital-only experiences. Customers will be able to have human conversations for advice or service, but these will be optional. AN INNOVATION AGENDA FOR THE COVID-19 ERA 08

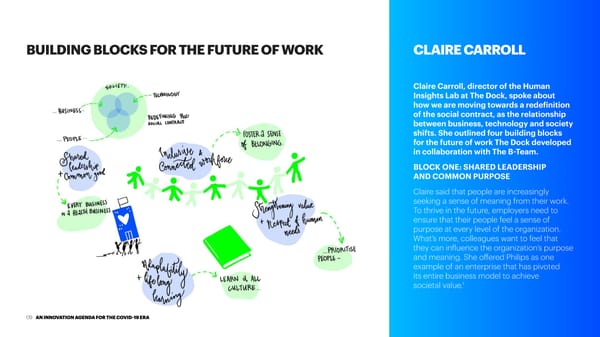

BUILDING BLOCKS FOR THE FUTURE OF WORK CLAIRE CARROLL Claire Carroll, director of the Human Insights Lab at The Dock, spoke about how we are moving towards a redefinition of the social contract, as the relationship between business, technology and society shifts. She outlined four building blocks for the future of work The Dock developed in collaboration with The B-Team. BLOCK ONE: SHARED LEADERSHIP AND COMMON PURPOSE Claire said that people are increasingly seeking a sense of meaning from their work. To thrive in the future, employers need to ensure that their people feel a sense of purpose at every level of the organization. What’s more, colleagues want to feel that they can influence the organization’s purpose and meaning. She offered Philips as one example of an enterprise that has pivoted its entire business model to achieve 1 societal value. AN INNOVATION AGENDA FOR THE COVID-19 ERA 09

BLOCK TWO: ADAPTABILITY AND LIFELONG LEARNING BLOCK FOUR: STRENGTHENING VALUE AND RESPECT OF HUMAN NEEDS The second block is about supporting the development of adaptable, resilient people who have the growth mindset and The leading employers of the future will prioritize their people, skills to prepare them for the future. Organizations with a learning investing in employees’ physical and mental wellbeing and creating culture and the ability to admit to mistakes are positioned to working conditions and wages that ensure all workers are treated thrive in the future, according to Claire. She pointed to how with respect and decency. An example of this is how Perpetual Microsoft has pivoted to the cloud as an example of a company Guardian, a New Zealand financial services company, 2 5 successfully transforming from a know-it-all to a learn-it-all culture. has experimented with the four-day working week. BLOCK THREE: INCLUSIVE AND CONNECTED WORKFORCE CLAIRE LEFT THE DIN GROUP WITH THREE IMPERATIVES FOR THE FUTURE OF WORK IN THEIR OWN BUSINESS: Claire highlighted the importance of organizations fostering a sense of belonging, being inclusive, supporting diversity • Adopt a piloting mindset to drive an innovation culture; and taking an active role in bridging the systemic inequalities that threaten society. Diageo, for example, has 44 percent • Make employees central to the design,implementation and female representation in the boardroom, has set up Asian and learning process; and African heritage groups, and runs a Rainbow Network for LGBT+ • Build authentic, transparent purpose into the day-to-day 3 employees. Jason Fried of Basecamp, meanwhile, has pioneered employee experience. 4 a new psychological contract that values impact over activity. AN INNOVATION AGENDA FOR THE COVID-19 ERA 10

ECOSYSTEMS - A GOOGLE CLOUD VIEW DAMION THOMPSON Damion Thompson, head of insurance at Google Cloud UK and Ireland, focused on the disruptive potential of ecosystems in his talk. He said that insurance is one of the industries most at risk of disruption, with Accenture research showing that 51 percent of insurance organizations are already experiencing disruption from competitors with partnerships in other industries. Google itself is one example of the power of ecosystems, with its customer experience spanning a range of technologies, services and infrastructure, some of which it owns (its own browsers, operating systems, apps, data centers and services) and some of which it doesn’t (broadband networks, competitor browsers, third-party smartphones). AN INNOVATION AGENDA FOR THE COVID-19 ERA 11

Over the years, Google has leveraged this ecosystem to enter Nationwide in the US is an example of an insurer that has used a range of partnerships, markets, and business lines—expanding APIs to reduce onboarding time for B2B partners from months 7 from search into businesses such as mobile operating systems to days. It has more than 1,000 internal developers building APIs. and payments. Its North Star is to be invisible to the user This shows how insurers can drive revenue from APIs in much as it orchestrates this ecosystem, which demands sub-200 the same way as digital platforms like Google, Salesforce, eBay millisecond response times. and Expedia. Digital ecosystem plays are bringing disruption to the physical Insurance is well placed to compete in ecosystems because world, said Damion. The ‘just-in-time’ car manufacturing industry, its products and services touch the real world and the real for instance, is being transformed by the real-time business economy, Damion added. The data insurers collect is a real models of Tesla, Waymo and other players in connected asset and they can use it to create powerful customer 6 and autonomous vehicles. This creates new opportunities experiences. Damion outlines three steps insurers can follow for car manufacturers, insurers and others that can adjust to enable their ecosystems: to a new world. • What: Ideation with business teams Application programming interfaces (APIs) are the mechanism • Why: Business case development that insurers can use to rapidly develop digital ecosystems, according to Damion. An API-driven approach offers a faster • How: Start small with big ambition time to market and enables companies to scale innovation. Companies that approach ecosystems via traditional strategic Setting the right incentives for the technology team alliances rather than APIs will not be able to move fast enough and encouraging an experimentation mindset to capitalize on all the opportunities. are keys to success. AN INNOVATION AGENDA FOR THE COVID-19 ERA 12

OPEN INSURANCE The sharing and consuming of data and services across multiple industries by means of APIs which are externally accessible and openly consumable. AN INNOVATION AGENDA FOR THE COVID-19 ERA 13

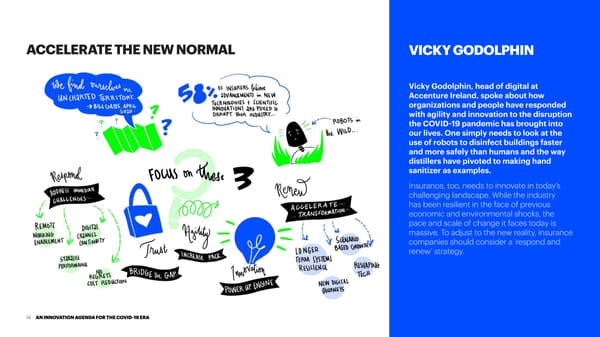

ACCELERATE THE NEW NORMAL VICKY GODOLPHIN Vicky Godolphin, head of digital at Accenture Ireland, spoke about how organizations and people have responded with agility and innovation to the disruption the COVID-19 pandemic has brought into our lives. One simply needs to look at the use of robots to disinfect buildings faster and more safely than humans and the way distillers have pivoted to making hand sanitizer as examples. Insurance, too, needs to innovate in today’s challenging landscape. While the industry has been resilient in the face of previous economic and environmental shocks, the pace and scale of change it faces today is massive. To adjust to the new reality, insurance companies should consider a ‘respond and renew’ strategy. AN INNOVATION AGENDA FOR THE COVID-19 ERA 14

The pressing concern for most is to address the immediate “ 58 percent of insurers believe challenges of ensuring business continuity and stabilizing the performance of systems essential to day to day work. advancements in new This encompasses enablement of the remote workforce, strengthening digital channels to cope for vast increases in technologies and scientific traffic, and reducing costs where possible. innovations are poised to But organizations should not allow themselves to get ‘stuck with disrupt their industry.” the pause button on’. Beyond the response to COVID-19, they also have the opportunity to accelerate digital transformation. To prepare for a new normal, organizations will need to build A CCENTURE TECHNOLOGY VISION resilience and agility into their operations and embark on new FOR INSURANCE 2020 digital journeys, for example, cloud enablement. Vicky said that there are a number of disruptive trends on the horizon—for instance, robots will most likely be more widely deployed in a world where physical distancing is important. This is going to significantly change the risk mix in insurance. As new technologies come into play, insurers will need to embrace new technology skills. The challenge for the future is to harness the bravery and creativity of the workforce, build employees’ trust in new technology, and embed agility and innovation into enterprise DNA. AN INNOVATION AGENDA FOR THE COVID-19 ERA 15

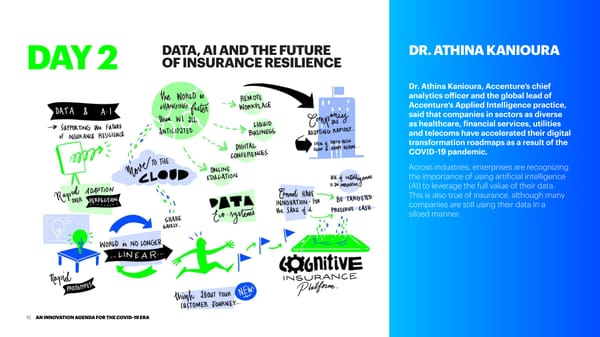

DATA, AI AND THE FUTURE DR. ATHINA KANIOURA DAY 2 OF INSURANCE RESILIENCE Dr. Athina Kanioura, Accenture’s chief analytics officer and the global lead of Accenture’s Applied Intelligence practice, said that companies in sectors as diverse as healthcare, financial services, utilities and telecoms have accelerated their digital transformation roadmaps as a result of the COVID-19 pandemic. Across industries, enterprises are recognizing the importance of using artificial intelligence (AI) to leverage the full value of their data. This is also true of insurance, although many companies are still using their data in a siloed manner. AN INNOVATION AGENDA FOR THE COVID-19 ERA 16

Athina suggested that insurance organizations can Insurers should be considering how they can tap into external move towards a cognitive insurance platform through data ecosystems and sources, as well as securely share their a five-step journey: data with other parties. A platform that centralizes AI and data • Reimagined intelligent processes: Processes in the front- capabilities is an indispensable asset. Insurance organizations should be looking at how they can embed data and AI into their office and back-office need to be reengineered to be more business processes. agile and more responsive to external signals. Athina stressed that rapid adaptation is more important in • Experience-centricity: Employee and customer experiences this journey than perfection. It is possible to design new should be redesigned to be more personalized and digital. processes and experiences within the space of six weeks. • Cloud-native capabilities: Technology infrastructure should From there, the organization could rapidly launch proofs of be shifted to the cloud to enable AI and data capabilities as well concept and minimal viable products to put solutions to the as to release funds from legacy investment. test. APIs and ecosystem partnerships, meanwhile, enable rapid scaling. • Ecosystem partnerships: The organization can access new capabilities through partnerships with technology companies, universities, startups and other members of the ecosystem. • Open APIs and data ecosystems: Insurers can use APIs and microservices to connect with partners in a manner that does not require them to constantly reshape architecture and business processes. AN INNOVATION AGENDA FOR THE COVID-19 ERA 17

HOW TO CREATE A STARTUP ALBERTO BUSETTO WITHIN THE GENERALI GROUP Alberto Busetto, head of connected insurance at Generali, discussed how Generali established Generali Jeniot as a data-driven, digital attacker brand. Generali established this separate subsidiary to develop innovative connected insurance and Internet of Things services in digital ecosystems in urban mobility, smart home, health and connected working. Goals included developing new channels to market in the business-to-business, business- to-consumer and business-to-business- to-consumer (B2B2C) segments, as well as creating an Internet of Things platform able to support a partner ecosystem. Generali also wanted to offer innovative digital products and services under a dedicated brand. AN INNOVATION AGENDA FOR THE COVID-19 ERA 18

Within the first 18 months of operations, Generali Jeniot Insurance companies that follow a similar approach to innovation introduced Internet of Things products and connected should not focus on technology for its own sake—it needs to be insurance solutions in the following markets: used as an enabler for the customer experience. Busetto noted the importance of cooperating with other units in the business. • Smart home solutions for monitoring air quality, tracking pets and managing security. Jeniot has filed two patents to date: one for its AirSafe air quality sensor and another for JADA, a robot subjecting telematics black • Vehicle telematics and safety offerings for the personal smart 9, 10 boxes to crash tests and other simulations. The company is also car market. gaining traction with customers. Developments such as this are • Corporate mobility offerings to improve employees’ driving helping to change Generali’s image in the market and position experience and safety. it as an innovator. • Wearable solutions to manage workplace safety with small wearable devices. Generali Jeniot has formed ecosystem partnerships with the likes of Fiat Chrysler Automobiles, DriveNow and Google 8 to bring digital solutions to market. Together with its partners, it can leverage proprietary behavior-related profiling algorithms and design products and solutions to support new market needs. Busetto said that Generali Jeniot has benefitted from Generali’s brand equity and large customer base, despite enjoying the agility of a startup. AN INNOVATION AGENDA FOR THE COVID-19 ERA 19

AXA XL CYBER COVERAGE JAMES TUPLIN James Tuplin, Head of Cyber and TMT - International Financial Lines at AXA XL, talked about the role of cyber-insurance in AXA’s strategic journey from being a payer of bills to becoming a genuine partner to its customers. Partnering is not a new concept to AXA since it has a risk engineering capability advising customers in sectors such as health. AXA XL’s cyber-insurance offering takes customer partnership to a new level. It is a full lifecycle product that includes threat intelligence at the quoting stage to help the client tighten information security, provides ongoing risk updates and penetration testing, and offers recovery and remediation services to help the client in the event of a breach. AN INNOVATION AGENDA FOR THE COVID-19 ERA 20

Cyber-insurance is well suited to such a partnership model since cyber risks are poorly understood and are evolving at high speed. Consider the fact that ransomware was not on anyone’s radar six years ago, for instance. This model benefits the insurer as much as the insured by reducing claims events and providing rich data for risk assessment and underwriting. AXA XL is establishing the cyber-insurance business as a global platform, with a view to reaching small and medium businesses around the world. James said that smaller businesses are an attractive market for this proposition because they are increasingly becoming targets for cyber- attacks. They need expert advice to manage cyber risk because they don’t have the inhouse capability. AN INNOVATION AGENDA FOR THE COVID-19 ERA 21

The session concluded BEWICA ANORAK with short presentations Bewica is a cyber-security platform David Vanek, the CEO of Anorak, from four insurtechs focusing on the small and medium discussed how his company is business sector in Europe. The bringing a fresh approach to life that are coming to company’s CEO, Eva Berg-Winters, insurance in the UK, a market that said that there are 10,000 cyber-attacks has been slow to innovate. Around 70 market with potentially on small businesses in the UK alone percent of products are sold through each day, leading to £4.5 billion a year intermediaries and processes are disruptive business lost to cyber-crime. Some 80 percent of still heavily manual. With nine million models and technology. successful attacks could be prevented families uninsured and 50 percent of with simple measures, yet small mortgages unprotected, there is businesses lack the in-house security a significant opportunity to expand 11 12 skills to implement and maintain these. this market. Bewica has developed a suite of solutions Anorak’s aim is to make life insurance for insurers to help their SME clients be more scalable and accessible through more cyber secure including a portal for a B2B2C strategy. It has built an advice brokers to assess and support their clients, engine and APIs that enable distribution automated risk assessments and a risk of life insurance products at scale across portal which can be aligned with cyber digital platforms. It is rapidly expanding insurance products. its access to the market through distribution partnerships with the likes of Starling Bank, Nutmeg and ClearScore. AN INNOVATION AGENDA FOR THE COVID-19 ERA 22

PORTABL Mike Minett of Portabl.co talked about Portabl aggreagates this highly fragmented, hard how his company is creating insurance to reach and poorly understood risk by providing solutions for the future of work and providers with quality distribution, accessed via the independent workforce. This is a ‘future of work’ B2B2C channel partners and significant and underserved market, white labelled platforms, delivering insurance with the gig economy in the US alone and benefits packages to their flexible workforce. estimated to be worth $1.3 trillion and around 50 percent of the workforce working independently or expected to CAURA do so soon, with COVID-19 accelerating 13 this trend. Independent workers are chronically Sai Lakshmi, CEO, and Bhavin Kotecha, underinsured and deserve to be looked at finance director, introduced their startup, more positively than they have been by the Caura, which aims to simplify the car financial services industry, said Mike. Portabl ownership experience in the UK. are using AI to build the world’s smartest Caura is creating a platform and app that offers financial services platform providing flexible a simpler way to purchase insurance and make insurance, benefits, and financial products other car-related payments. The goal is to that address the systemic bias issues facing enable a quote-to-purchase journey of less than freelance and gig-economy workers globally 10 seconds. Users can purchase cover from the – unlocking billions of value. app, receive all documents electronically, and manage policy adjustments within the app. AN INNOVATION AGENDA FOR THE COVID-19 ERA 23

CLOSING REMARKS AND REFLECTION Daniele thanked DIN members for their engagement. He said that the presentations illustrated how COVID-19 has accelerated the transformation of the insurance industry at every level— architecture, data, ecosystem and change management. In this context, C-suite executives have a vital role to play in driving and sponsoring transformation and innovation. Summing up the trends discussed at the meeting, Daniele said that many insurance companies are working hard to unlock the value of data and AI. There is also a move towards living services as insurers embrace their role of helping customers to monitor and reduce risk, in addition to their traditional business of paying claims. AN INNOVATION AGENDA FOR THE COVID-19 ERA 24

REFERENCES 1. “How We Create Value for Our Stakeholders”, Philips, retrieved 10. “Jeniot Home Airsafe,” Generali Jeniot, retrieved June 12, 2020. June 12, 2020. https://www.philips.com/a-w/about/company/ https://www.jeniot.it/famiglie/sensore-qualita-aria-airsafe our-strategy/how-we-create-value.html 11. “Small Firms Suffer Close to 10,000 Cyber-attacks Daily”, FSB, 2. “How to Introduce a Learn-it-all Culture in Your Business: August 5, 2019. https://www.fsb.org.uk/resources-page/small- 3 Steps to Success”, Geekwire, August 4, 2016. https://www. firms-suffer-close-to-10-000-cyber-attacks-daily.html geekwire.com/2016/microsoft-learn-it-all/ 12. “Life Insurance Statistics”, Finder, April 27, 2020. https://www. 3. “Diageo Named by Equileap as the Top Company Globally for finder.com/uk/life-insurance-statistics Gender Equality”, Diageo, October 1, 2019. https://www.diageo. com/en/news-and-media/features/diageo-named-by-equileap- 13. “The Future of Employment – 30 Telling Gig Economy as-the-top-company-globally-for-gender-equality/ Statistics”, SmallBizGenius, August 20, 2019. https:// www.smallbizgenius.net/by-the-numbers/gig-economy- 4. “It Doesn’t Have to Be Crazy at Work”, Basecamp, retrieved statistics/#gref June 12, 2020. https://basecamp.com/books/calm 5. “Four-day Week: Trial Finds Lower Stress and Increased Productivity”, The Guardian, February 19, 2019. https://www. theguardian.com/money/2019/feb/19/four-day-week-trial- study-finds-lower-stress-but-no-cut-in-output 6. “How Google’s Self-Driving Car Will Change Everything”, Investopedia, March 3, 2020. https://www.investopedia.com/ articles/investing/052014/how-googles-selfdriving-car-will- change-everything.asp 7. Nationwide Insurance: Modernizing Shared Services with API Management”, Google, retrieved June 12, 2020. https://cloud. google.com/customers/nationwide-insurance 8. “Generali Country Italia, Fiat Chrysler Automobiles and FCA Bank Strengthen Their Partnership for Mobility”, Generali Jeniot, October 3, 2019. https://www.jeniot.it/chi-siamo/press 9. “High-speed Robot Tests the Reliability of Black Boxes”, Omron, May 5, 2020. https://industrial.omron.eu/en/solutions/blog/ generali-jeniot-customer-reference AN INNOVATION AGENDA FOR THE COVID-19 ERA 25

ABOUT ACCENTURE Samantha Sanders Accenture is a leading global professional services company, providing Accenture Global Insurance Marketing a broad range of services in strategy and consulting, interactive, technology and operations, with digital capabilities across all of samantha.sanders@accenture.com these services. We combine unmatched experience and specialized capabilities across more than 40 industries — powered by the world’s Daniele Presutti largest network of Advanced Technology and Intelligent Operations centers. With 513,000 people serving clients in more than Chairman: Digital Insurer Network, and Accenture Senior Managing 120 countries, Accenture brings continuous innovation to help Director – Insurance Lead, Europe clients improve their performance and create lasting value across their enterprises. daniele.presutti@accenture.com Visit us at www.accenture.com STAY CONNECTED ABOUT THE RESEARCH Read our blog Accenture Research shapes trends and creates data driven insights about the most pressing issues global organizations face. Combining Linkedin the power of innovative research techniques with a deep understanding Twitter of our clients’ industries, our team of 300 researchers and analysts spans 20 countries and publishes hundreds of reports, articles and points of view every year. Our thought-provoking research—supported Copyright © 2020 Accenture. All rights reserved. Accenture, its logo, and High Performance Delivered are trademarks by proprietary data and partnerships with leading organizations, such of Accenture. This document is produced by consultants at as MIT and Harvard—guides our innovations and allows us to transform Accenture as general guidance. It is not intended to provide theories and fresh ideas into real-world solutions for our clients. For specific advice on your circumstances. If you require advice or further details on any matters referred to, please contact your more information, visit www.accenture.com/research Accenture representative. AN INNOVATION AGENDA FOR THE COVID-19 ERA 26